Bitcoin’s community hashrate has fallen 3.5% since mid-June, marking the sharpest decline in computing energy since July 2024.

The dip comes amid falling transaction charges and weaker value motion, that are squeezing miner margins following April’s block reward halving.

Regardless of rising strain, the anticipated wave of miner capitulation has not but appeared.

Miner Promoting Exercise Stays Muted

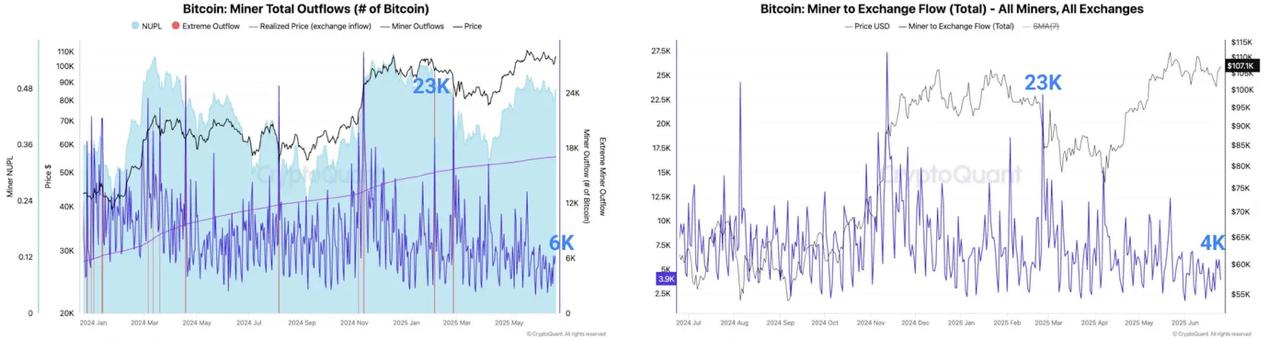

Based on CryptoQuant, outflows from miner wallets have dropped sharply — from 23,000 BTC per day in February to only 6,000 BTC at present. Furthermore, there have been no main BTC switch spikes to exchanges, a typical precursor to mass promoting.

Wallets linked to Satoshi-era miners have additionally remained largely inactive, with simply 150 BTC bought in 2025, in comparison with practically 10,000 BTC in 2024. This means long-term holders are staying put.

Miner Reserves Proceed to Climb

In a key sign of conviction, miner-held reserves are rising, implying that almost all miners are selecting to climate the downturn somewhat than offload their cash at present value ranges — with Bitcoin hovering close to native lows.

“This additional suggests there’s no promoting strain coming from miners at these value ranges,” CryptoQuant concluded.

Lengthy-Time period Technique Over Panic

The info paints an image of a mining sector selecting to carry — both in hopes of a near-term rebound or as a deliberate long-term technique. Even amid falling incentives, most miners seem keen to burn by money as a substitute of liquidating BTC at unfavorable ranges.

As Bitcoin’s community adjusts post-halving, miner habits stays surprisingly resilient, reinforcing the notion that supply-side strain will not be a priority — no less than for now.