Bitcoin is at the moment holding simply above the $108,000 stage and bulls are sustaining momentum after a unstable begin to July. Nonetheless, a more in-depth take a look at on-chain information exhibits how fragile that place is likely to be.

Curiously, two assist ranges, $106,738 and $98,566, are actually a very powerful zones for bulls to defend. These ranges symbolize clusters of addresses holding giant quantities of Bitcoin, and shedding them might set off a deeper correction.

Associated Studying

Bitcoin’s Assist Clusters Round $106,000 And $98,000

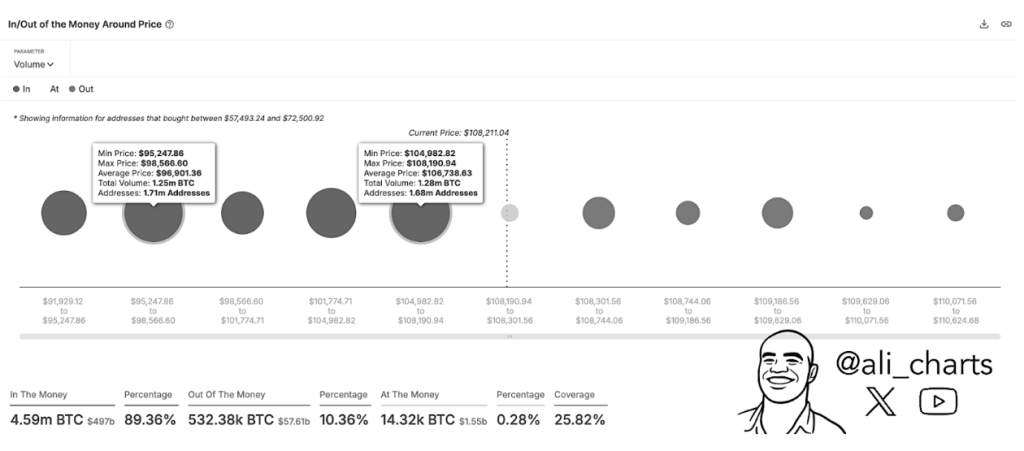

Taking to the social media platform X, crypto analyst Ali Martinez pointed to two main assist ranges primarily based on information exhibiting Bitcoin’s buy clusters. This information relies on Sentora’s (beforehand IntoTheBlock) In/Out of the Cash Round Worth metric amongst addresses that purchased Bitcoin shut to the present worth.

As proven by the metric, a very powerful present zones of buy are at $106,738 and $98,566. These two zones are the place huge shopping for exercise has occurred previously few weeks, and so they might act as assist in case of a Bitcoin worth crash.

The primary zone, between $104,982 and $108,190, incorporates 1.68 million addresses with a complete quantity of 1.28 million BTC at a median worth of $106,738. Beneath the primary zone, a bigger group of 1.71 million addresses holds a higher quantity of 1.25 million BTC inside the worth vary of $95,248 to $98,566, with a median worth of $98,566.

So long as Bitcoin continues to commerce above these ranges, the continued rally might proceed to push upward. Nonetheless, if these pockets of demand are damaged with sufficient promoting stress, the main cryptocurrency might enter into an unsure worth zone with little shopping for curiosity to offer assist.

Talking of promoting stress, on-chain information exhibits a slowing promote stress amongst giant holders. Based on information from on-chain analytics platform Sentora, Bitcoin recorded its fifth straight week of web outflows from centralized exchanges. The previous week alone noticed greater than $920 million value of BTC moved into self-custody or institutional merchandise, largely Spot Bitcoin ETFs.

Bitcoin Wants To Break Weekly Resistance For New Highs

Even with strong demand zones beneath, Bitcoin’s path to new highs isn’t but confirmed. Analyst Rekt Capital weighed in along with his evaluation, noting that Bitcoin is at the moment going through a powerful weekly resistance band slightly below $109,000. Significantly, Bitcoin is liable to a decrease excessive construction on the weekly candlestick timeframe chart.

Rekt Capital famous {that a} weekly shut above the purple horizontal resistance line have to be achieved to ensure that Bitcoin to reclaim a extra bullish stance. That resistance, which is at the moment round $108,890, is performing as a ceiling for Bitcoin’s upward rally.

Associated Studying

As such, Bitcoin would want to make a weekly shut above $108,890 to place itself for brand new all-time highs. Except there’s a convincing break of that stage, the value motion of Bitcoin might be erratic and prone to a retracement to $106,000.

On the time of writing, Bitcoin is buying and selling at $108,160.

Featured picture from Unsplash, chart from TradingView