- ADA is bouncing off key assist between $0.55–$0.60, with bullish divergence hinting at a possible breakout.

- Technical targets level to $1.20 if resistance between $0.80–$1.00 is damaged, although short-term sentiment stays blended.

- Cardano’s earlier provide cap (2100 vs. Bitcoin’s 2140) may imply smoother tokenomics within the a long time to return.

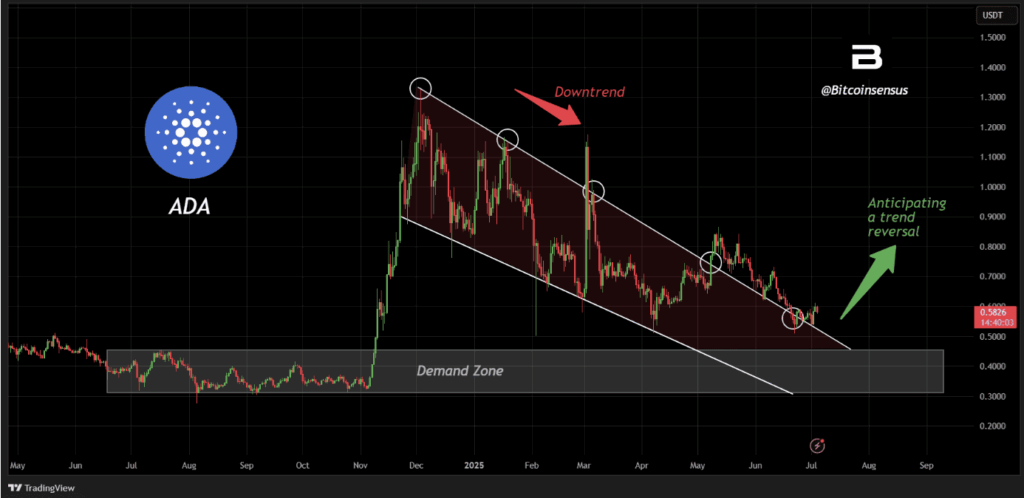

Cardano (ADA) is kinda at that tipping level once more. The weekly chart’s been displaying one thing attention-grabbing—value is bouncing inside this clear, virtually too-perfect descending channel that’s been holding since early 2024. Now, it’s dancing round a fairly crucial demand zone, between $0.55 and $0.60. Appears like we’re seeing a little bit of a base type right here, which could simply be what ADA must lastly push up.

From what Bitcoinsensus exhibits, the newest candles bounced proper off assist—and right here’s the kicker—there’s a bullish divergence forming. That often indicators a pattern reversal is lurking across the nook. RSI and perhaps even MACD are seemingly flashing increased lows whereas value motion dips decrease. Basic divergence stuff.

Now, that descending resistance line? It’s floating up close to $0.80 to $1.00. That’s the large take a look at. If ADA breaks above that ceiling, then yeah, we might be wanting on the finish of this lengthy slog downward. However it’s gotta clear that line clear. No fake-outs.

Bullish Patterns, However the Transfer Isn’t Assured

Zooming out, ADA’s been respecting its parallel channel like a well-behaved altcoin. Higher line, decrease line—it’s all very symmetrical. Bitcoinsensus marked up their chart with the standard: purple arrow for “downtrend,” inexperienced for “reversal,” and containers declaring the demand zone and the place a breakout would possibly launch.

As of early July 2025, ADA’s sitting round $0.57. It’s gained about 3% this week, not unhealthy. TradingView exhibits barely increased numbers—4.5% for the week and a hefty 46% on the 12 months. That form of development retains the optimism alive.

If it breaks that resistance band with drive, we might be speaking a couple of soar to $1.20. That’s a earlier rejection zone—the place issues obtained heavy final time. Nonetheless, regardless of the setup, the broader technical temper feels impartial. CentralCharts has ADA leaning long-term bullish, however the short-term vibe? Extra on the bearish facet.

Provide Curve: A Quiet Benefit?

Right here’s one thing not lots of people are speaking about—Cardano’s provide cap timeline. The DApp Analyst posted that ADA will hit its full provide restrict by 2100. That’s forty years earlier than Bitcoin reaches its max in 2140.

By the 12 months 2040, Cardano could have about 91–93% of its complete provide (roughly 41–42 billion ADA) out in circulation. Bitcoin, by comparability, could have launched virtually all of its 21 million cash—about 99%. So, what does that imply? ADA would possibly attain a provide plateau earlier, smoothing out its tokenomics over time.

No extra dramatic halvings like BTC. Simply regular launch, a capped provide, and fewer issuance volatility. That would make ADA extra predictable long-term… and perhaps much more enticing for the affected person investor.