Lido (LDO) is presenting as a key beneficiary of Ethereum’s continued progress right into a strategic monetary infrastructure layer.

Lido is the dominant ETH staking protocol. It contains a decentralized autonomous group (DAO) that permits customers to stake Ether and obtain each day rewards whereas holding full management of their staked tokens.

Lido Positioned because the Revenue Engine Behind Ethereum’s Rise

Crypto market members are warming as much as the concept that staking infrastructure goes past technical plumbing and turns into a revenue engine.

With a surge of institutional and ecosystem curiosity in ETH, some analysts now argue that Lido’s native token, LDO, might be considerably undervalued.

Kyle Reidhead, co-owner of Milk Street, lately highlighted a cluster of bullish catalysts forming round Ethereum. The crypto government pointed to Ethereum’s profitable Layer-2 (L2) roadmap, adoption by main corporations like Robinhood and OKX, and the rising pattern of ETH utilized in company treasuries.

“ETH is setting as much as do very well right here IMO…I’m getting very bullish on ETH,” he mentioned.

Reidhead cited the involvement of the Ethereum Basis (EF) and the upcoming arrival of ETH staking ETFs as additional accelerants.

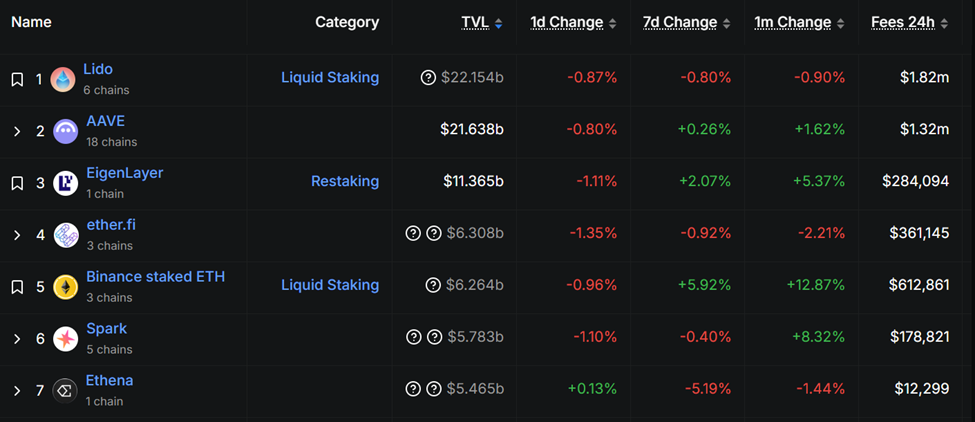

This pattern might translate immediately into bottom-line income for Lido, which controls roughly 60% of all staked ETH.

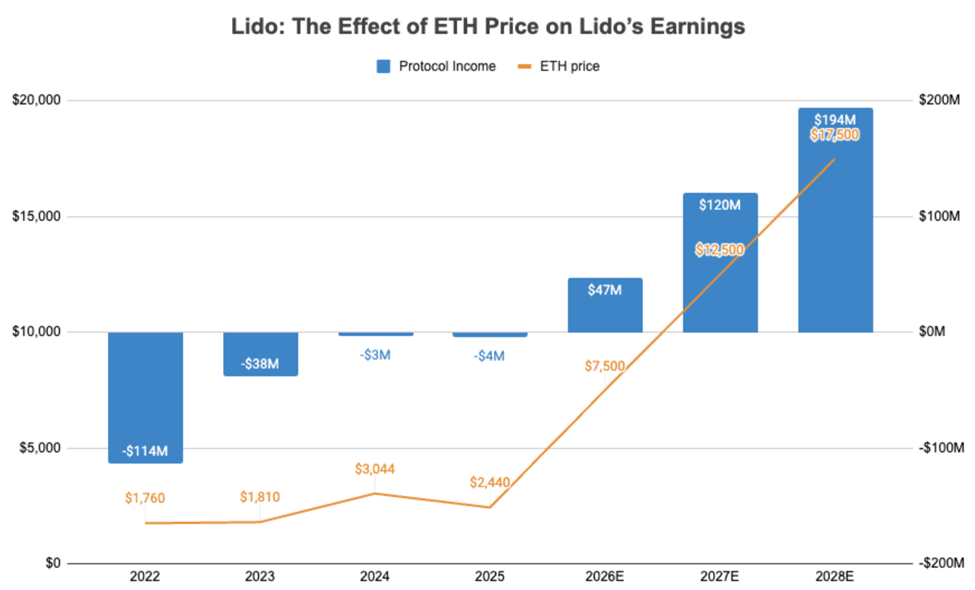

m0xt, an analyst at Milk Street, defined that Lido’s income mannequin scales with ETH itself.

“Bullish on ETH? Then try to be bullish on LDO too,” he wrote.

This stance is predicated on Lido incomes staking rewards in ETH and solely distributing round 50% of that earnings to validators. Based mostly on this, a rising ETH value boosts Lido’s revenue margin with no corresponding enhance in operational prices.

“However right here’s the kicker, not all prices rise with ETH,” m0xt continued.

Over the previous three years, Lido’s liquidity prices have averaged $13.5 million yearly. In the meantime, working bills have hovered round $40 million.

Assuming these keep flat, and even conservatively bump to $50 million, Lido might generate tens of thousands and thousands in revenue purely from Ethereum’s value appreciation.

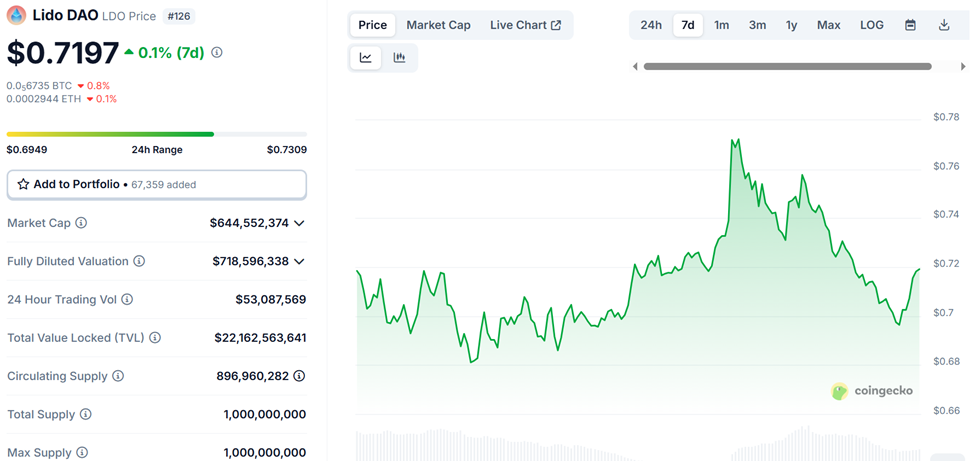

With 90% of LDO’s token provide already in circulation and a present market cap of $644 million, LDO could also be mispriced relative to its money stream potential.

Rising Investor Curiosity in LDO as ETH Demand Accelerates

Investor sentiment is beginning to shift consistent with this thesis. Crypto dealer kcryptoyt emphasised Lido’s dominant market share within the ETH staking ecosystem.

The dealer acknowledged some skepticism across the long-rumored “price change,” which might redirect protocol charges to LDO holders. He additionally admits that the LDO appears to be like like a horny purchase.

“I haven’t pulled the purchase set off as a result of effectively…it’s ETH we’re speaking about however I can’t lie it, LDO is beginning to look very interesting,” wrote the dealer.

In the meantime, the broader market backdrop solely strengthens the case. As Ethereum begins to resemble a “reserve asset” for the crypto economic system, mirroring Bitcoin’s position in institutional portfolios, Lido stands to learn as the most important gateway to ETH staking.

Ethereum’s rising integration into company treasuries, DeFi infrastructure, and ETF merchandise is reinforcing demand for yield-bearing ETH publicity, a lot of which flows by means of Lido.

Whereas dangers stay round protocol governance, regulatory scrutiny, or aggressive staking fashions, analysts recommend Lido’s place is uniquely entrenched.

As Ethereum inches nearer to order asset standing, LDO might emerge as probably the most leveraged methods to achieve publicity to that shift.

In accordance with information on CoinGecko, LDO was buying and selling for $0.7197, up by a modest 0.1% within the final week.

Disclaimer

In adherence to the Belief Challenge tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nevertheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.