- DeFi Growth Corp. added 17,760 SOL, bringing its complete to 640,585 tokens, backed by $112.5M in contemporary funding and a $5B credit score line.

- The agency is betting on staking-heavy PoS belongings, becoming a member of a rising wave of crypto treasury corporations diversifying past Bitcoin.

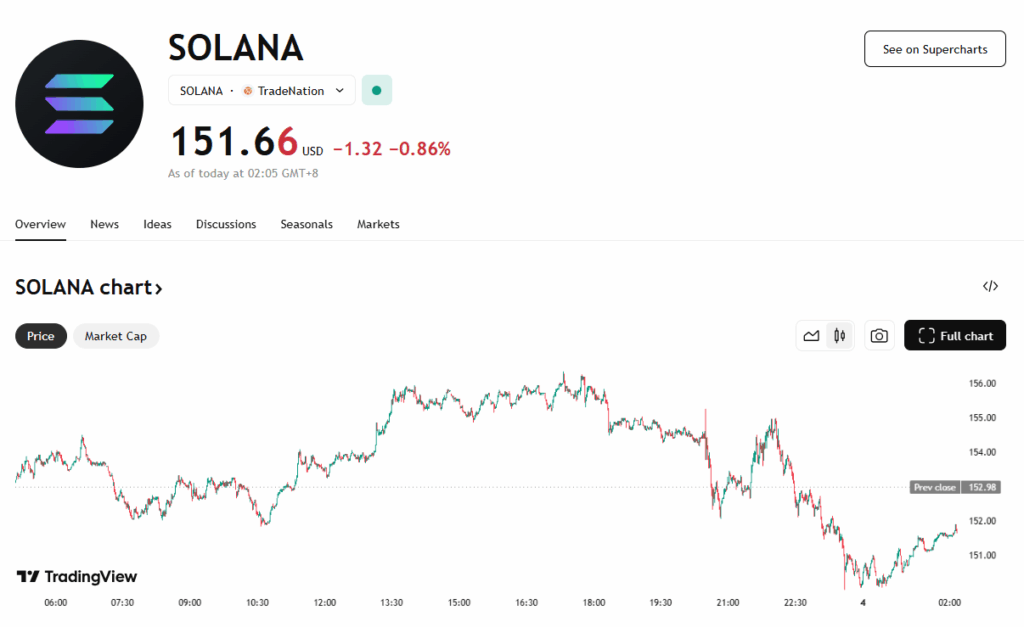

- At a mean purchase worth of $153.10 per SOL, DDC maintains a “SOL per Share” ratio of 0.042 to benchmark its fairness’s on-chain worth.

DeFi Growth Corp. (DFDV), a Solana-focused treasury agency, simply expanded its SOL stash by one other 17,760 tokens, bumping its complete holdings to 640,585 SOL—value about $96 million at present costs. This newest purchase isn’t simply one other quiet accumulation. It alerts a broader technique the agency has been doubling down on since its April acquisition by ex-Kraken executives. The acquisition got here shortly after DDC secured a contemporary $112.5 million in non-public funding to spice up its warfare chest.

A New Treasury Playbook Backed by Billions

The $112.5M funding spherical isn’t DDC’s first rodeo. The corporate had already raised $42 million in earlier financing and locked in a large $5 billion line of credit score. As a part of the most recent deal, $75.6 million was allotted for a “pay as you go ahead” inventory transaction—mainly a construction meant to defend consumers of DDC’s convertible notes from danger. The remaining funds are going into company ops and, unsurprisingly, extra SOL.

Staking Is the Technique, Not Simply Hypothesis

DDC isn’t alone on this sport. It joins different treasury-style gamers like SOL Methods and Upexi who’re betting exhausting on proof-of-stake tokens. Whereas most corporations lean on Bitcoin for steadiness sheet safety, these corporations are making a case for PoS belongings like SOL, ETH, and BNB—tokens that earn yield by staking. It’s much less about HODLing and extra about turning token treasuries into productive income streams.

$153.10 Common Purchase-In and a Distinctive Metric

The agency’s most up-to-date SOL tranche was purchased at a mean worth of $153.10—roughly $2.72 million value. DDC tracks its efficiency with a novel “SOL per Share” ratio, which presently sits at 0.042 as of July 3. This metric is designed to assist traders monitor how a lot precise SOL backs every share of fairness—a intelligent contact for transparency and valuation anchoring as crypto treasuries go extra mainstream.