Cardano (ADA) hasn’t moved a lot this week. The worth hovers close to $0.587 on the time of writing regardless of a 4% weekly acquire. One-month efficiency remains to be purple at –12%, however ADA is up practically 60% year-to-date.

Now, whereas the charts might look boring, the metrics beneath the floor recommend one thing’s constructing.

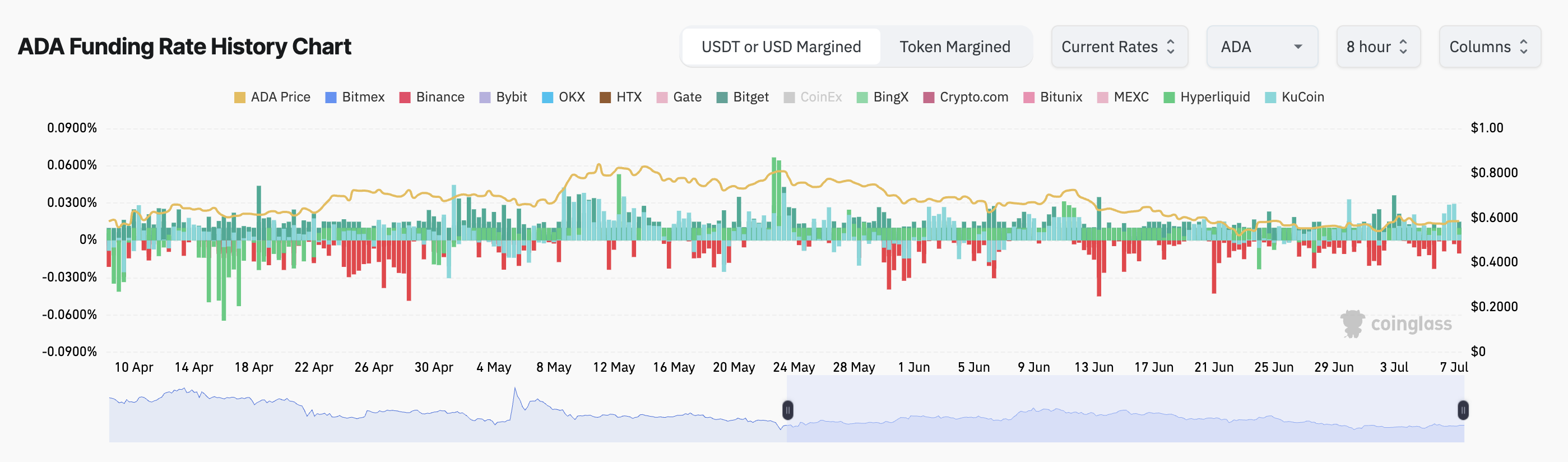

Funding Charge Indicators Retail Merchants Are Nonetheless Betting Towards ADA Worth

Throughout most main exchanges, ADA’s funding charge stays impartial. Which means most merchants are undecided between going lengthy and brief. It additionally means sentiment hasn’t shifted but, even after the bounce from $0.50.

Funding charge is the price to carry leveraged positions in perpetual futures. A unfavourable charge exhibits the group expects costs to drop, but when the commerce turns into too crowded, a squeeze can flip the market quick. Because the area stays undecided, a sentiment-heavy commerce (ideally a whale) can push the costs in both path.

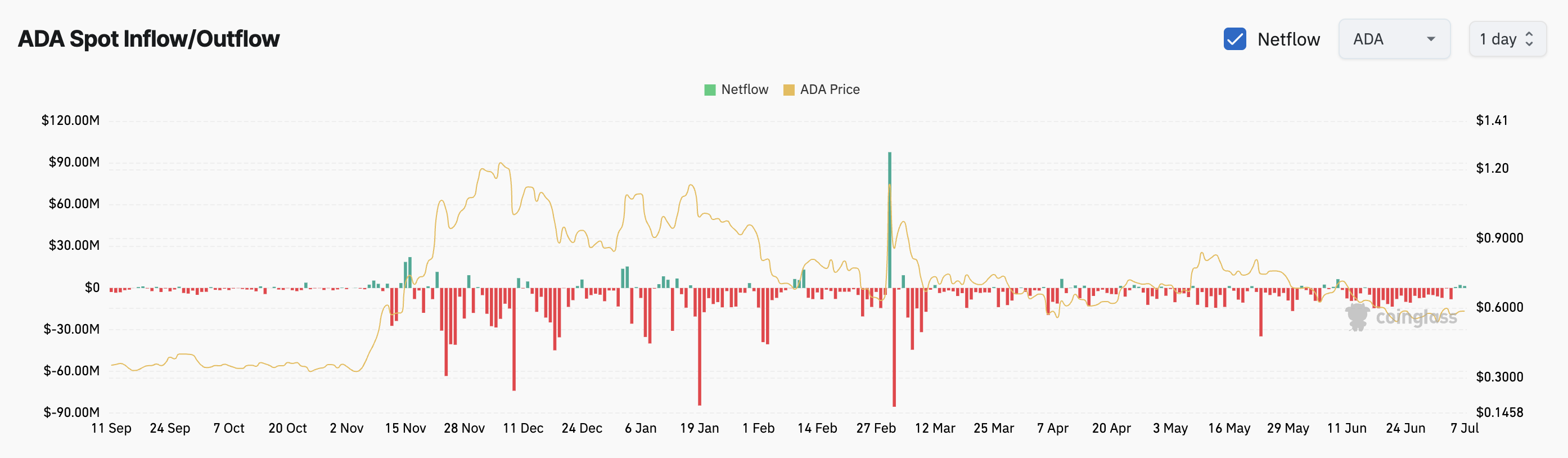

Trade Netflows Keep Unfavourable; One other Clue of Accumulation

Though the value hasn’t damaged out, web flows stay firmly unfavourable. This implies extra ADA is flowing out of exchanges than getting in, normally an indication that holders aren’t seeking to promote quickly.

Unfavourable web flows usually coincide with accumulation. When merchants withdraw cash, they’re normally shifting them to chilly wallets, not prepping them to dump.

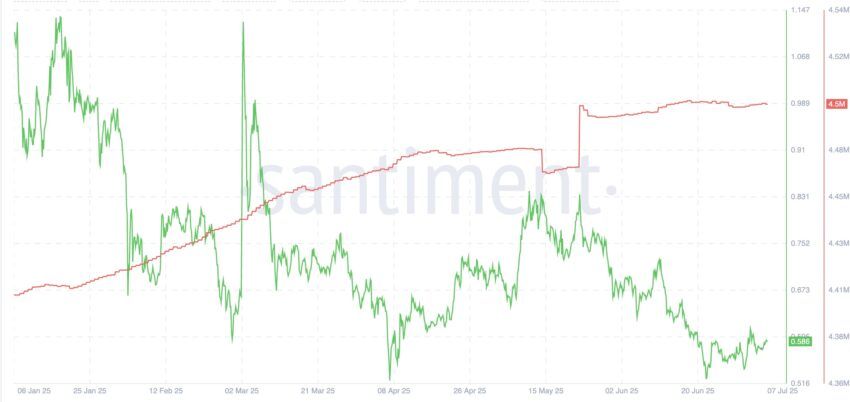

Holder Depend Retains Climbing Whereas ADA Worth Lags

One of many clearest indicators of conviction is the regular rise in whole ADA holders. Primarily based on six-month knowledge, the variety of wallets holding ADA has simply hit a brand new year-to-date (YTD) excessive of 4.5 million. This occurred whilst the value dropped from $0.90 to $0.58.

In different phrases, long-term ADA buyers proceed so as to add. The worth could also be going sideways, however the broader base of possession is rising. This sort of holder progress usually units the stage for a stronger upside as soon as the development flips.

Cardano Worth Construction: Descending Triangle Is In The Works

On the chart, ADA remains to be inside a descending triangle, a sample that sometimes breaks to the draw back. However right here’s the twist: as an alternative of slipping decrease, the value is now pushing in opposition to the higher trendline close to $0.612.

If that trendline breaks, there’s not a lot resistance as much as $0.66. If ADA breaks out, the transfer might be sharp. However the sample stays bearish except a transparent breakout happens.

The important thing assist lies round $0.537. A drop under that flips the construction bearish once more and opens up room towards $0.51.

Nonetheless, there’s some divergence to take into accounts, all because of the On-Steadiness Quantity (OBV). Whereas ADA value has traded largely flat for days, OBV has been quietly trending up. That’s a traditional early sign of stealth accumulation when patrons step in with out shifting the value a lot.

OBV tracks quantity circulate. It provides quantity on up days and subtracts it on down days. When OBV rises forward of value, it usually exhibits that capital is coming into with out triggering main value shifts; a bullish signal.

Disclaimer

Consistent with the Belief Undertaking pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.