The European Union has granted a complete of 53 licenses underneath its MiCA (Markets in Crypto-Belongings) regulatory framework, marking a significant step towards harmonized crypto oversight throughout the area.

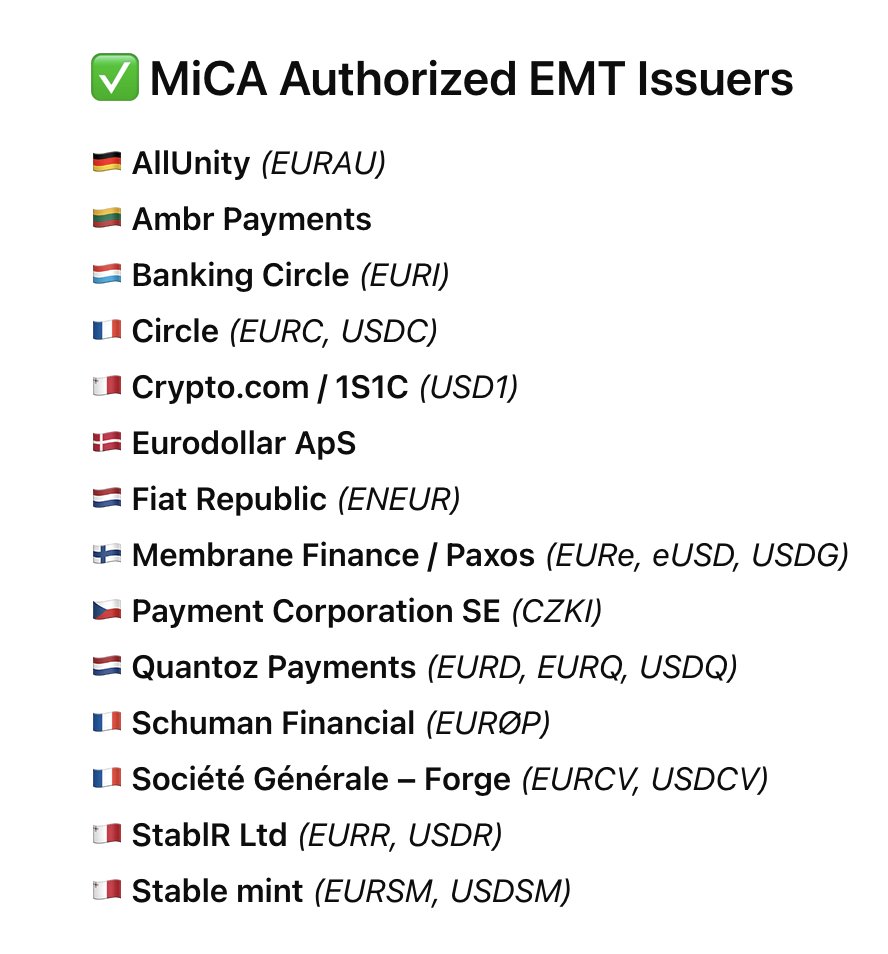

This consists of 14 approved e-money token (EMT) issuers and 39 MiCA-licensed crypto-asset service suppliers (CASPs).

The 14 EMT issuers originate from seven EU member states and are collectively issuing 20 fiat-backed stablecoins: 12 pegged to the euro, 7 to the U.S. greenback, and 1 to the Czech koruna. Main names embrace Circle, Société Générale – Forge, Membrane Finance, and Crypto.com. These approvals purpose to standardize stablecoin compliance underneath MiCA and increase shopper belief in digital euro and greenback equivalents.

In the meantime, 39 CASPs have secured full MiCA licenses, permitting them to function throughout your complete European Financial Space (EEA). Nations like Germany (12 corporations), the Netherlands (11), and Malta (5) dominate the approvals. The record features a mix of conventional monetary establishments (e.g., BBVA, Clearstream), fintech platforms (eToro, N26), and main crypto exchanges (Coinbase, Kraken, Bitstamp, OKX).

MiCA Momentum Builds Amid Oversight Gaps and Compliance Push

Regardless of the progress, the MiCA rollout has revealed regulatory blind spots. No asset-referenced token (ART) issuers have been authorised, indicating tepid market curiosity in non-fiat-backed property. About 30 whitepapers have been filed underneath MiCA Title II for main property like BTC and ETH, reflecting growing institutional alignment with crypto regulation.

On the identical time, over 35 corporations are flagged as non-compliant—many by Italy’s CONSOB. Transition intervals have led to a number of jurisdictions, together with Finland, Poland, and the Netherlands, the place the Dutch AFM is main license issuance. With MiCA enforcement underway, corporations are racing to realize approval and passport their companies throughout 30 EEA states.