Regardless of widespread fears that world crises spell catastrophe for crypto markets, new knowledge from Binance Analysis suggests the alternative could also be true — not less than for Bitcoin.

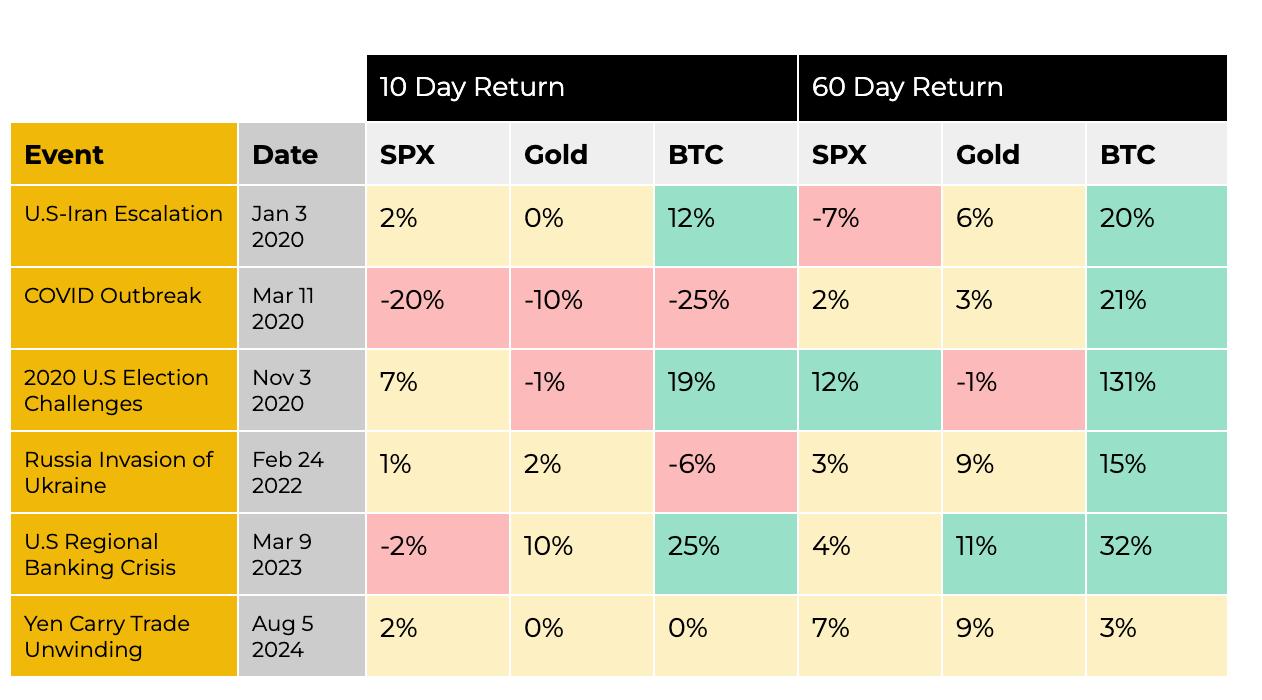

The platform’s newest evaluation reveals that BTC has traditionally delivered sturdy post-event returns, averaging a 37% achieve inside 60 days of main geopolitical or monetary shocks since 2020.

BTC Outperforms in Disaster Restoration

The info exhibits that Bitcoin persistently recovers — and even thrives — after durations of intense market stress. For example:

After the 2020 U.S. election challenges, Bitcoin surged 131% over the next 60 days.

Within the aftermath of the U.S. regional banking disaster in March 2023, BTC rallied 32%.

Even after the COVID-19 outbreak triggered a pointy 25% drop in 10 days, Bitcoin bounced again with a 21% return two months later.

Different examples embody:

- A 20% rise after the U.S.-Iran escalation in January 2020

- A 15% rebound following Russia’s invasion of Ukraine in February 2022

The one muted efficiency got here after the Yen carry commerce unwinding in August 2024, the place BTC posted only a 3% achieve over 60 days.

Bitcoin vs. Conventional Property

In comparison with the S&P 500 and gold, Bitcoin’s common returns following disaster occasions are considerably stronger. Whereas equities (SPX) and gold posted combined outcomes — starting from -7% to +12% and -10% to +11% respectively — Bitcoin was the clear outperformer.

For instance:

- Within the COVID crash, the S&P 500 fell 20% in 10 days and solely recovered 2% in 60.

Throughout the banking disaster, gold rose 10% in 10 days, however Bitcoin delivered the very best 60-day return at 32%.

Implications for Traders

The findings recommend Bitcoin’s worth might initially react sharply to geopolitical or monetary uncertainty — usually with double-digit drops within the brief time period. Nonetheless, historic patterns present that BTC tends to rebound strongly as soon as worry subsides and speculative inflows return.

Binance Analysis emphasised that these post-crisis positive aspects might mirror a flight to decentralized belongings throughout occasions of mistrust in conventional monetary programs, in addition to renewed investor threat urge for food as soon as stability returns.