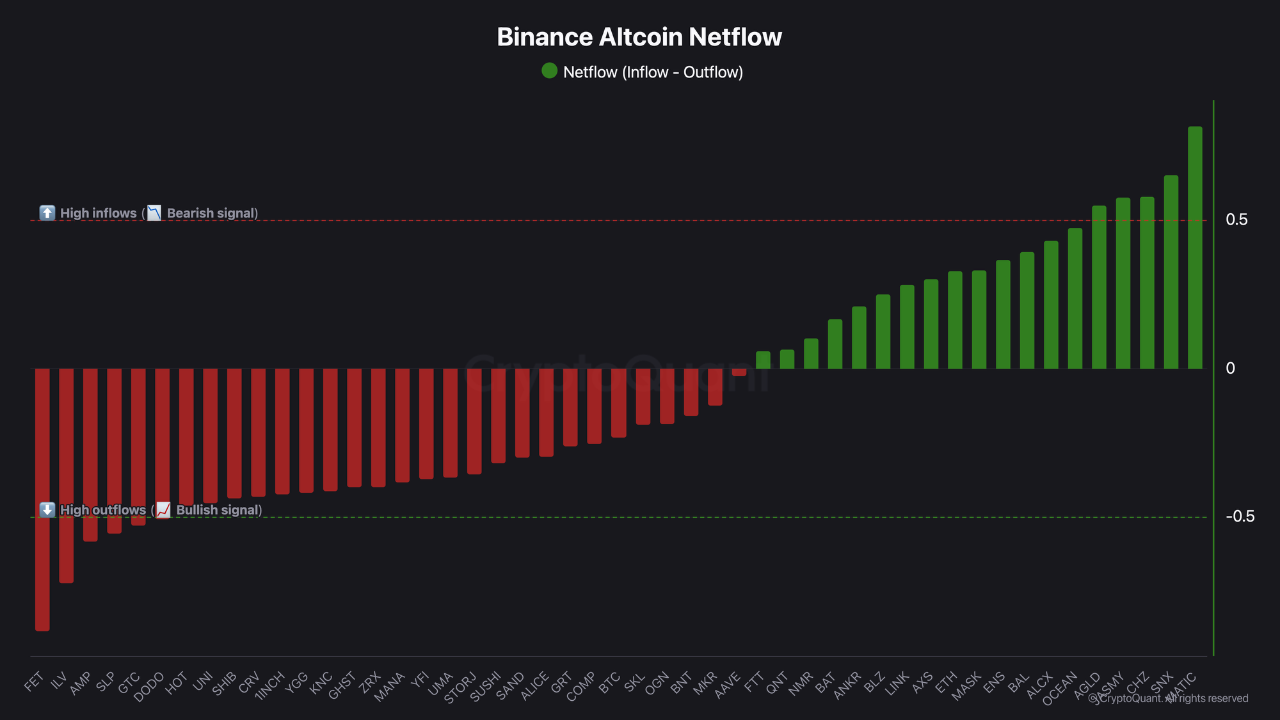

In response to a brand new report from CryptoQuant, latest Binance netflow information reveals a transparent divergence in altcoin habits — providing insights into which tokens could also be poised for upside and which might face near-term promote strain.

The report highlights that Fetch.AI (FET) is main a gaggle of altcoins experiencing important outflows from Binance, adopted by Illuvium (ILV), AMP, SLP, GTC, and DODO. These outflows recommend that holders are transferring belongings off the trade — probably into chilly storage or long-term positions — decreasing speedy promote strain and enhancing the chance of bullish momentum.

“Altcoins with persistent web outflows have a tendency to indicate stronger upward potential,” CryptoQuant famous.

Altcoins With Inflows Might Be Dealing with Distribution

Alternatively, tokens akin to Polygon (MATIC), Synthetix (SNX), Chiliz (CHZ), ASMY, and AGLD are seeing notable web inflows to Binance. These actions usually precede distribution occasions, with buyers transferring belongings to centralized exchanges in preparation for promoting.

This shift might cap short-term upside for these tokens and will even sign bearish setups if inflows persist.

Netflow Patterns Provide a Invaluable Buying and selling Sign

In abstract:

- Tokens with outflows (e.g., FET, ILV): Lowered promote strain, increased likelihood of value appreciation.

- Tokens with inflows (e.g., MATIC, SNX): Elevated promote strain, weaker bullish setups or draw back threat.

CryptoQuant emphasizes that trade netflows stay one of many extra dependable on-chain indicators for anticipating directional momentum, notably when mixed with value motion and quantity evaluation.