Allianz SE, Europe’s second-largest insurance coverage firm and Germany’s largest, has acquired practically 25% of MicroStrategy’s latest convertible be aware providing. The funding marks a considerable endorsement of Bitcoin by a significant monetary establishment.

Allianz Needs Bitcoin Publicity

Allianz bought 24.75% of MicroStrategy‘s $2.6 billion be aware sale meant for institutional traders, which closed on November 21. The funding was made throughout 4 of Allianz’s sub-organizations, in keeping with Bloomberg Terminal knowledge shared by the pseudonymous analyst Petruschki in a November 22 submit on X: “German insurance coverage large Allianz purchased 24.75% of MicroStrategy’s 2031 bond.”

He additional detailed: “The positions have been filed in July and October. The shares are held by the next sub-organizations: Allianz World Buyers Luxembourg 14.34%, Allianz World Buyers of America LP 6.64%, Nicholas Applegate Capital Administration Inc. 3.74%, and Allianz World Buyers GmbH 0.04%.”

MicroStrategy, referred to as the world’s largest company holder of Bitcoin, initially introduced a $1.75 billion combination principal quantity of notes on November 18. Nonetheless, resulting from robust institutional demand, the corporate upsized the providing to $2.6 billion simply two days later.

The completion of the be aware providing on November 21 raised $3 billion in capital, indicating that preliminary purchasers exercised the choice to purchase the utmost quantity of further notes accessible. Michael Saylor, founder and Government Chairman of MicroStrategy, confirmed the profitable closure of the providing.

The allocation of the convertible notes showcases a various vary of institutional traders. Allianz SE stands as the most important investor with 149,455 shares, accounting for twenty-four.75% of the whole providing. Calamos Companions LLC follows with 37,329 shares (6.18%), and Context Capital Administration LLC holds 30,500 shares (5.05%).

Different notable traders embody State Avenue Corp with 8,307 shares (1.38%) and FMR LLC with 7,199 shares (1.19%). BlackRock, Schroders PLC, and the Royal Financial institution of Canada additionally participated, every holding lower than 1% of the shares.

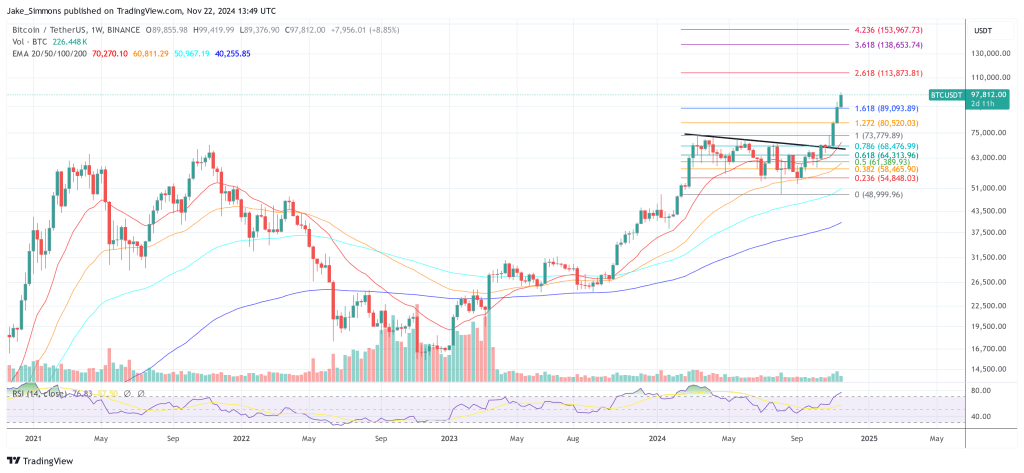

This inflow of institutional capital comes at a pivotal second for Bitcoin, because the cryptocurrency approaches the historic milestone of $100,000. The funding by Allianz is seen by many as a powerful vote of confidence in Bitcoin’s long-term potential.

Patrick Dotson, Co-Founder and COO of Synnax, commented on the event through X: “In but once more one other instance of Wall Avenue FOMO (amongst these asset managers not allowed to take a position immediately in Bitcoin), MSTR simply issued a $2.6bn Convertible Bond, upsizing it by a whopping $850m from the preliminary supply. The curiosity MSTR pays? ZERO. […] In case you surprise who’s handing cash on a silver plate to MSTR to purchase extra Bitcoin. […] Do you see any retail on the checklist? No, blame Wall Avenue, not Saylor.”

At press time, BTC traded at $97,812.

Featured picture created with DALL.E, chart from TradingView.com