Key Takeaways

- Analyst Charles Edwards says long-term Bitcoin holders are promoting to establishments, conserving costs stagnant regardless of ETF inflows.

- A brand new cohort of six-month holders, together with treasury corporations, is absorbing the Bitcoin provide unloaded by unique holders.

- Bitcoin stays range-bound between $102,000 and $110,000 amid continued inflows to identify ETFs and elevated treasury exercise.

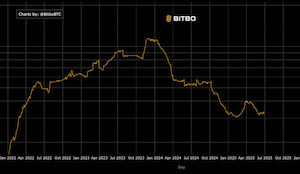

Capriole Investments founder Charles Edwards defined that Bitcoin’s worth progress has stalled as unique long-term holders proceed to promote into institutional demand because the launch of spot Bitcoin ETFs in January 2024.

Edwards acknowledged:

“Individuals are questioning why Bitcoin has been caught at $100K so lengthy, regardless of the institutional FOMO.”

He attributed this stagnation to Bitcoin OGs “dumping on Wall Road” and decreasing their positions.

Edwards highlighted that the six-month holder cohort—largely made up of latest Bitcoin treasury corporations—has absorbed the Bitcoin unloaded by long-term holders over the previous 1.5 years.

“The quantity of BTC acquired within the final two months by this cohort has utterly consumed the entire BTC unloaded by LTHs over the past 1.5 years.”

Treasury companies and ETF narrative

Edwards steered these treasury corporations are making a “flywheel shopping for frenzy” that would overshadow the ETF narrative.

Latest entrants embody Cardone Capital, ProCap, Panther Metals, and Inexperienced Minerals, all including Bitcoin to their treasuries.

Brief-term revenue taking and market response

Jeff Mei, BTSE COO, famous merchants are taking earnings forward of the July 9 tariff deadline, with extra public corporations accumulating Bitcoin for his or her treasuries.

Han Xu of HashKey Capital pointed to approaching US macroeconomic information and coverage selections as key market dangers.

Sideways buying and selling persists

Bitcoin has traded between $102,000 and $110,000 since early Could, regardless of over $3.2 billion in inflows to US spot Bitcoin ETFs and a gentle rise in treasury firm holdings.