The US Senate has narrowly handed former President Donald Trump’s sweeping $3.3 trillion fiscal package deal — the so-called “Huge Lovely Invoice.” Because the laws heads to the Home for last approval, crypto markets are intently watching the potential affect.

Bitcoin and Ethereum costs remained regular Tuesday regardless of the broader market dip. Nevertheless, BeInCrypto evaluation initiatives that this invoice, if enacted, may reshape investor sentiment and capital allocation.

Bitcoin More likely to Acquire as a Fiscal Hedge

Essentially the most fast affect could be on Bitcoin. The invoice anticipated to lift the nationwide debt by over $3 trillion. So, market individuals are already bracing for longer-term inflationary strain.

Bitcoin, usually seen as a hedge towards fiat forex debasement, may gain advantage from renewed demand.

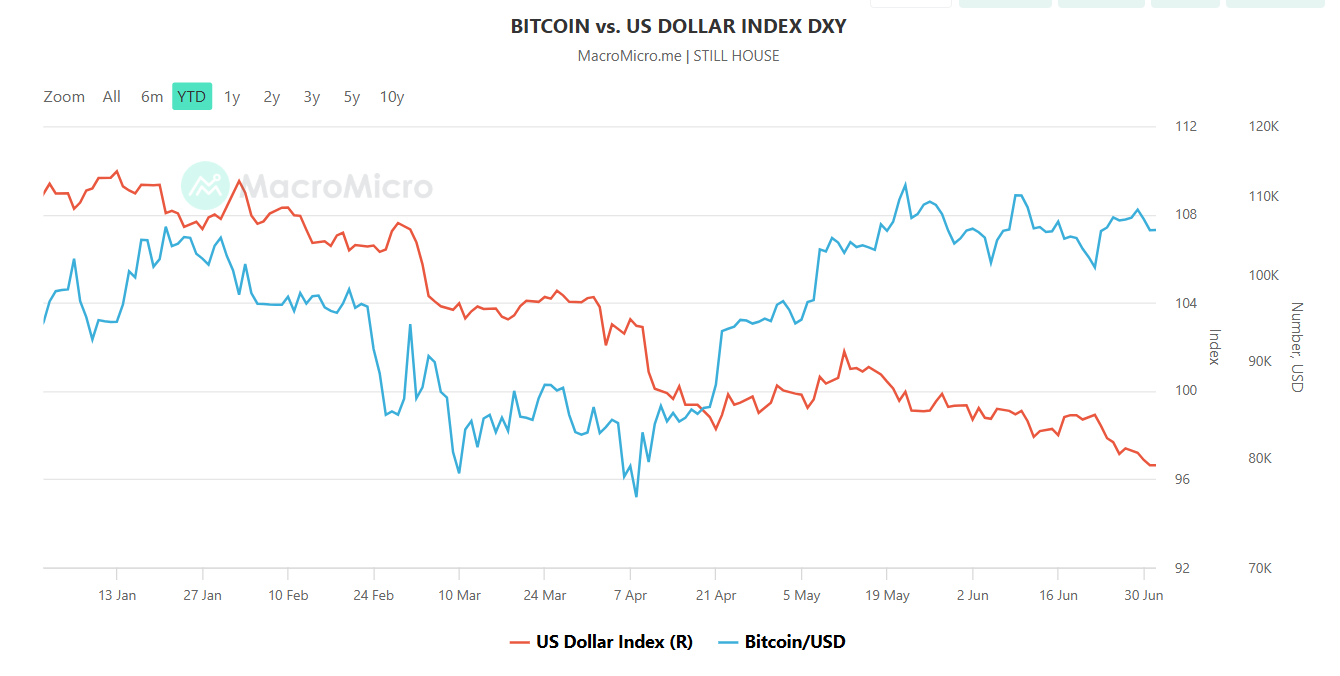

Most significantly, a weaker greenback and declining confidence in US fiscal administration would doubtless reinforce Bitcoin’s “digital gold” narrative.

Altcoins May See Uneven Advantages

Ethereum and different large-cap altcoins may additionally achieve short-term help. Danger rotation out of bonds and into different belongings usually lifts crypto broadly.

Nevertheless, not all tokens are positioned equally. Infrastructure and utility tokens stand to learn from growing exercise and capital flows.

Meme cash and speculative belongings, then again, might stay unstable or underperform.

Clearer tax guidelines — similar to exemptions for small crypto transactions — may encourage broader adoption, notably amongst retail customers.

Retail and Institutional Sentiment Will Doubtless Diverge

Retail traders may reply positively to decrease private taxes and simplified crypto reporting.

If the ultimate invoice contains crypto-friendly tax reforms — together with de minimis exemptions and staking earnings readability — it may decrease friction for small merchants and DeFi customers.

Institutional sentiment could also be extra cautious. Fast debt accumulation and a probably inflationary outlook could lead on institutional traders to undertake a wait-and-see strategy, particularly if the Federal Reserve tightens coverage in response.

Brief-Time period Outlook: Crypto Market May Push Greater

If the Home passes the invoice with crypto provisions intact, Bitcoin and Ethereum might rally additional. Capital rotation out of Treasuries, pushed by rising US debt and monetary uncertainty, may drive costs greater.

The overall crypto market cap may check the $3.5 to $3.7 trillion vary within the close to time period.

Nevertheless, the extent of the rally will rely upon broader macroeconomic situations, together with rate of interest coverage, regulatory enforcement, and international liquidity tendencies.

Medium-Time period Outlook: Fed Coverage Will Be Key

The longer-term affect on crypto hinges on how the Federal Reserve responds to the invoice’s inflationary results.

If the Fed raises rates of interest to counter fiscal growth, this might strengthen the greenback and strain crypto markets. Conversely, if the Fed stays accommodative, digital belongings might proceed to learn.

The survival of the invoice’s crypto provisions may also be essential. If tax aid measures are stripped out or watered down within the Home model, the sector may face renewed headwinds.

Backside Line

The Senate’s passage of Trump’s “Huge Lovely Invoice” marks a significant fiscal shift.

If it clears the Home, crypto belongings — particularly Bitcoin — are more likely to profit from rising fiscal issues and investor need for different hedges.

But volatility stays a threat. Fed coverage, inflation information, and legislative negotiations will form how sustainable any crypto rally turns into.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nevertheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any selections primarily based on this content material. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.