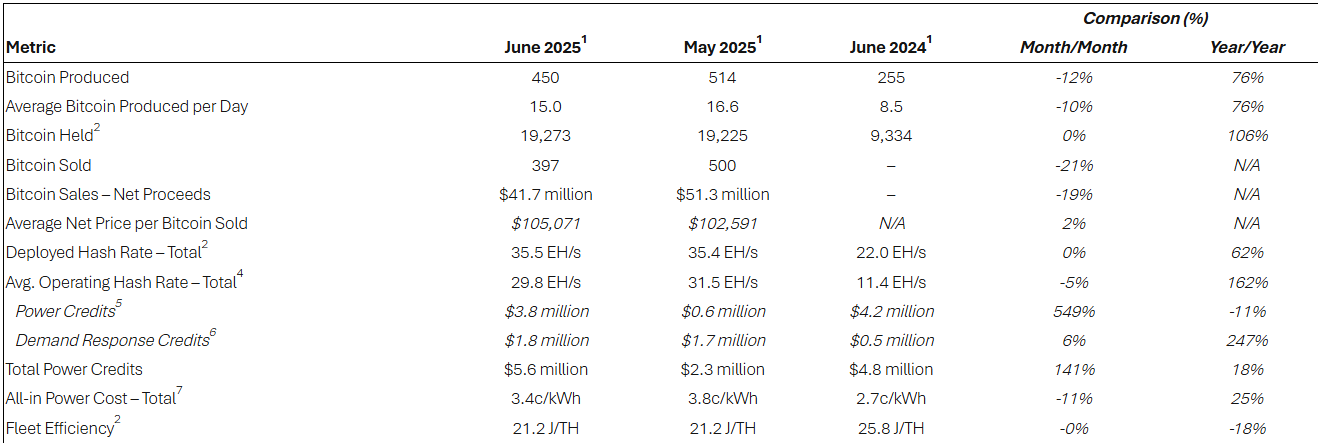

Right this moment, Riot Platforms, Inc. (NASDAQ: RIOT) reported the manufacturing of 450 Bitcoin in June 2025, a 12% lower from Could however a 76% enhance year-over-year. The corporate additionally noticed a surge in energy credit, totalling $5.6 million, greater than double from the earlier month.

Riot bought 397 Bitcoin for $41.7 million, representing a 21% lower in quantity and a 19% decline in proceeds from Could, however at a better common worth per coin ($105,071). The corporate ended the month holding 19,273 Bitcoin, greater than double the quantity held in June 2024.

The typical working hash charge decreased 5% month-over-month to 29.8 EH/s, however stays 162% increased than a 12 months in the past. Fleet effectivity held regular at 21.2 J/TH, an 18% enchancment over the prior 12 months.

“Riot mined 450 bitcoin in June, which additionally represented the beginning of ERCOT’s 4 Coincident Peak (“4CP”) program,” acknowledged the CEO of Riot, Jason Les. “Riot’s energy technique, which incorporates financial curtailment and voluntary participation within the 4CP and different demand response packages, considerably contributes to grid stability whereas enhancing Riot’s aggressive positioning.”

June’s efficiency follows an identical April, during which Riot produced 463 Bitcoin, bought 475 Bitcoin for $38.8 million at a mean worth of $81,731, and accomplished a significant acquisition. The corporate acquired all tangible property of Rhodium at its Rockdale Facility, together with 125 MW of energy capability.

“April was a big month for Riot as we closed on the acquisition of the entire tangible property of Rhodium at our Rockdale Facility, together with 125 MW of energy capability, and mutually ended all excellent litigation,” stated Les. “This transaction ends the internet hosting settlement with our final internet hosting shopper and marks the entire exit of Riot from the bitcoin mining internet hosting enterprise.”