The most recent market turbulence, fueled by geopolitical tensions and investor worry, provided a textbook case of how sentiment swings and whale habits form crypto value motion.

In Santiment’s latest “This Week in Crypto” livestream, analyst Brian dissected the dramatic occasions of late June, offering an in-depth take a look at how good cash responded whereas retail buyers scrambled.

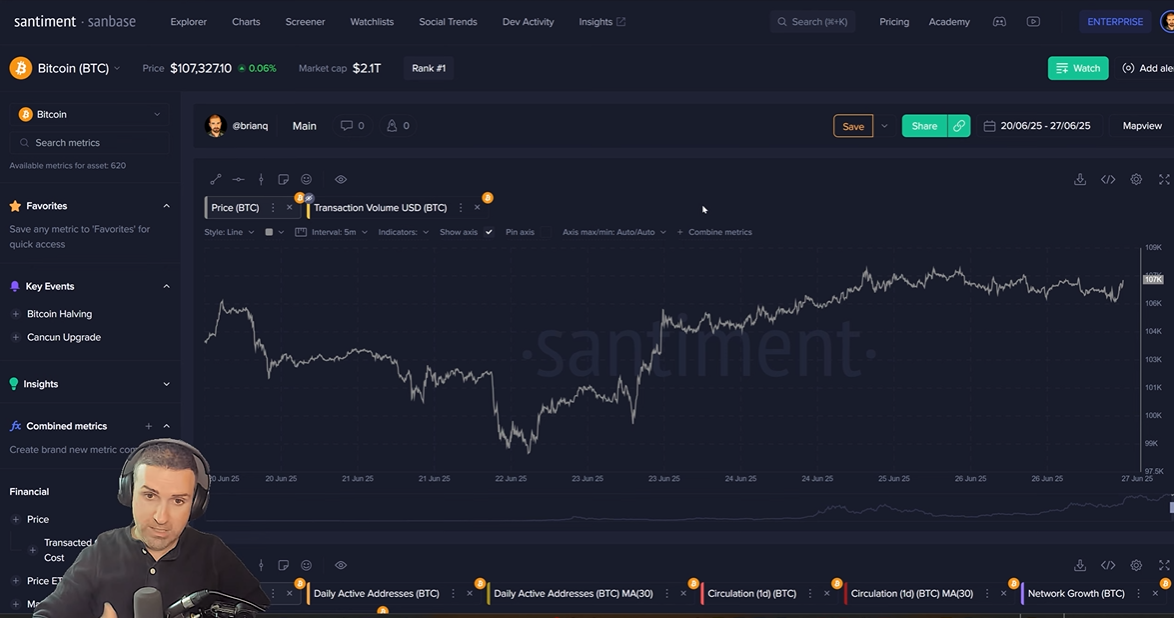

Bitcoin Plunges Beneath $100K as Panic Takes Maintain

The week kicked off with a jolt: escalating U.S.-Iran tensions despatched shockwaves throughout monetary markets. Bitcoin reacted sharply, falling to $98,500—its lowest level in practically two months. In accordance with Brian, this swift decline was emotionally pushed, underscoring how geopolitical uncertainty typically results in impulsive selloffs in crypto. He advises merchants to attend 24–48 hours earlier than reacting to international occasions, as preliminary strikes are sometimes deceptive.

Whales Accumulate, Retail Retreats: A Acquainted Sample Repeats

Whereas retail merchants offered in panic, whales quietly purchased the dip. Wallets holding between 10 and 10,000 BTC added 22,200 BTC in simply 18 days. Brian defined that these durations of worry supply supreme entry factors for seasoned buyers. Santiment’s sentiment knowledge hit month-to-month lows simply earlier than the rebound, indicating basic “most worry equals most alternative” habits. In the meantime, wallets holding at the very least 10 BTC reached a 3.5-month excessive—one other clear signal of rising whale confidence.

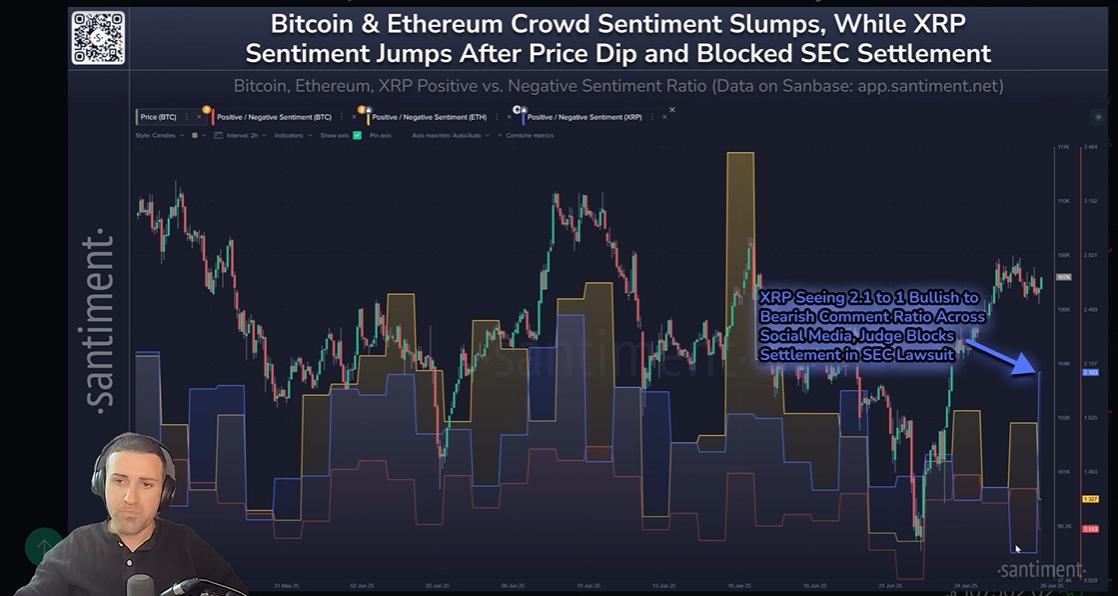

XRP Sentiment Climbs Regardless of Authorized Setback

In an sudden twist, XRP sentiment rose even after Choose Torres blocked the proposed $50 million SEC settlement. Whereas the information solid recent uncertainty over Ripple’s case, the XRP group responded positively, signaling potential hidden optimism. Brian famous that this divergence between value and sentiment can foreshadow bullish momentum.

Ethereum Faces Doubts, However Contrarian Alerts Emerge

Not like Bitcoin, Ethereum lagged in the course of the restoration. Futures funding charges for ETH turned detrimental, revealing an inflow of brief positions. Nevertheless, Brian warned that such bearish crowding typically precedes a brief squeeze—a situation the place rising costs drive brief merchants to purchase again in, additional accelerating positive factors.

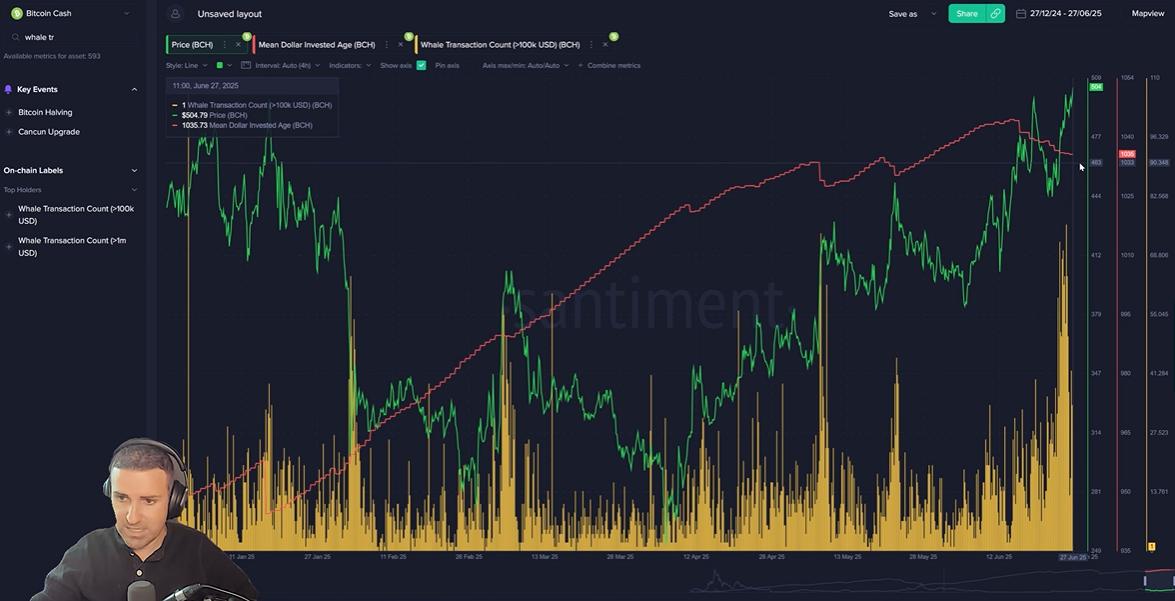

BCH and GameFi Narratives Warmth Up

Bitcoin Money (BCH) drew consideration with its largest whale transaction spike of the 12 months. Mixed with elevated social dominance and declining “imply greenback invested age,” the information means that dormant cash are transferring—typically a precursor to cost motion. On a story degree, discussions about GameFi, stablecoins, and Bitcoin versus fiat cash dominated Santiment’s Alpha Narratives instrument, providing early perception into the place dealer consideration is heading subsequent.

Key Takeaway: Watch Whale Exercise and Sentiment Spikes

This week’s occasions reaffirm an important lesson: on-chain knowledge tells the story behind the charts. As retail panic peaks, whale accumulation and sentiment bottoms typically sign that the worst has handed. Traders who observe wallets, social sentiment, and funding charges can place themselves forward of the curve.

For a deeper look, Santiment affords real-time dashboards that observe these metrics—serving to merchants navigate volatility with confidence and readability.