Bitcoin confirms its evolution as a global-scale asset, reaching report capitalization ranges and shocking with the resilience demonstrated in latest weeks.

An in-depth evaluation of monetary flows, investor behaviors, and demand indicators provides a transparent overview of the present power of the market and its future prospects.

Bitcoin and the expansion of capitalization in latest months

The present market capitalization of Bitcoin has reached 2.1 trillion {dollars}, a determine that represents the spectacular development and maturation in the direction of a multi-trillion asset. In parallel, the Realized Cap – that’s, the valuation based mostly on the latest transaction worth of every coin – now stands at 955 billion.

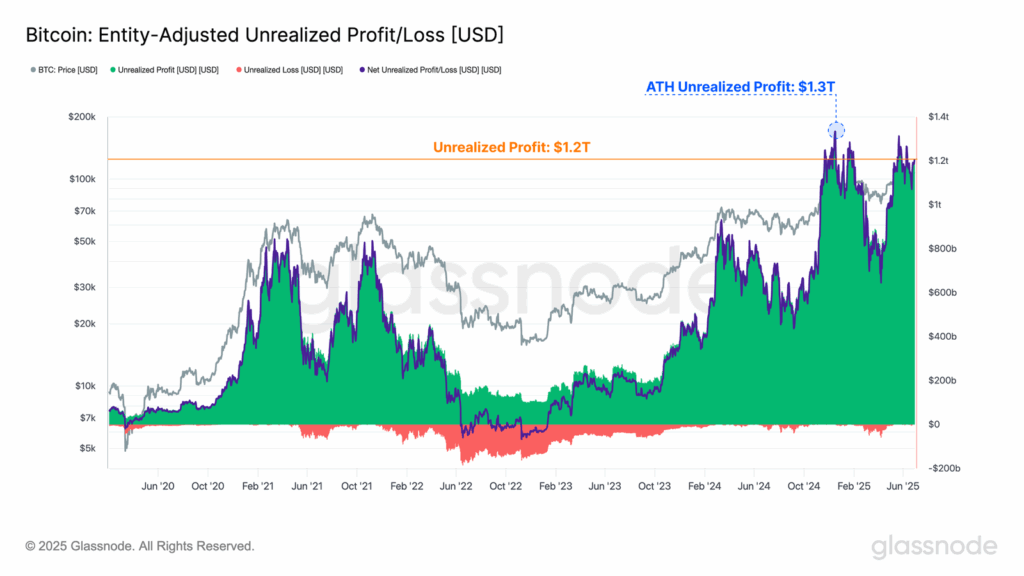

The info proven within the Glassnode weekly report tells an vital story: on one hand, a large inflow of capital into the system; on the opposite, the progressive transition of Bitcoin from a speculative asset to a worldwide retailer of worth. The distinction between market cap and realized cap represents the unrealized revenue held by traders, which at present stands at 1.2 trillion {dollars}. This important stream highlights each the potential for additional bull runs and the potential of promoting stress ought to sentiment shift.

Latest fluctuations: between geopolitics and technical helps

Final week, the growing tensions between Israel and Iran triggered robust volatility, inflicting the value to drop from 106,000 to 99,000 {dollars}. Nevertheless, the market discovered a strong help on the Quick-Time period Holder price foundation of 98,300 {dollars}, a stage that always separates bull and bear phases.

The flexibility to keep up this help in a state of affairs of excessive uncertainty nonetheless suggests a prevalence of consumers and a momentum that is still oriented to the bull.

Unrealized income: a big increase for Bitcoin

Right this moment, nearly all of traders in Bitcoin maintain important unrealized income. In keeping with the MVRV (Market Worth to Realized Worth) report, the typical improve in costs (“paper achieve”) is +125% in comparison with the typical buy price. This worth, though decrease than the +180% recorded on the peaks of March 2024, displays the speedy development of the capital base locked within the community.

An evaluation of the coin age cohorts indicators exhibits that the latest worth contraction has not considerably affected this profitability. Quite the opposite, the sentiment stays constructive amongst traders of all ages, reinforcing the concept of an underlying context that’s nonetheless constructive for the market.

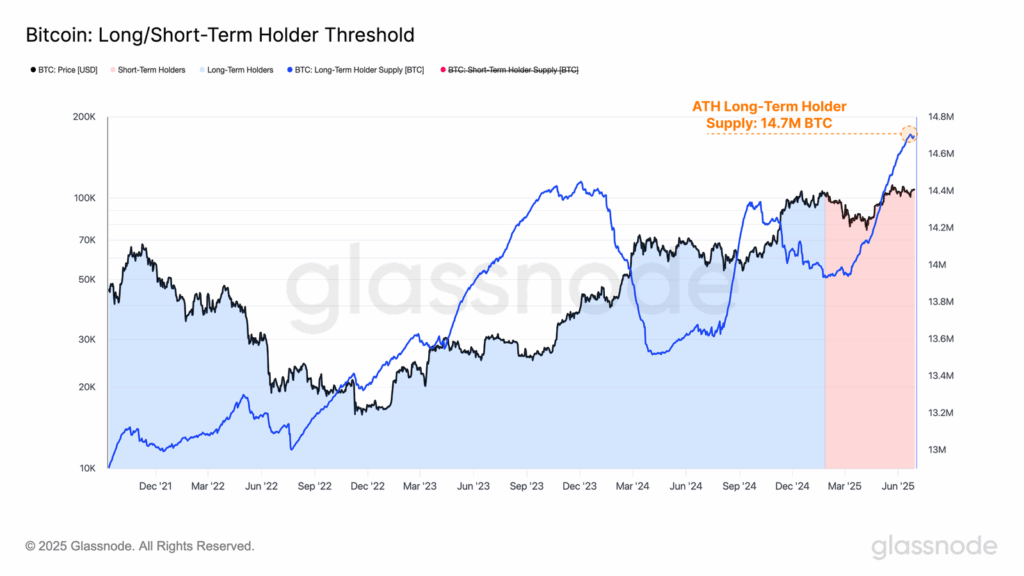

HODLing and reduce in promoting stress

Regardless of the extensive revenue margin on paper, the conduct of traders suggests a robust propensity for accumulation and holding (“HODLing”). The income truly realized in latest weeks have remained contained, simply 872 million {dollars} each day – a lot much less in comparison with the peaks of earlier bull waves.

Probably the most important information issues the provide held by Lengthy-Time period Holders, now reaching 14.7 million BTC, a historic excessive that demonstrates traders’ readiness to keep up their positions even at present costs. Moreover, the Liveliness parameter – which measures the stability between accumulation and spending – exhibits a downward pattern, a transparent sign that spending one’s BTC just isn’t but thought of enticing by nearly all of contributors.

A market equilibrium pushed by the demand for stablecoins

The stablecoin have established themselves as basic parts of liquidity in digital markets, performing as “gunpowder” prepared for the acquisition of digital belongings. The Stablecoin Provide Ratio (SSR) indicator – which measures the stablecoin buying energy relative to the provision of Bitcoin – is at present close to equilibrium ranges. This displays a possible underlying power in demand, particularly when in comparison with earlier breakouts above $100,000, when the SSR was a lot greater.

In parallel, the pattern of the Change Shopping for Energy (variation within the availability of stablecoins relative to BTC/ETH inflows on exchanges) means that the market is witnessing a rotation of liquidity from stablecoins immediately in the direction of Bitcoin and different fundamental belongings. If this dynamic continues, it might present additional help to the valuations of digital belongings.

Institutional Inflows and Lengthy-Time period Help

With the expansion of Bitcoin capitalization, the push from institutional traders turns into more and more important. The web flows into Bitcoin ETF Spot USA present a gradual development: the weekly common has reached +298 million {dollars}, confirming the constant shopping for stress from massive regulated monetary operators.

This pattern highlights how institutional urge for food stays robust even at present valuations, performing as a basic demand driver whereas the invested plenty attain unprecedented ranges.

Implications for the way forward for the Bitcoin market

The rebound from the technical helps of 98,300 {dollars} has introduced nearly all of traders again into constructive territory, with the combination unrealized revenue at 1.2 trillion {dollars}. Nevertheless, regardless of the widespread robust profitability, on-chain information confirms a transparent prevalence of the HODL method: the propensity to promote stays low, and the indications of volatility and coin distribution are reducing.

Within the meantime, the demand for stablecoin and institutional inflows additional consolidate the framework, suggesting a nonetheless extensive development potential. On this situation, intently monitoring the event of the principle demand indicators, in addition to the reactions to geopolitical and market actions, proves essential for decoding the upcoming evolutions of the Bitcoin worth.