HBAR, Hedera’s native token, is displaying indicators of life after weeks of sideways chop, however not every part below the hood seems wholesome. A clear RSI divergence, bettering funding charges, and a uncommon CMF crossover into the constructive territory trace at a doable breakout.

But, below the floor, improvement exercise stays caught close to multi-month lows. The query now’s whether or not this rally has sufficient substance or if it’s simply one other technical bounce with out spine.

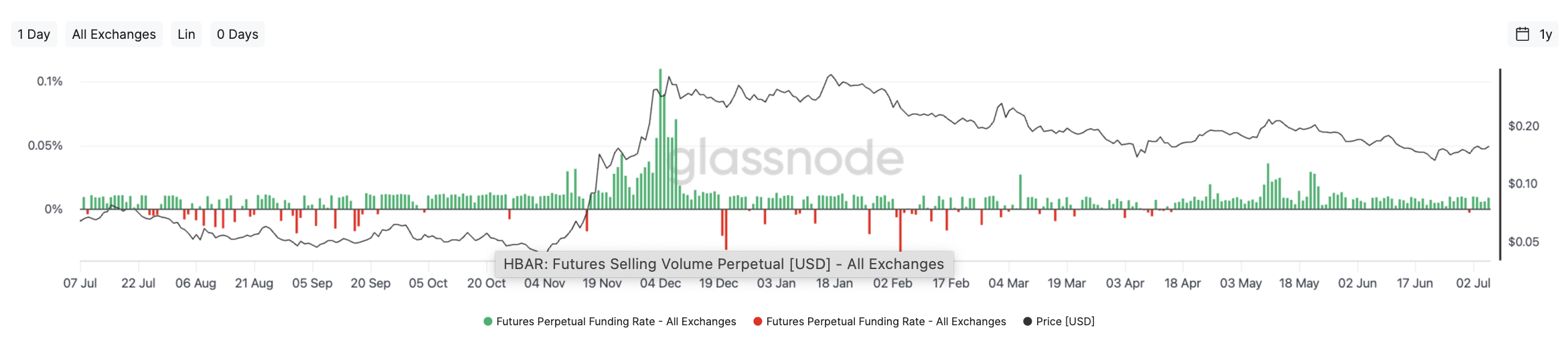

Funding Charges Present Bullish Construct-Up, However No Euphoria But

Futures merchants have been steadily rotating bullish on HBAR, as seen within the rising funding charges throughout perpetual contracts. Since early June, the vast majority of candles have stayed inexperienced, which means lengthy positions are paying shorts, a typical signal of bullish bias returning.

The final time HBAR maintained this sample for an prolonged stretch was in September–October 2024. That interval preceded a short worth rally, which aligns with the present sluggish upward grind.

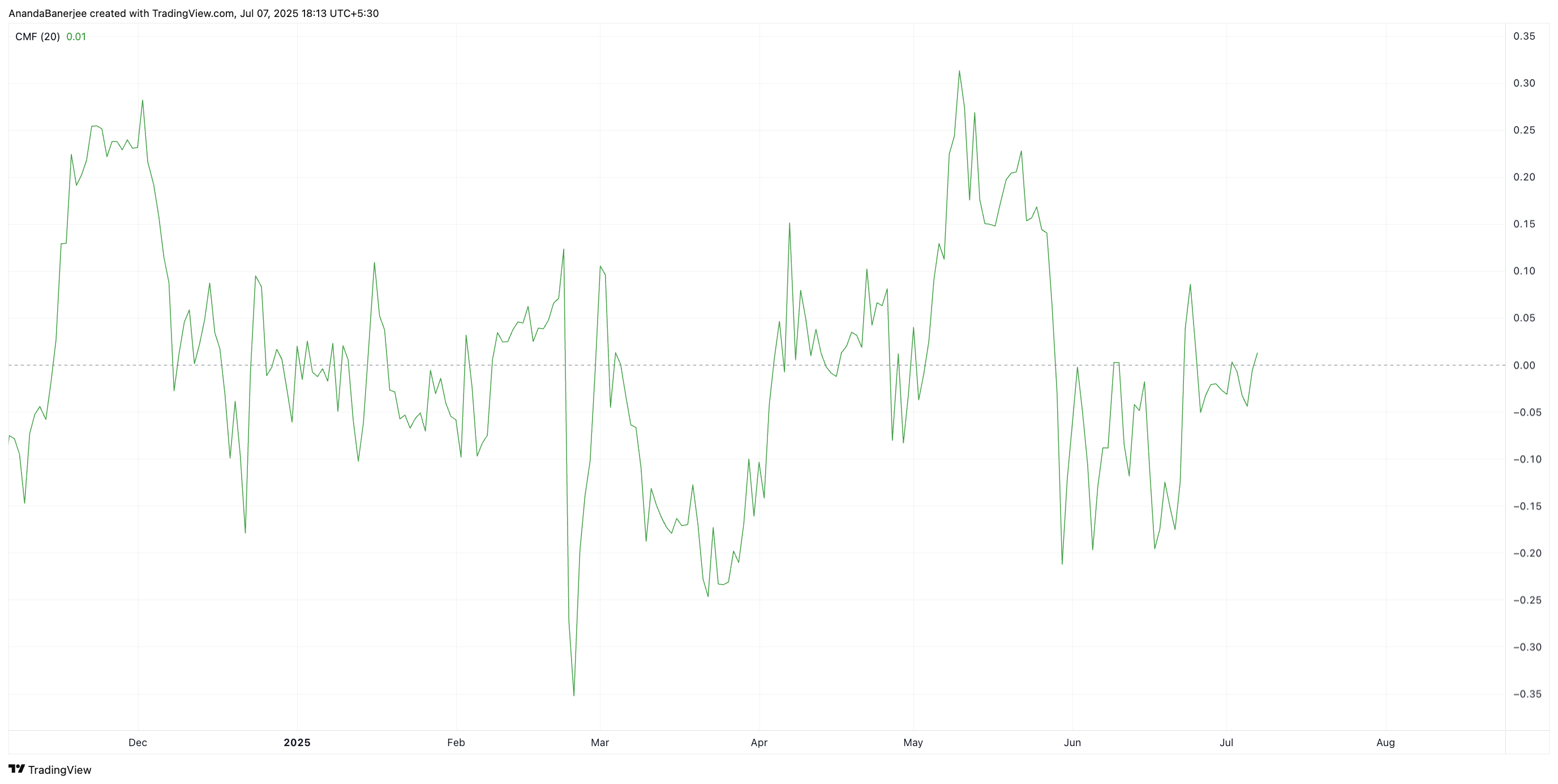

Chaikin Cash Circulate Crosses Into Constructive Zone

For the primary time in practically two months, the Chaikin Cash Circulate (CMF) has crossed above the zero line. This indicator, which tracks shopping for and promoting stress weighted by quantity, is commonly used to validate whether or not accumulation is real or simply noise.

The present CMF studying round +0.01 continues to be marginal, however it breaks a protracted streak of detrimental values. That crossover alone doesn’t verify sustained inflows, however when paired with a strengthening worth construction and RSI divergence, it provides a layer of technical help.

Improvement Exercise Stays Regarding

Whereas worth and derivatives sentiment are turning, Hedera’s improvement exercise continues to pattern downward. Based on your Santiment chart, the purple line representing improvement contributions has been on a sluggish however regular slide since March.

It’s now sitting close to its lowest stage in six months, indicating fewer updates or seen work on the Hedera ecosystem.

Worth Approaches Breakout With RSI Divergence

HBAR is buying and selling slightly below a descending trendline that stretches from the March excessive to at this time’s construction. The token now sits just below the $0.162 resistance, a stage that’s been examined thrice up to now week however hasn’t but damaged.

What strengthens the bullish case right here is the traditional RSI divergence. Whereas worth motion stays largely flat or barely down from mid-June, the Relative Energy Index (RSI) has been making larger lows. This hole between momentum and worth usually indicators a possible breakout.

If the breakout confirms above $0.162, the subsequent resistance lies close to $0.178, adopted by $0.217. However a rejection right here may drag the HBAR worth again to $0.143 help, particularly if improvement exercise continues to stagnate.

Disclaimer

According to the Belief Undertaking pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.