Geopolitical battle rattles markets, however historical past reveals panic promoting crypto in response is often the fallacious transfer.

In line with knowledge from blockchain analytics agency Santiment, fear-driven reactions to battle headlines usually create prime alternatives for big buyers—whereas retail merchants get left behind.

Historical past Repeats in International Crises

The crypto market noticed a well-known sample unfold over the previous week. The U.S. launched airstrikes on three Iranian nuclear websites, heightening tensions throughout the Center East. Iran fired missiles in retaliation. Fears of a wider battle surged as U.S. embassies went on excessive alert and regional airspace closures unfold. But regardless of this chaos, Bitcoin bounced again above $108,000 by June 25.

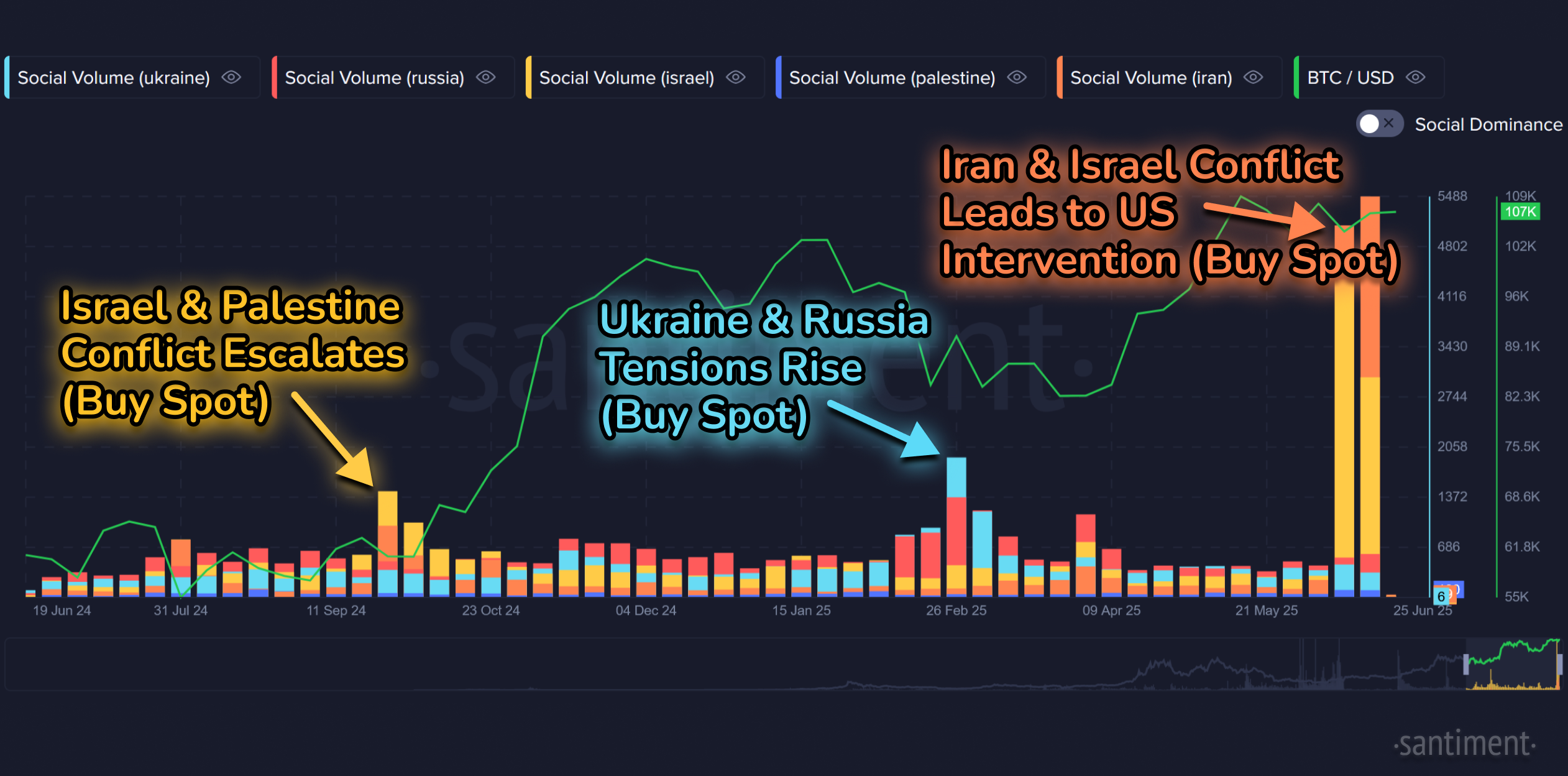

This rebound aligns with earlier cycles. In February 2022, Bitcoin initially plunged when the Russia-Ukraine battle broke out—solely to rally days later. In October 2024, battle between Israel and Palestine brought about related short-lived dips earlier than a swift restoration. In every case, costs dropped when battle dominated headlines, then rebounded as soon as retail merchants had exited in worry.

Santiment’s knowledge reveals crowd sentiment usually peaks in worry simply earlier than markets rally. Mentions of “battle” and “battle” surged because the U.S.–Iran pressure escalated. In the meantime, social media confirmed a pointy rise in bearish value predictions for Bitcoin—simply earlier than it rebounded by 10%.

Panic Promoting Advantages the Whales

Santiment’s on-chain metrics point out retail merchants usually overreact to geopolitical shocks, whereas whales quietly accumulate. On June 12, following Israel’s preliminary strike on Iran, $335 million was liquidated throughout crypto markets in only one hour. By June 22, President Trump confirmed U.S. airstrikes on Iranian nuclear amenities, which spiked on-line mentions of “Iran”—however didn’t result in a significant value collapse.

As a substitute, as smaller merchants bought out, the market discovered help. Bitcoin started climbing simply as the bulk anticipated additional declines. A ceasefire between Israel and Iran adopted, providing a attainable turning level. As seen in previous occasions, these de-escalation moments usually mark the beginning of a brand new bullish part.

Correlation With Shares Provides Stability

Not like previous cycles, crypto now strikes extra carefully with equities. Since early 2022, Bitcoin has trended in step with the S&P 500 and Nasdaq-100. This correlation signifies that broader market power can present help even throughout international crises.

Whereas war-related panic nonetheless triggers short-term volatility, macroeconomic situations—like inflation and inventory efficiency—now play an even bigger function in crypto’s course. That’s why Bitcoin’s rebound has mirrored inventory market resilience regardless of geopolitical headlines.

Don’t Struggle the Information

Merchants hoping to time battle headlines have traditionally gotten burned. Bitcoin’s present rise—regardless of rising oil tensions, missile strikes, and U.S. navy motion—proves as soon as once more that emotional buying and selling is expensive. As Santiment’s charts present, when worry peaks, it usually alerts alternative.

The important thing takeaway: war-related information doesn’t at all times imply a sustained crash. In reality, it usually units the stage for rallies. This isn’t to downplay the seriousness of geopolitical battle—however in markets, sentiment can mislead.

With Bitcoin nonetheless close to its all-time excessive and merchants divided between worry and greed, the approaching weeks will take a look at investor self-discipline. If the group stays fearful, whales could hold accumulating. If the group turns euphoric too quickly, a pullback may comply with.

For now, historical past suggests this: when battle strikes and panic hits the headlines, don’t rush for the exit. Endurance—and a degree head—tends to win.