ETF inflows and institutional purchases proceed to climb, but many buyers are puzzled by the muted Bitcoin value motion. With billions flowing into BTC, why aren’t we seeing the worth explode to new highs? The truth is extra nuanced than it first seems.

Bitcoin ETF Inflows

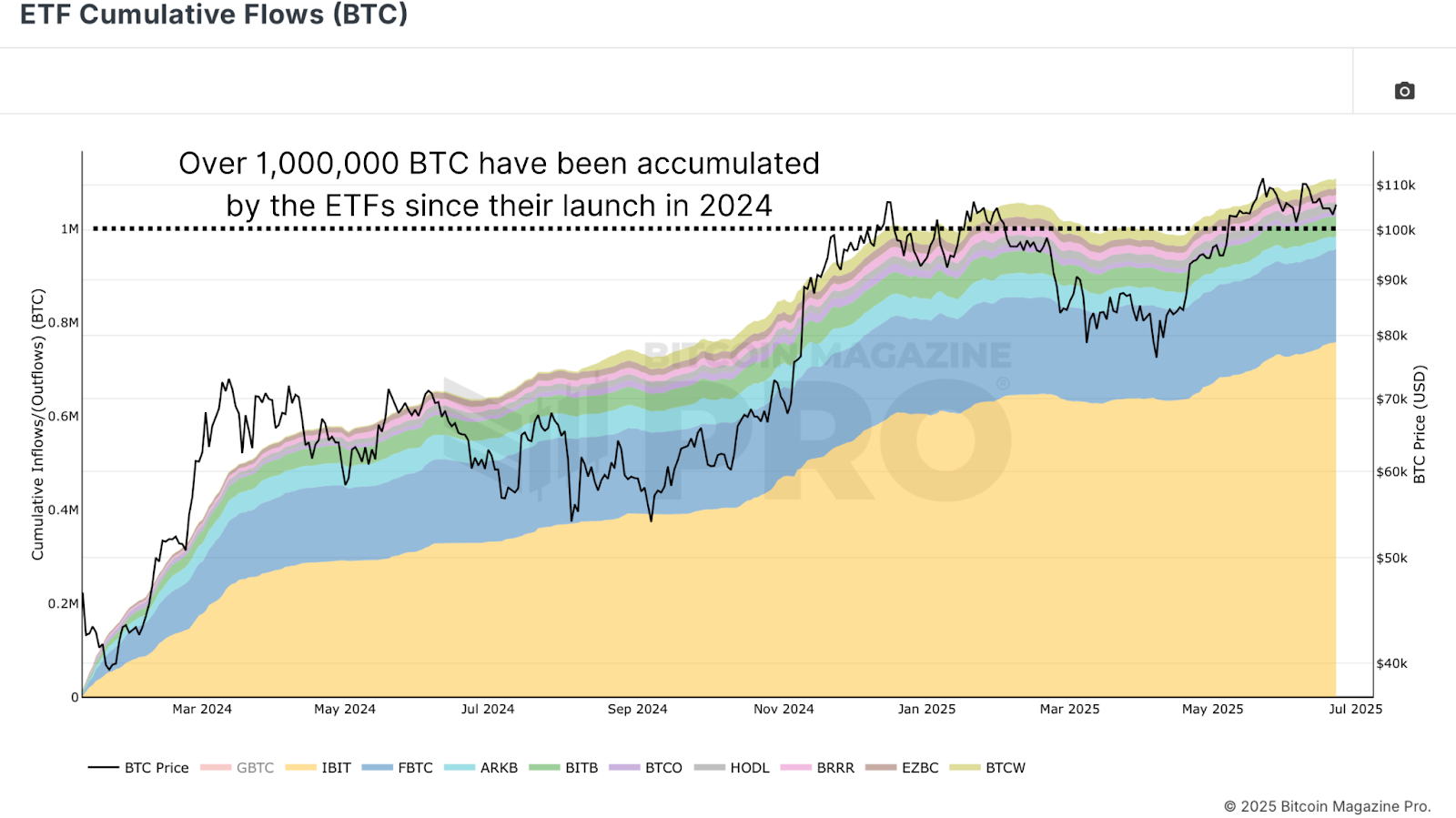

Wanting on the ETF cumulative inflows chart (excluding GBTC outflows), it’s clear that demand from institutional gamers has been strong. Since the latest pullback in late March, internet ETF inflows have climbed from roughly 527,000 BTC to over 630,000 BTC, a rise of round 100,000 BTC in beneath 3 months. These are vital numbers, but the Bitcoin value has largely primarily drifted sideways for the reason that begin of 2025.

It’s essential to do not forget that not all ETF flows characterize “institutional” shopping for within the purest sense. Many ETF purchases come from consumer allocations, for instance, household workplaces or high-net-worth people utilizing platforms like BlackRock. Nonetheless, these flows matter, and the regular accumulation is a optimistic driver for long-term provide and demand dynamics.

Bitcoin Treasury Shopping for

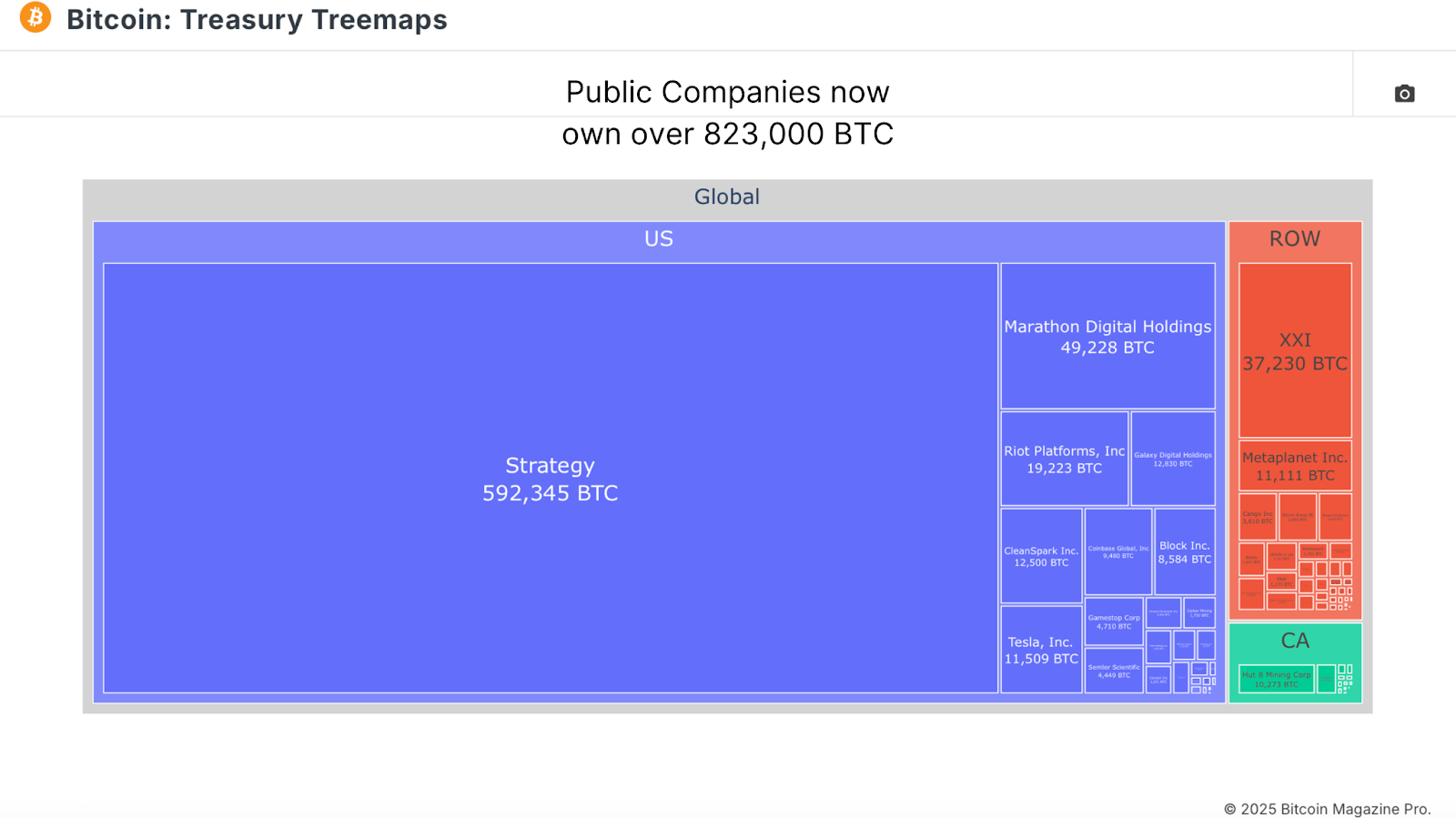

Complementing ETF inflows, company treasury shopping for has additionally been robust, with (Micro)Technique main the cost. MSTR alone have seen their holdings have jumped from roughly 528,000 BTC to over 592,000 BTC on this yr alone. Throughout all treasury corporations tracked, complete holdings now exceed 823,000 BTC, representing an astounding $86 billion in worth.

Regardless of this, many market individuals really feel underwhelmed by value motion in comparison with prior cycles. However we should contextualize expectations: the BTC market cap is now within the multi-trillion-dollar vary. The sheer scale of capital required to drive exponential strikes right this moment dwarfs earlier cycles. Evaluating this cycle to the 10x returns of earlier eras isn’t reasonable. In fact, BTC has greater than doubled from $40K on the time of ETF launch to current ranges above $110K, a nonetheless monumental achievement for a maturing asset class.

Bitcoin Provide Overhang

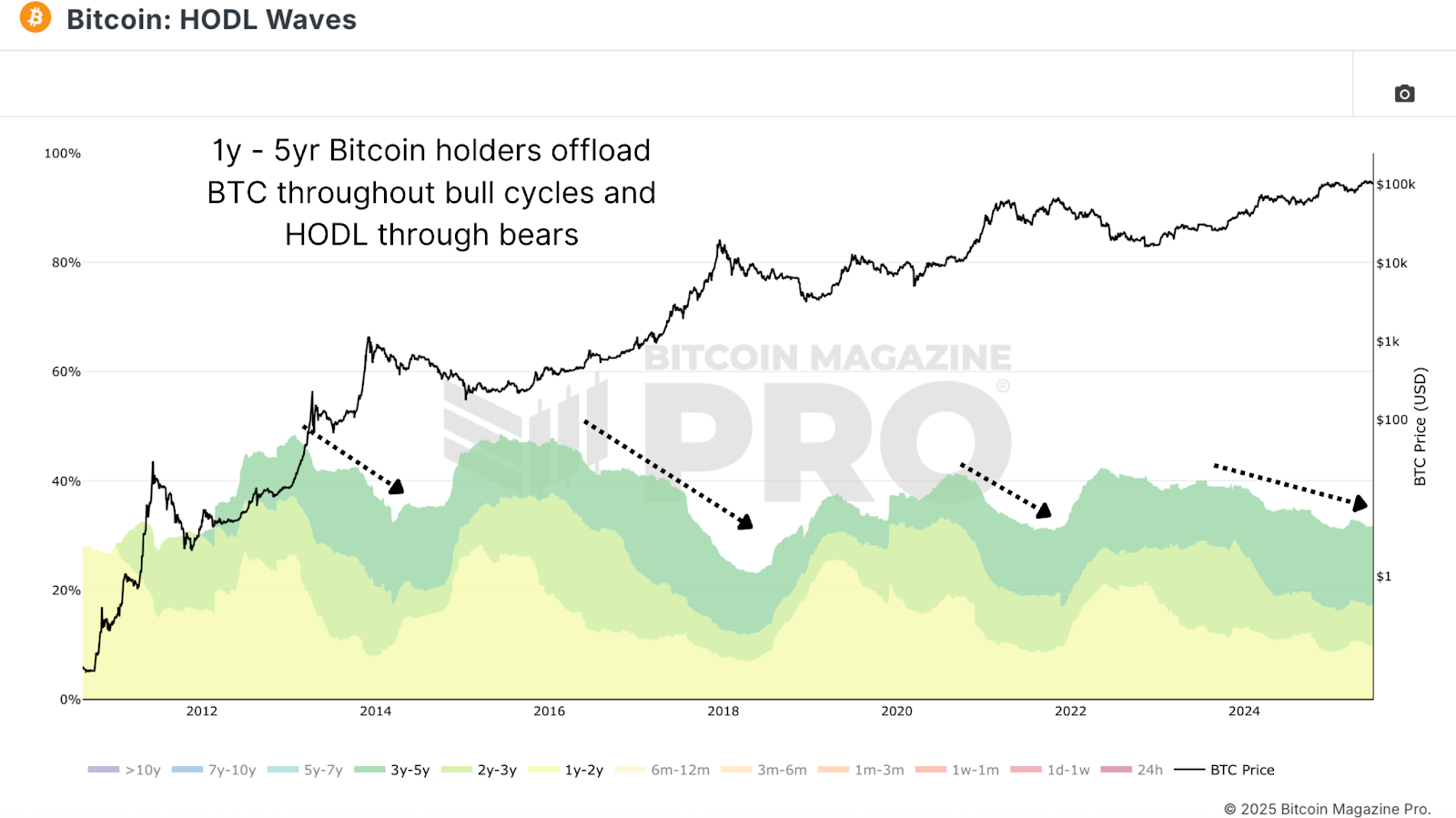

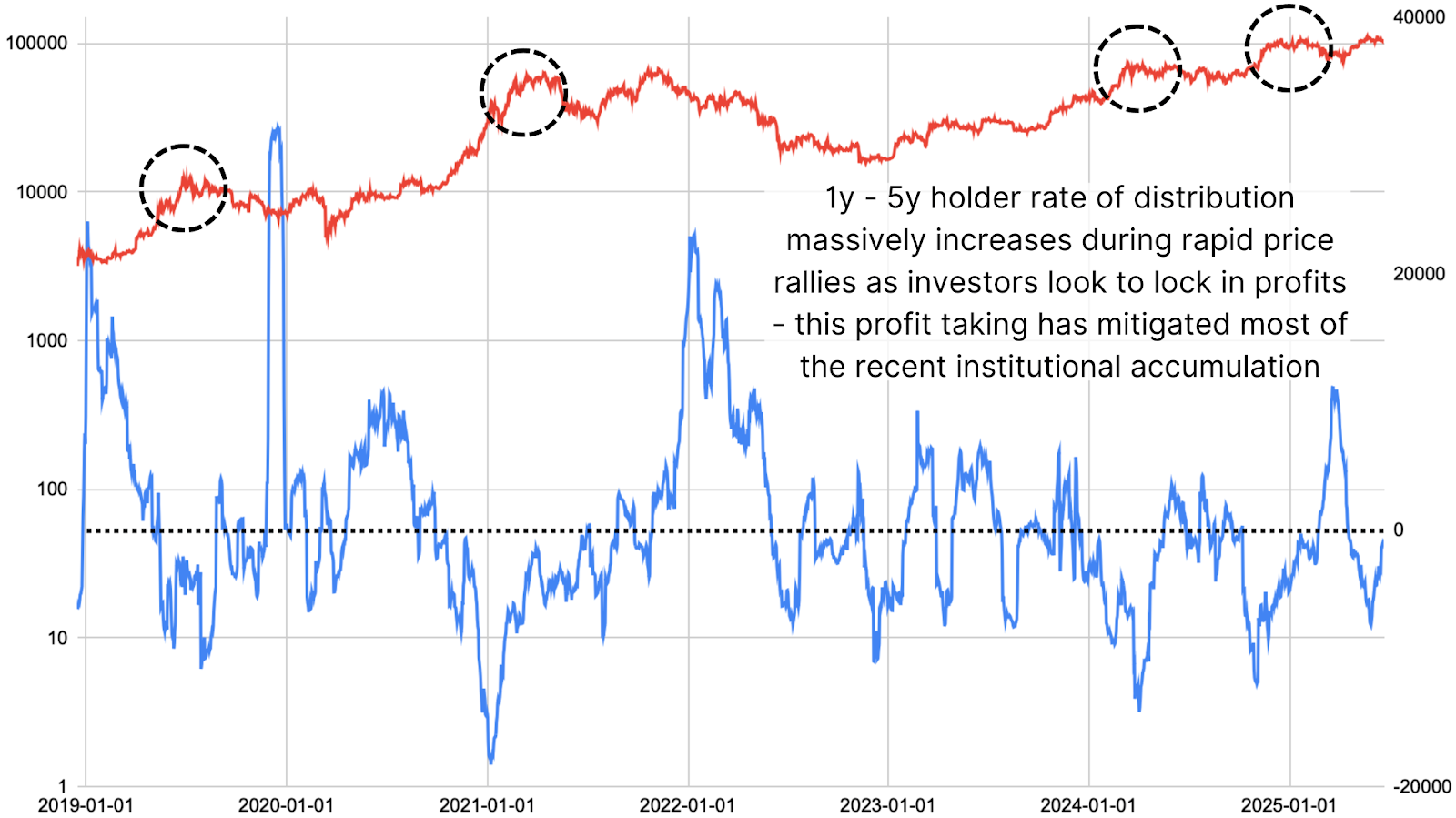

To grasp why Bitcoin costs haven’t surged even additional, we should study promoting conduct. By analyzing HODL Waves knowledge for 1-5 yr bands, we are able to quantify long-term holder profit-taking. Over the previous three months, greater than 240,000 BTC from these older bands has been distributed to the market, practically a quarter-million BTC in internet outflows.

This promoting has largely counterbalanced institutional accumulation. Provided that day by day miner issuance nonetheless provides one other ~450 BTC to the market, we see why value has struggled to interrupt larger: the market is in a state of supply-demand equilibrium.

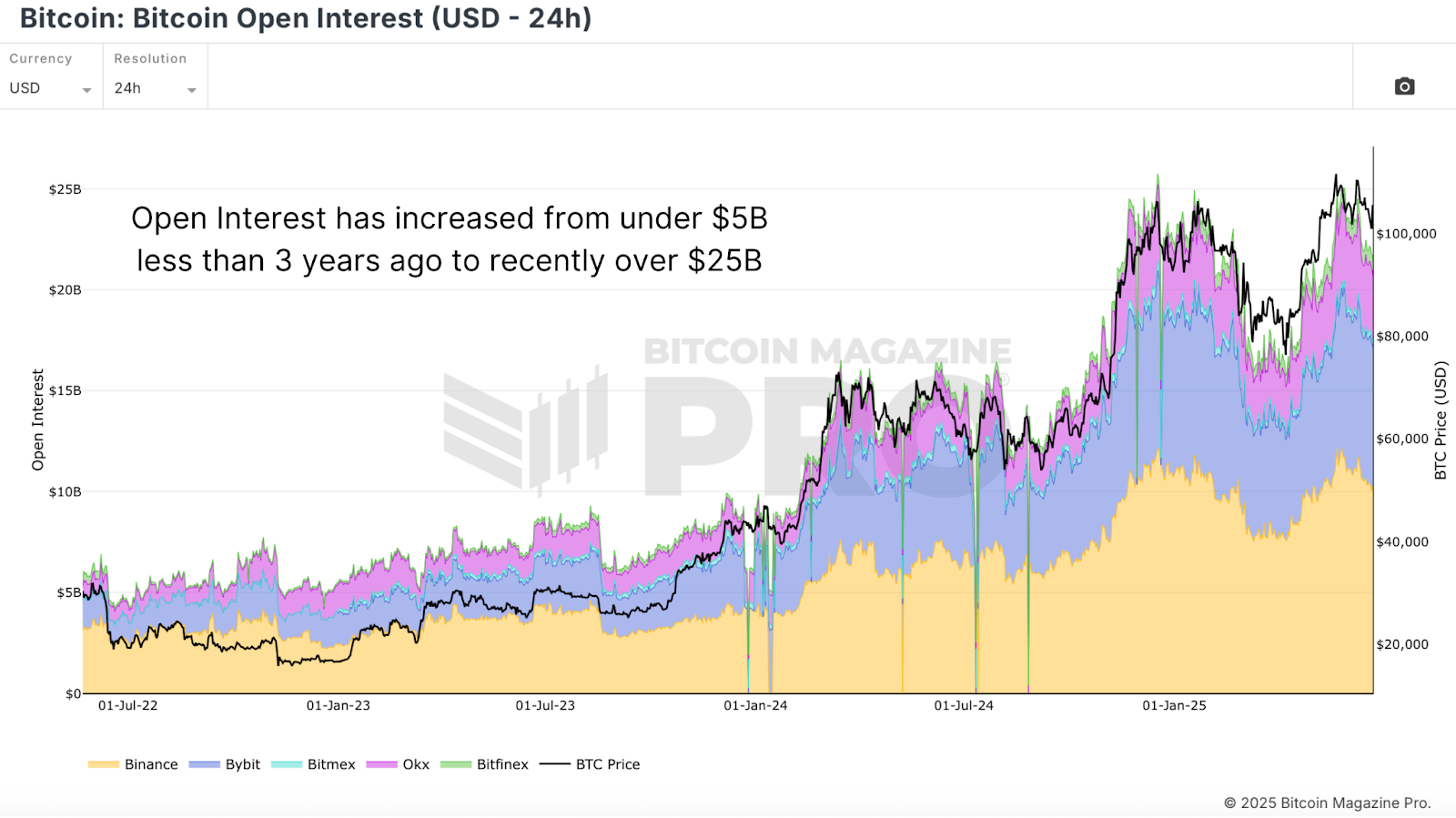

In the meantime, open curiosity on BTC derivatives markets has exploded. From beneath $5B lower than 3 years in the past to over $25B right this moment. Many new individuals favor are opting to commerce “paper BTC” on derivatives quite than shopping for spot BTC, which reduces the optimistic affect on value of elevated market individuals.

Bitcoin Bullish Shifts

There’s nonetheless now motive for optimism. Lengthy-term holder promoting is now decelerating, with current internet outflows falling beneath 1,000 BTC per day, a considerable discount from earlier month-to-month averages simply weeks in the past. If institutional inflows stay regular and retail demand begins to awaken, even at ranges seen earlier this cycle quite than excessive prior peaks, we might simply see one other highly effective leg larger. Previous cases present that when retail flows surge from these ranges, BTC can double in value inside months.

Conclusion

ETF inflows and treasury purchases are pouring billions of {dollars} into Bitcoin, however the muted Bitcoin value response makes excellent sense when seen by way of the lens of provide and demand. Heavy profit-taking by long-term holders and rising derivatives hypothesis have balanced out the inflows.

As long-term promoting subsides and institutional shopping for continues, the stage is being set for the following bullish impulse. Whether or not we see the euphoric retail mania of prior cycles stays to be seen, however even modest retail inflows mixed with present institutional demand might drive costs sharply larger sooner quite than later.

💡 Beloved this deep dive into bitcoin value dynamics? Subscribe to Bitcoin Journal Professional on YouTube for extra knowledgeable market insights and evaluation!

For extra deep-dive analysis, technical indicators, real-time market alerts, and entry to a rising group of analysts, go to BitcoinMagazinePro.com.

Disclaimer: This text is for informational functions solely and shouldn’t be thought-about monetary recommendation. All the time do your personal analysis earlier than making any funding choices.