In response to on-chain analyst Darkfost, Bitcoin is coming into a brand new stage of on-chain habits marked by two key developments: a uncommon third peak within the SOPR Pattern Sign throughout a single bull cycle and a sustained outflow dominance in alternate flows.

Collectively, these traits counsel a strengthening conviction amongst holders and a maturing section of accumulation, regardless of short-term volatility.

SOPR pattern hits uncommon third peak

The SOPR (Spent Output Revenue Ratio) Pattern Sign, a metric that tracks the common revenue margin of cash moved on-chain, has now risen for the third time throughout the identical bull cycle — an unprecedented prevalence. This means that inside simply 12 months, Bitcoin holders have seen a number of worthwhile exit factors but proceed to point out robust holding habits.

This metric turns into particularly related when figuring out market shifts. If the SOPR sign’s blue line crosses beneath its long-term orange pattern line, it usually flags a transition towards bearish sentiment. As of now, nonetheless, the sign stays bullish, indicating that profit-taking has not but overwhelmed market demand.

Change outflows reaffirm long-term confidence

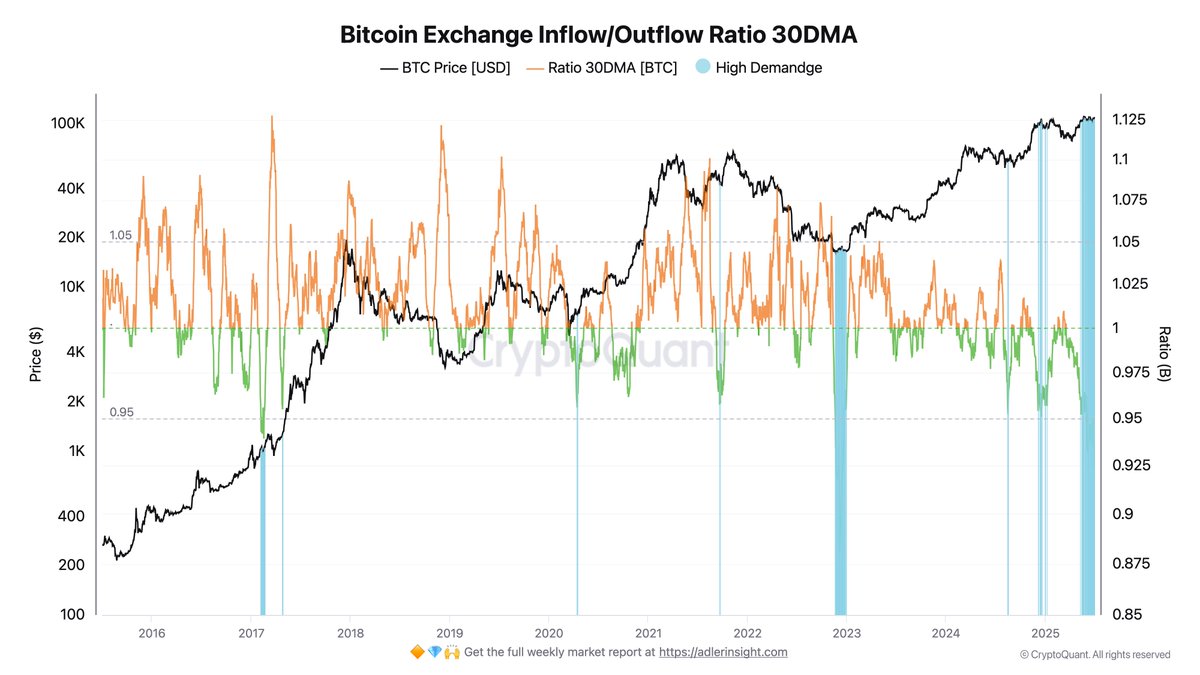

Supporting this pattern is the present influx/outflow ratio for BTC on exchanges, which has dropped to round 0.9 — a stage final seen throughout the 2023 bear market. A ratio beneath 1 means that extra Bitcoin is leaving exchanges than coming into, a traditional sign of accumulation.

Traditionally, when this ratio rises above 1.05, it has marked the beginning of distribution phases or broader corrections. However with long-term holders persevering with to soak up provide and outflows dominating, Darkfost suggests the market stays in a good spot-driven demand cycle.

Each indicators — the triple SOPR peak and sustained outflows — level to a market the place conviction is rising, not waning. Whereas dangers stay, these traits counsel that Bitcoin’s subsequent main transfer might as soon as once more defy standard expectations.