- The REX-Osprey Solana Staking ETF debuted with $12M in inflows and $33M in buying and selling quantity, changing into the primary U.S. ETF to supply each spot Solana publicity and staking rewards.

- It overcame SEC objections utilizing a novel regulatory construction, sidestepping the standard 19b-4 submitting and opening the door for future staking-enabled ETFs.

- Analysts predict a wave of altcoin ETF approvals in 2025, with Solana, XRP, and Litecoin anticipated to obtain the inexperienced mild by year-end, signaling rising institutional urge for food.

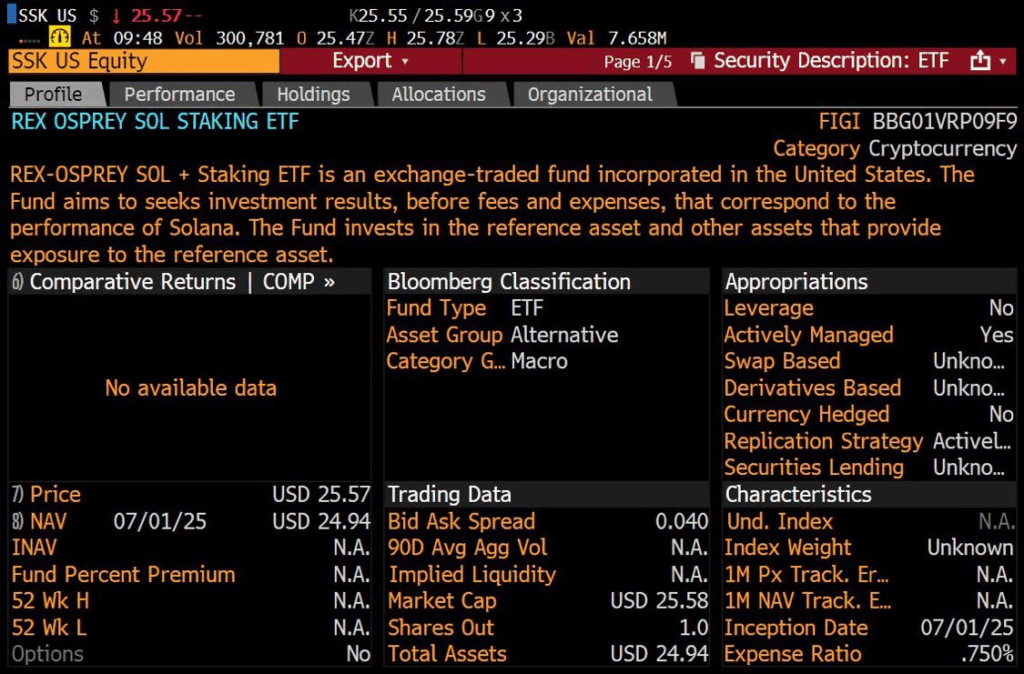

The REX-Osprey Solana Staking ETF (SSK) launched with a bang this week, closing its first day with $12 million in inflows and a strong $33 million in whole buying and selling quantity. As the primary U.S.-approved staking-enabled ETF, it marks an enormous milestone for Solana and for crypto ETFs extra broadly. The product offers buyers publicity not simply to identify Solana (SOL), however to staking rewards as nicely—a function that distinguishes it from different crypto-based monetary merchandise.

Breaking Limitations: A Regulatory Workaround That Labored

The highway to launch wasn’t precisely easy. The SEC initially pushed again in Could, questioning whether or not the ETF certified as an “funding firm.” REX-Osprey sidestepped this hurdle by allocating a minimum of 40% of its belongings into different exchange-traded merchandise (ETPs), primarily outdoors the U.S. Structured beneath the Funding Firm Act of 1940, the fund averted the standard 19b-4 submitting course of used for spot ETFs. Whereas some name it a regulatory loophole, others see it as a daring precedent for future staking ETFs.

A “Wholesome Begin” Amid July 4 Vacation Buying and selling

ETF analysts like James Seyffart described the launch as a “wholesome begin,” noting $8 million in buying and selling quantity inside simply the primary 20 minutes. Whereas modest in comparison with spot Bitcoin ETF debuts—which noticed $4.6 billion in day-one quantity—SSK nonetheless outperformed earlier futures-based Solana and XRP ETFs. Given the U.S. vacation week, analysts say true demand could also be even stronger than preliminary numbers counsel. Anchorage Digital, the ETF’s staking associate, referred to as the launch “a defining second for digital belongings.”

A Glimpse into ETF Summer season? Extra on the Horizon

This ETF debut comes simply as analysts forecast a “second-half wave” of altcoin ETFs. Seyffart and Balchunas now assign a 95% likelihood that spot Solana, XRP, and Litecoin ETFs will achieve SEC approval by year-end. With Grayscale’s Digital Massive-Cap Fund ETF conversion already authorized, momentum is constructing. Whether or not or not SSK is assessed as a “true” spot ETF, its launch is an indication that institutional urge for food for Solana and staking yield is actual—and rising.

SOL Worth Muted, However Futures Inform a Completely different Story

Apparently, SOL’s worth didn’t spike dramatically on the information, gaining simply 3.6% in 24 hours. However look beneath the floor and the image adjustments—Solana CME futures hit document open curiosity at $167 million following the ETF’s debut, indicating institutional merchants are paying consideration. SOL continues to be down 48% from its January highs, however indicators of long-term curiosity are clearly constructing.

Remaining Ideas

The profitable launch of the REX-Osprey Solana Staking ETF marks a pivotal second for each Solana and the broader crypto market. It’s not simply in regards to the $12 million in inflows or the regulatory gymnastics—it’s about proving that staking-enabled ETFs can exist inside U.S. monetary infrastructure. This might reshape how conventional buyers achieve entry to yield-bearing digital belongings.

Although it didn’t spark a right away worth breakout for SOL, the ETF’s robust debut exhibits that institutional curiosity is actual—and rising. With document open curiosity in Solana futures and analysts forecasting a wave of altcoin ETF approvals, SSK might find yourself being the primary domino in a a lot greater shift. The quiet energy of this launch would possibly simply set the stage for staking to change into a normal function within the subsequent period of crypto investing.