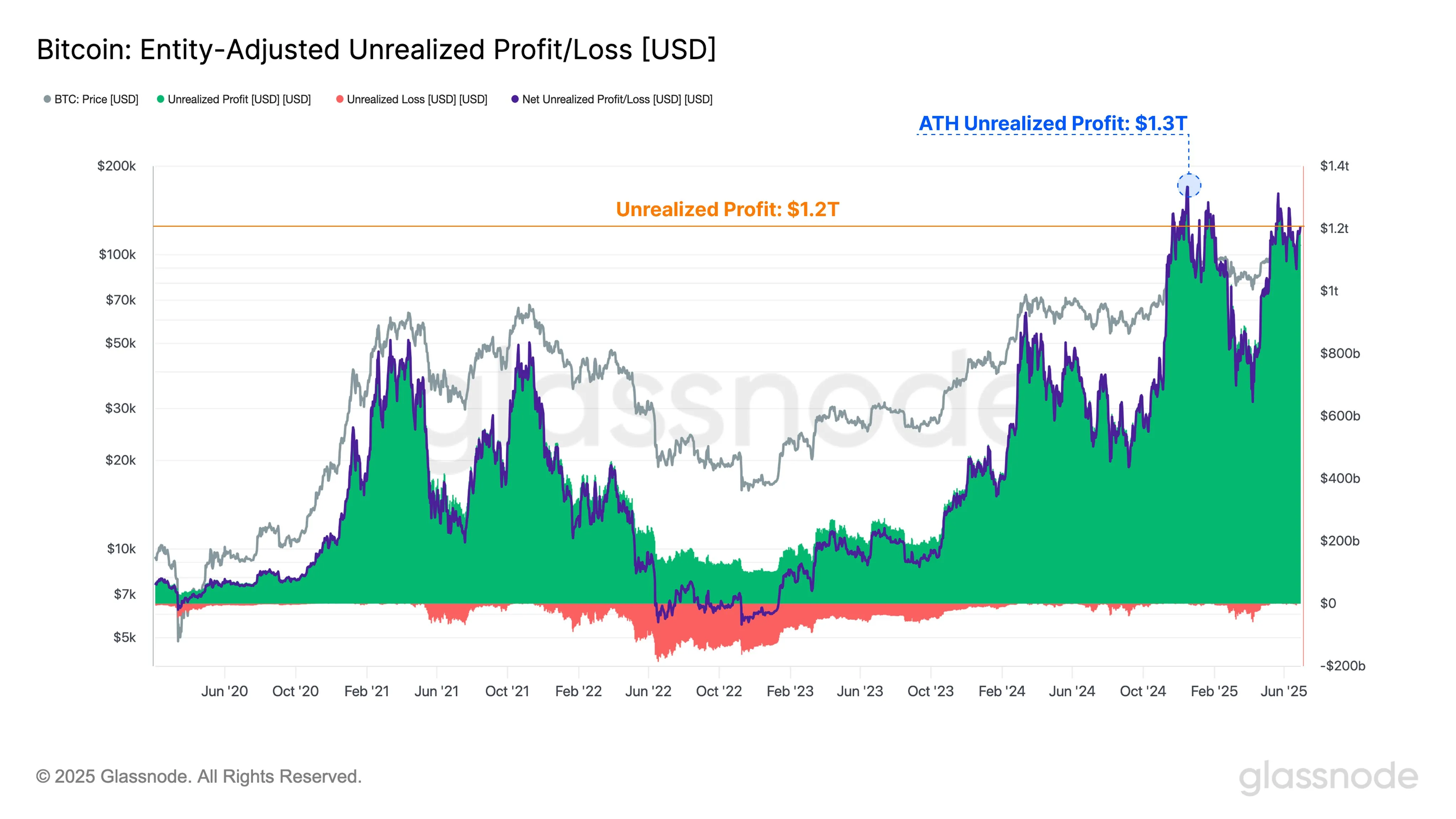

Bitcoin traders are at present holding an estimated $1.2 trillion in unrealized earnings, in accordance with on-chain analytics platform Glassnode.

This important determine highlights the paper features gathered by long-term holders as Bitcoin continues to commerce near its document highs.

Bitcoin Investor Base Shifts From Merchants to Lengthy-Time period Institutional Allocators

Glassnode information reveals that the common unrealized revenue per investor stands at round 125%, which is decrease than the 180% seen in March 2024, when the BTC value reached a peak of $73,000.

Nevertheless, regardless of these large unrealized features, investor habits suggests no main rush to promote the highest crypto. BeInCrypto beforehand reported that every day realized earnings have remained comparatively subdued, averaging simply $872 million.

This starkly contrasts earlier value surges, when realized features surged to between $2.8 billion and $3.2 billion at BTC value factors of $73,000 and $107,000, respectively.

Furthermore, present market sentiment means that traders are ready for a extra decisive value motion earlier than adjusting their upward or downward positions. The pattern factors to agency conviction amongst long-term holders, with accumulation persevering with to outweigh promoting strain.

“This underscores that HODLing stays the dominant market habits amongst traders, with accumulation and maturation flows considerably outweighing distribution pressures,” Glassnode acknowledged.

In the meantime, Bitcoin analyst Rezo famous that the present pattern displays a elementary shift within the considerably developed profile of Bitcoin holders. In keeping with him, the everyday BTC holder has shifted from short-term speculative merchants to long-term institutional traders and allocators.

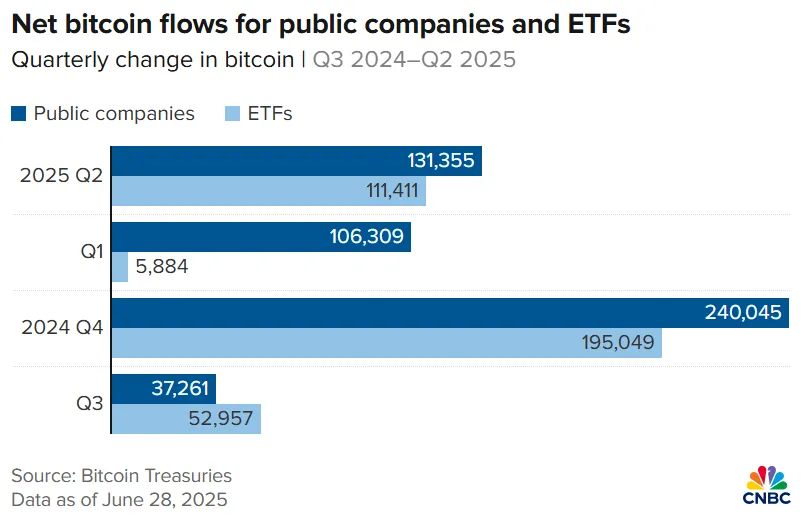

Rezo pointed to the rising affect of institutional gamers corresponding to ETFs and public corporations like Technique (previously MicroStrategy).

“The holder base has modified – from merchants looking for exit to allocators looking for publicity. MicroStrategy, sitting on tens of billions in unrealized features, retains including. ETFs = fixed bid, not swing merchants,” he mentioned.

Notably, public corporations like Technique elevated their Bitcoin holdings by 18% in Q2, whereas ETF publicity to Bitcoin climbed by 8% in the identical interval.

Contemplating this, Rezo concluded that almost all short-term sellers possible exited between $70,000 and $100,000. He added that what stays are traders who deal with Bitcoin much less as a speculative commerce and extra as a strategic long-term allocation.

Disclaimer

In adherence to the Belief Mission tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.