A brand new report by crypto analytics agency Alphractal reveals that Bitcoin miners are going through a number of the lowest profitability ranges in over a decade — but have proven little signal of capitulation.

Regardless of declining revenues and growing community pressure, the trade seems to be in a part of recalibration relatively than panic.

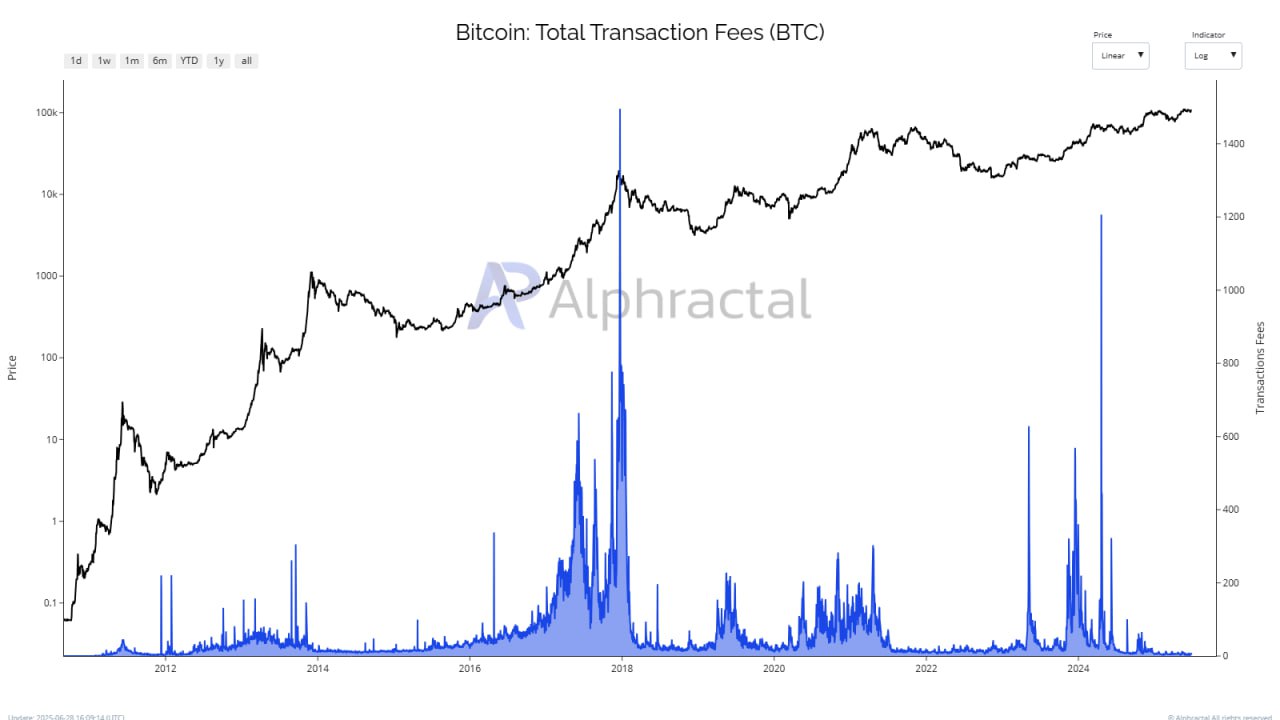

Transaction Charges Drop to 12-12 months Lows

In accordance with Alphractal’s newest information, complete transaction charges on the Bitcoin community have fallen to ranges final seen in 2012. This decline is intently tied to diminished on-chain exercise within the present cycle, which has considerably slashed miners’ earnings past the common block rewards.

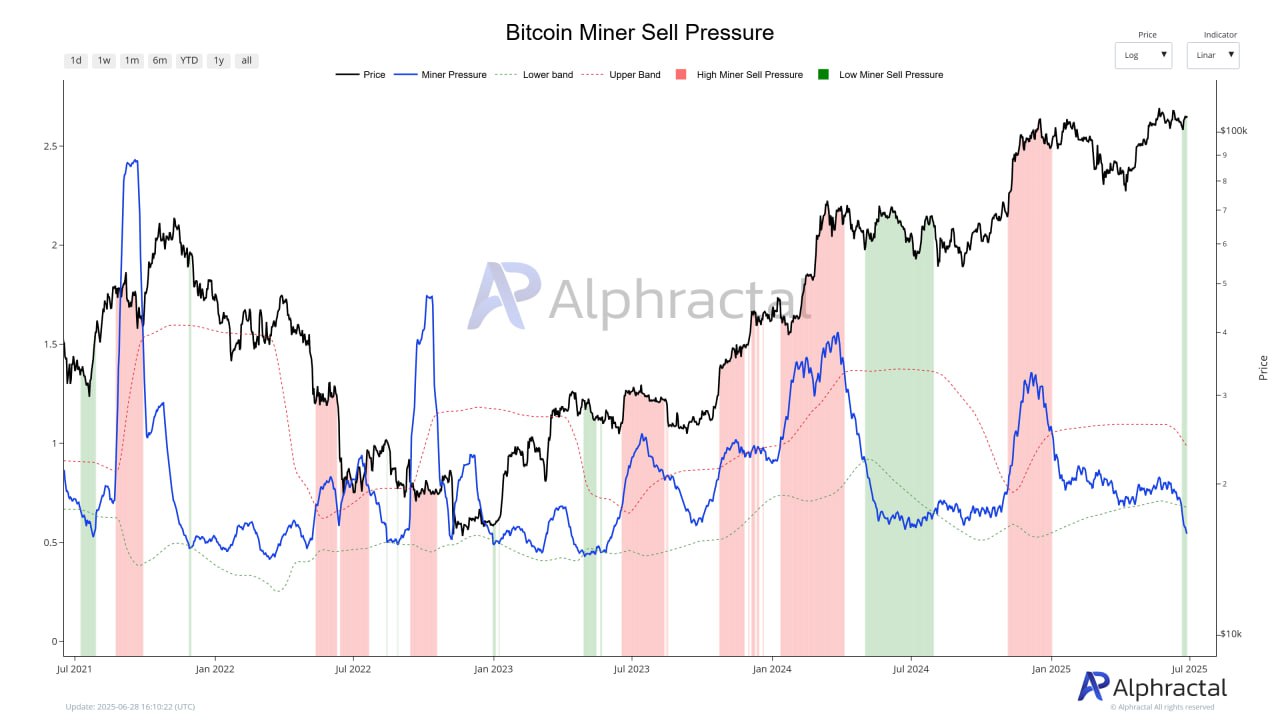

Promote Stress and Hash Price Sign Resilience

Alphractal highlights that the Miner Promote Stress metric stays traditionally low. This means that miners, regardless of shrinking revenue margins, are refraining from mass liquidation of their BTC holdings.

The report means that miners could also be holding out for higher market circumstances, betting on future value appreciation.

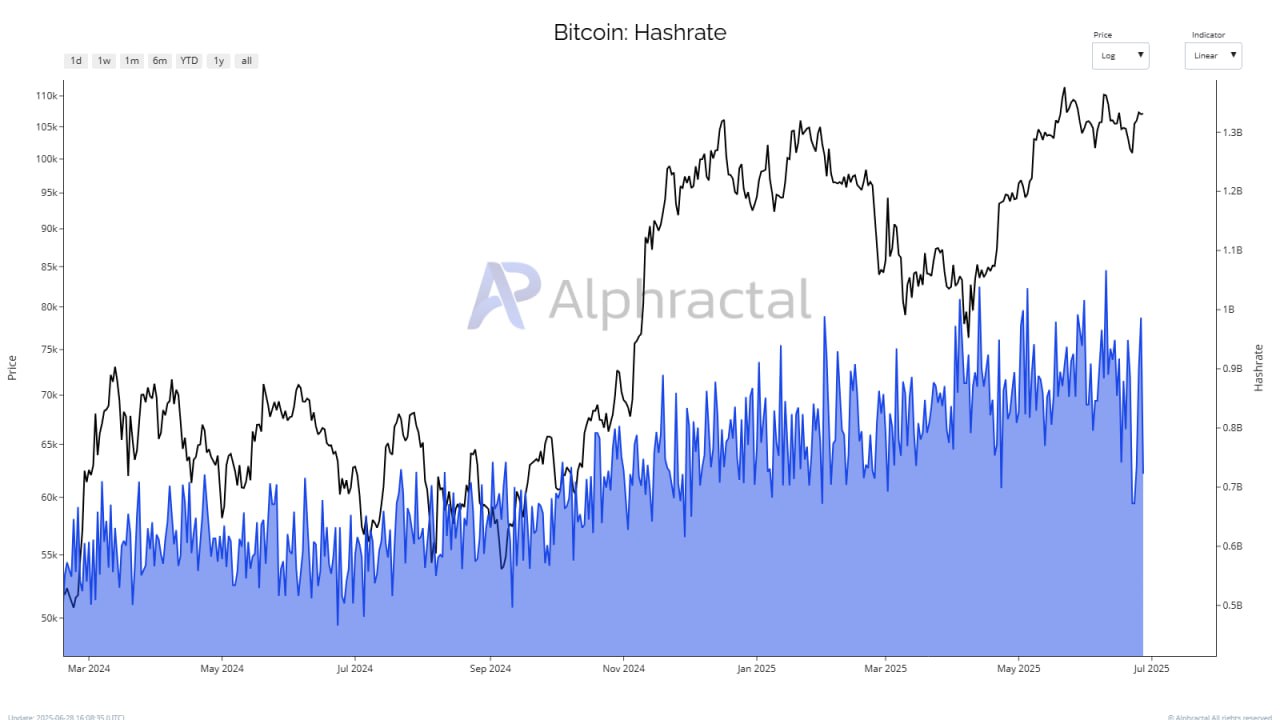

In the meantime, the community’s hash price volatility has hit file highs. Alphractal attributes this to large-scale miners turning off ASIC {hardware} in response to tightening margins and subdued community demand.

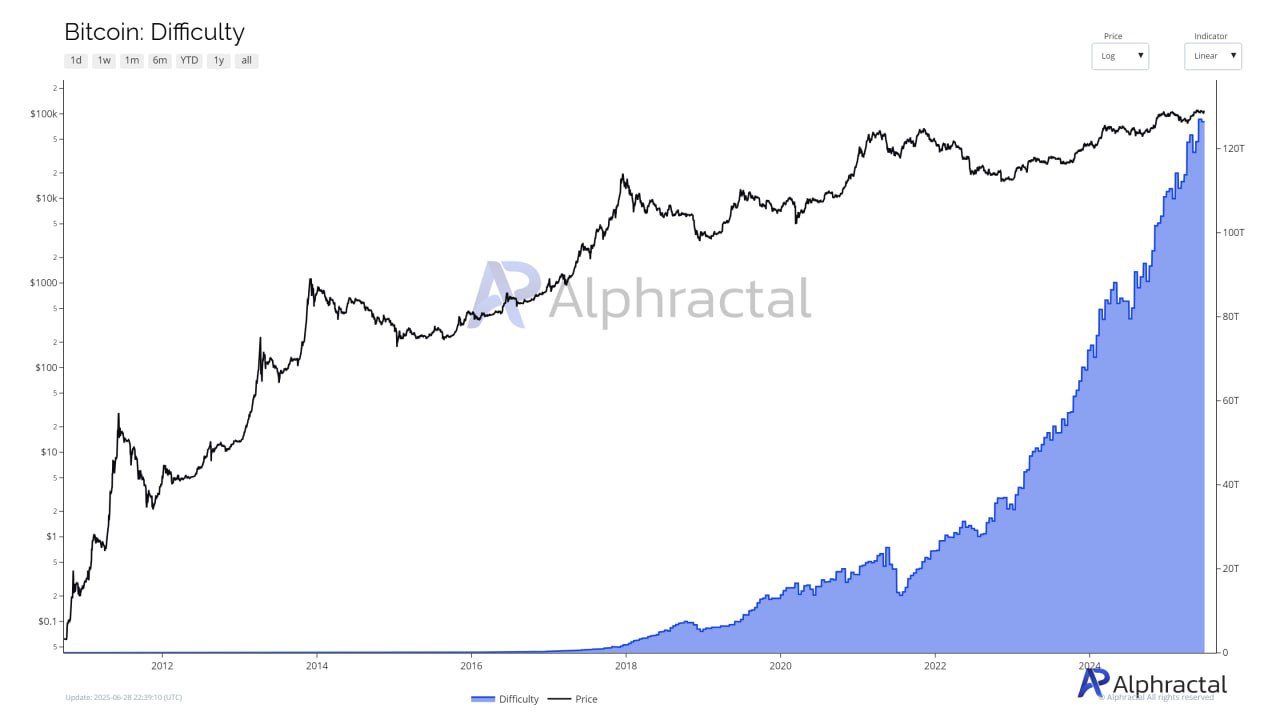

Regardless of this, total mining problem stays excessive, including additional stress on miner operations and delaying a pure adjustment in computational necessities.

A Interval of Strategic Retrenchment, Not Capitulation

Whereas mining operations face elevated stress, Alphractal emphasizes that we’re not seeing conventional indicators of miner capitulation. Relatively, this can be a transitional part the place miners redistribute hash energy and optimize operations to adapt to a slower community atmosphere.

Traditionally, miners are likely to promote aggressively throughout value surges or spikes in on-chain utilization. With Bitcoin buying and selling steadily above $107,000 and utilization subdued, Alphractal suggests the present part is certainly one of consolidation and strategic positioning relatively than a bearish sign.