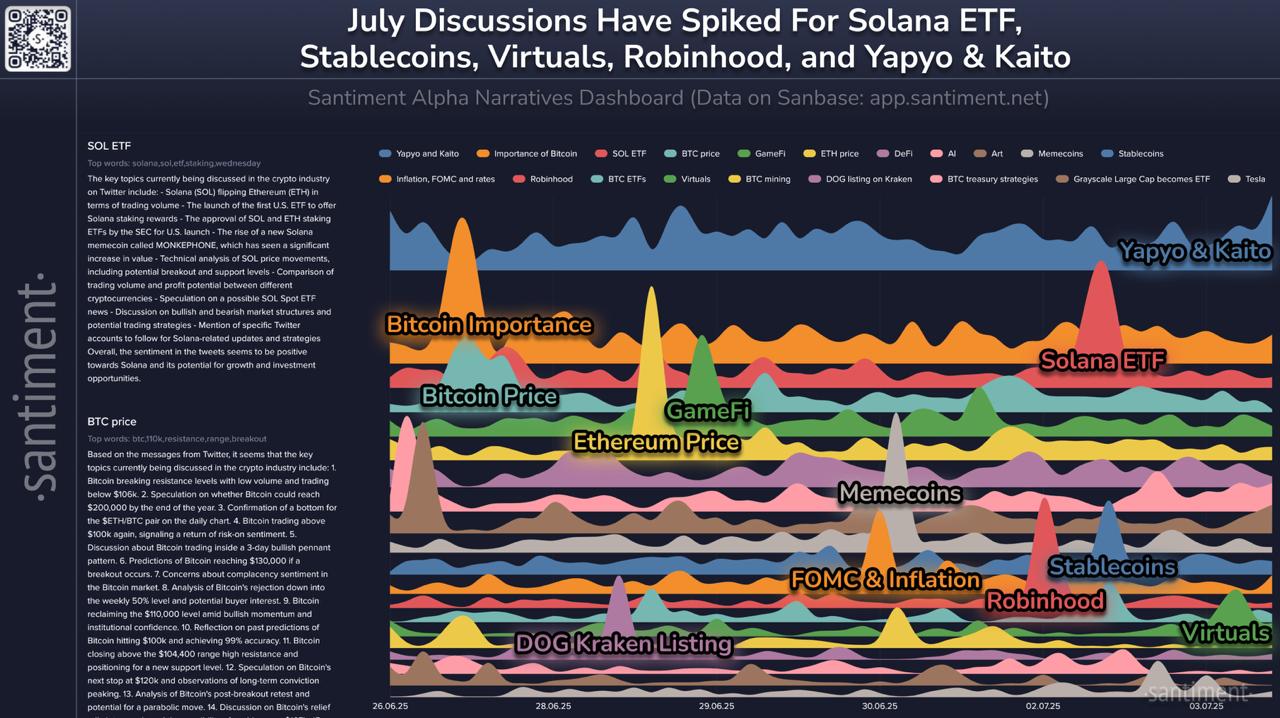

In keeping with Santiment’s newest narrative dashboard, the beginning of July has seen a surge in on-line discussions round a variety of crypto themes, with Solana ETFs, stablecoins, Virtuals, Robinhood, and AI bot initiatives like Yapyo & Kaito main the spike in mentions throughout platforms.

The July 4 replace, which coincided with each U.S. Independence Day and Santiment’s anniversary, highlights how shifting market narratives are influencing dealer sentiment and neighborhood focus.

Santiment’s Alpha Narratives Dashboard, which tracks thematic tendencies throughout crypto conversations, exhibits that Solana ETF hypothesis is at present dominating consideration.

This consists of discuss across the approval of the U.S. spot ETF tied to Solana and the mixing of staking rewards as a part of its providing.

Along with ETF pleasure, stablecoins have re-entered the highlight, probably attributable to current geopolitical developments and coverage debate round digital greenback infrastructure. In the meantime, Virtuals, a phase related to metaverse and augmented identification platforms, has gained renewed consideration, alongside Robinhood, seemingly triggered by the platform’s rising crypto buying and selling quantity and ETF publicity.

Curiously, Yapyo & Kaito—AI-focused bots or crypto-native agent instruments—have emerged as new sizzling subjects. Their rise displays rising curiosity in AI-enhanced buying and selling or evaluation instruments throughout the crypto house, aligning with broader tech adoption tendencies.

Santiment’s dashboard additionally continues to trace legacy narratives like Bitcoin value volatility, Ethereum fundamentals, memecoins, and inflation-related chatter, although they’ve seen comparatively reasonable spikes in comparison with the newer focal factors.

With consideration biking quickly in crypto, Santiment’s information means that narrative rotation is a key driver of short-term volatility and engagement. As ETF approvals and coverage shifts proceed to unfold, these main dialogue subjects could provide a window into evolving market sentiment.