This week, Ripple utilized for a US nationwide banking license, a big transfer that positions the corporate nearer to the regulated monetary mainstream. However the market response was muted—and for good cause.

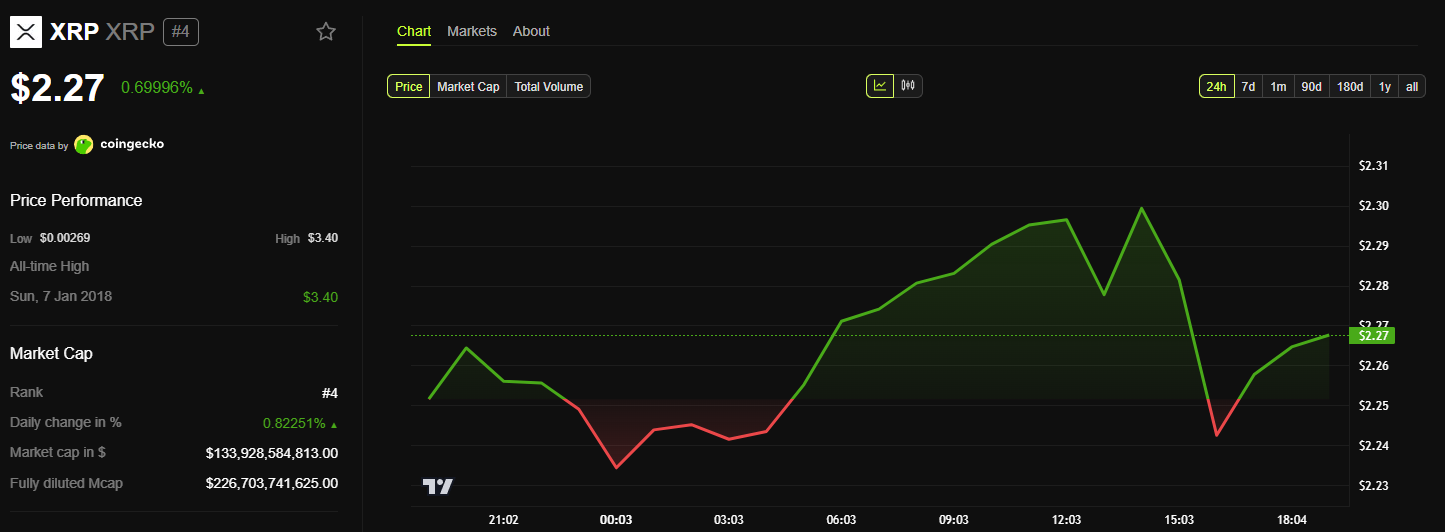

XRP worth gained solely about 3% after the information. That modest rise displays the truth that the banking license, if granted, doesn’t instantly enhance XRP’s utility or authorized standing—no less than not but.

Ripple Turning into a Compliant US Custodian Doesn’t Influence XRP

The banking utility was filed with the Workplace of the Comptroller of the Forex (OCC), the identical federal regulator overseeing belief financial institution charters.

Ripple’s objective is to function as a regulated financial institution entity, permitting it to custody digital property and handle stablecoin reserves for its new product, RLUSD. This growth mirrors related strikes by different crypto companies, like Circle and Constancy.

Nonetheless, Ripple’s technique has restricted implications for XRP’s worth or demand within the close to time period.

Critically, the OCC license wouldn’t alter XRP’s present regulatory standing within the US. Earlier, Ripple dropped its cross-appeal in opposition to the SEC within the XRP lawsuit. This implies the federal court docket’s 2023 ruling stands.

To recap, the ruling discovered that XRP retail gross sales are usually not securities, however institutional gross sales by Ripple did violate securities legal guidelines.

That injunction nonetheless stands, and Ripple can’t promote XRP to establishments within the US with out correct SEC registration or exemption.

Subsequently, even when Ripple positive aspects financial institution standing, it can’t use that constitution to restart institutional XRP gross sales domestically. Nor does it make XRP a regulated or authorized asset beneath federal securities regulation.

Conditional Bullish State of affairs

What the license may allow is improved integration between Ripple’s providers—particularly RLUSD—and its broader infrastructure.

If Ripple makes use of its banking capabilities to serve regulated shoppers, XRP would possibly not directly profit as a liquidity bridge. However that will rely upon new enterprise flows and hall growth, not authorized change.

Now, Ripple may finally use its financial institution standing to construct belief with US establishments. This may probably revive curiosity in utilizing XRP inside tokenized asset methods or cross-border cost rails.

Nonetheless, that’s a long-term narrative, not a right away catalyst.

For now, XRP’s worth motion displays that. Merchants are pricing in a company compliance story, not a token utility improve.

Till XRP turns into central to Ripple’s bank-backed operations, the market will doubtless view this transfer as impartial from a token worth standpoint.

Ripple’s financial institution license, if authorized, may reshape the corporate’s regulatory profile. However XRP stays the place it was—partly cleared for retail, restricted for establishments, and ready for a much bigger use-case breakthrough.

The put up Why Ripple’s US Banking License Bid Isn’t a Clear Bullish Sign for XRP appeared first on BeInCrypto.