Ripple’s RLUSD stablecoin has been steadily gaining momentum, rising as one of many fastest-growing belongings within the crypto house.

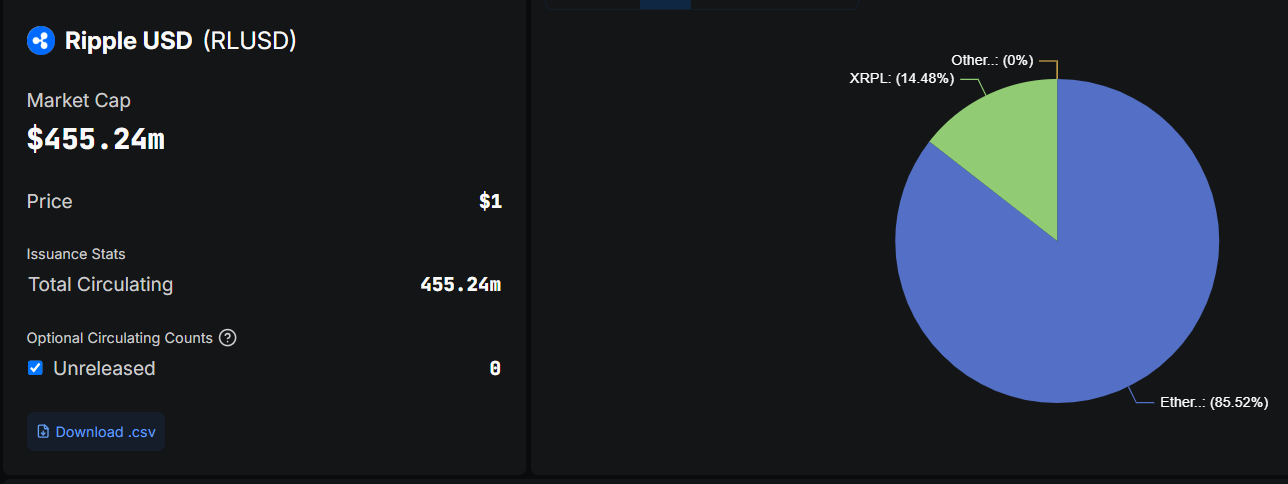

Information from DeFillama reveals that RLUSD’s circulating provide surged by 47% this month, reaching a formidable $455 million in June. This implies its provide elevated by over $150 million this month.

Ripple RLUSD Positive factors Floor as Ethereum Provide Quadruples

Based on the info, roughly $390 million of RLUSD’s provide is on the Ethereum community, whereas $65 million resides on Ripple’s XRP Ledger.

Notably, the stablecoin’s provide on Ethereum has grown by practically 4 instances since January, in response to blockchain analytics platform Token Terminal.

Market analysts famous that a number of key components have contributed to RLUSD’s spectacular market progress.

One of many main drivers is the passage of the US GENIUS Act, which gives clear regulatory pointers for dollar-backed stablecoins.

This authorized framework is predicted to encourage additional progress within the sector by enabling stablecoin issuance underneath well-defined laws.

Furthermore, Ripple’s improved authorized standing with the US Securities and Trade Fee (SEC) is additional boosting RLUSD’s attraction within the trade.

After a five-year authorized battle, Ripple CEO Brad Garlinghouse introduced that the corporate would drop its cross-appeal. This transfer alerts a attainable finish to the protracted authorized dispute.

Contemplating this, market observer expects the event to strengthen confidence in RLUSD as a dependable stablecoin for trade gamers.

Ripple launched RLUSD in December 2024 as a US dollar-pegged stablecoin designed to fulfill regulatory requirements and provide international accessibility. The digital asset is minted underneath a New York belief firm license and is backed by short-term Treasurys and money.

Along with the US legislative developments, RLUSD has additionally obtained approval from the Dubai Monetary Providers Authority (DFSA), which regulates the Dubai Worldwide Monetary Centre (DIFC).

This approval permits firms inside the DIFC to make use of RLUSD for numerous digital asset companies, together with funds and treasury administration.

The DIFC is house to almost 7,000 registered companies and serves as a key monetary hub for the Center East, Africa, and South Asia. This positioning units the stage for broader adoption of RLUSD throughout these areas.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nevertheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.