Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

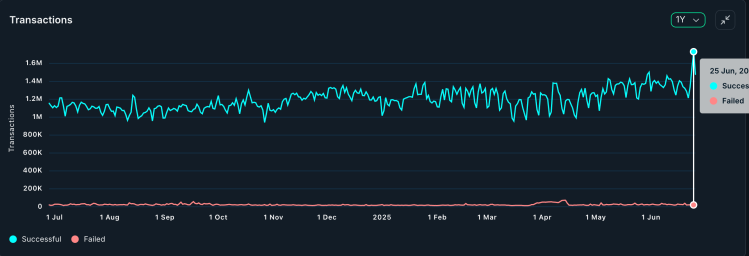

Ethereum has seen a notable spike in its day by day transactions after every week crammed with unsure market motion. Whereas the rise within the day by day transactions has caught consideration, what is actually important to level out is that it has been a very long time for the reason that day by day transactions have been this excessive. Actually, the spike has led to the best stage that Ethereum’s day by day transactions have been in over 16 months, displaying a return to the blockchain that appeared beforehand deserted.

Ethereum Day by day Transactions Cross 1.7 Million

In accordance with information from the on-chain information aggregation web site, Nansen, the Ethereum day by day transaction depend has spiked by nearly 50% over the previous few days. The week had begun with the day by day transaction depend sitting at 1.2 million on Monday. Nevertheless, by Wednesday, this determine was already altering quickly to achieve new yearly peaks.

Associated Studying

Because the Ethereum value rose above $2,400, so did participation on the blockchain, main day by day transactions to rise to 1.729 million. This sharp spike has led to the best stage to date in 2025, and is the primary time since January 2024 that the day by day transactions has crossed the 1.7 million mark.

On the similar time, there was additionally an uncommon spike within the day by day energetic addresses, which rose by nearly 50% as effectively in the identical time interval. The day by day energetic addresses rose from 345,406 addresses to 593,637 addresses within the area of 4 days.

All of those have occurred because the Ethereum value has recovered, suggesting that the spike in on-chain participation is definitely extra from traders shopping for than promoting. If this development continues, then it may ship the Ethereum value hovering greater from right here.

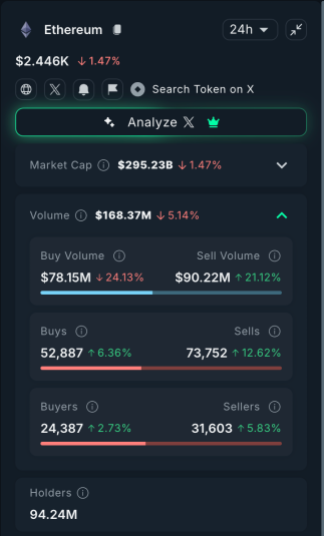

Promote Quantity Begins Dominating ETH Value

In distinction to the rise in Ethereum on-chain participation, there has additionally been a rise within the on-chain promote quantity in comparison with the purchase quantity. Nansen information factors out that within the $168.37 million on-chain purchase quantity recorded in a 24-hour interval, roughly $78.15 million was going towards buys, whereas a bit of over $90 million was from sellers.

Associated Studying

Moreover, relating to particular person transactions concerned in shopping for and promoting Ethereum, the sellers stay within the lead. There have been greater than 52,000 purchase transactions recorded throughout this era, with round 24,300 consumers. Whereas the promote transactions ran up in the direction of 74,000, with sellers at greater than 32,000. This exhibits the next proportion of sellers in comparison with consumers, which might clarify why the worth has been unable to achieve different help ranges.

This rise within the promoting quantity means that the buys aren’t sufficient to soak up the promoting quantity. This might battle off any shopping for momentum that would result in a value restoration and maintain the Ethereum value down whereas the crypto market struggles to seek out its footing.

Featured picture from Dall.E, chart from TradingView.com