Bitcoin is displaying resilience because it continues to battle just under its $112,000 all-time excessive. Regardless of a number of failed makes an attempt to interrupt by, bulls have maintained robust management of the market, holding BTC nicely above the important thing $100,000 demand degree. Since rebounding from the $75,000 low in April, Bitcoin has climbed over 15%, with consumers stepping in at each main dip and reinforcing bullish momentum all through the consolidation part.

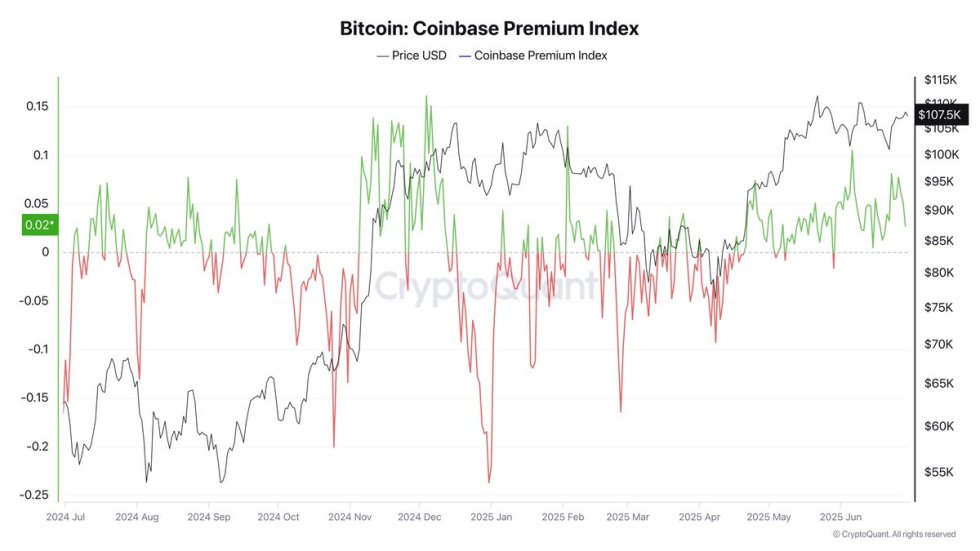

A lot of this energy seems to be pushed by regular institutional demand. Prime analyst Darkfost lately highlighted knowledge displaying that the Coinbase Premium Index—a extensively used indicator to trace U.S. institutional shopping for strain—has remained constructive with out interruption because the finish of April. This sustained premium suggests robust shopping for exercise from US-based traders, seemingly fueled by rising ETF inflows and the rising institutional urge for food for Bitcoin publicity.

With the value holding above all key assist ranges and macro tailwinds in play, sentiment stays optimistic. Nonetheless, till Bitcoin can decisively break and shut above $112K, the market stays at a crucial inflection level. The approaching days might decide whether or not BTC enters a brand new part of worth discovery or faces one other spherical of consolidation beneath resistance.

Bitcoin Faces Defining Week As Worth Assessments Resistance

This week may show pivotal for Bitcoin because it continues to commerce just under its $112,000 all-time excessive. After weeks of grinding larger, bulls try to interrupt by this key resistance degree. Nonetheless, the market stays on edge, as no clear route has been established. Volatility continues to shake short-term sentiment, and the potential of a retracement again towards the $100,000 degree—and even beneath—stays on the desk if bulls fail to ship a breakout.

Including a layer of optimism, the US inventory market lately reached a brand new all-time excessive, reinforcing risk-on sentiment throughout monetary markets. Many analysts imagine Bitcoin and altcoins might be subsequent to observe, particularly as liquidity circumstances enhance and investor urge for food for high-beta asset returns.

A key driver supporting BTC’s energy is the Coinbase Premium Index, which has remained in a constant constructive pattern because the finish of April, in accordance with insights from Darkfost. This indicator measures the value distinction between Coinbase and different exchanges, and is extensively seen as a proxy for US institutional and whale demand. Traditionally, a sustained constructive premium has coincided with bullish worth developments.

The continued energy on this metric—alongside regular ETF inflows—means that US consumers are enjoying a serious position in holding Bitcoin above the six-figure mark. Some attribute this renewed institutional curiosity to US President Donald Trump’s pro-crypto positioning, as he pushes to ascertain the US as the worldwide chief in digital property, significantly Bitcoin.

Because the week unfolds, all eyes stay on the $112K degree. A confirmed breakout may set off the subsequent leg of the bull cycle, whereas failure to carry might result in a broader retracement and renewed warning out there.

BTC Holds Vary Between $103.6K and $109.3K

The three-day chart exhibits Bitcoin buying and selling at $107,714, consolidating in a decent vary between key assist at $103,600 and main resistance at $109,300. This vary has outlined worth motion for a number of weeks, with bulls sustaining management above assist however struggling to push decisively into new all-time highs. The sample displays rising pressure out there, as costs coil in anticipation of a breakout.

BTC stays firmly above all main transferring averages: the 50 SMA ($95,164), 100 SMA ($89,475), and 200 SMA ($73,090). This alignment confirms a powerful, long-term bullish construction, with every dip being met by robust demand. Quantity, nonetheless, has began to flatten, suggesting indecision amongst merchants and the necessity for a powerful catalyst to set off the subsequent transfer.

A every day or 3-day candle shut above $109,300 would seemingly ignite a breakout into worth discovery territory. Then again, a breakdown beneath $103,600 may result in a deeper correction towards the $95K degree, the place the 50 SMA might act as dynamic assist.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our workforce of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.