Ripple’s XRP is up 4% over the previous seven days, driving a wave of bettering sentiment throughout the broader altcoin market.

Nonetheless, regardless of this upward momentum, key on-chain indicators recommend that the rally may quickly lose steam as XRP holders rush to lock in earnings.

XRP Is Up 4% This Week—However Merchants Are Quietly Exiting the Market

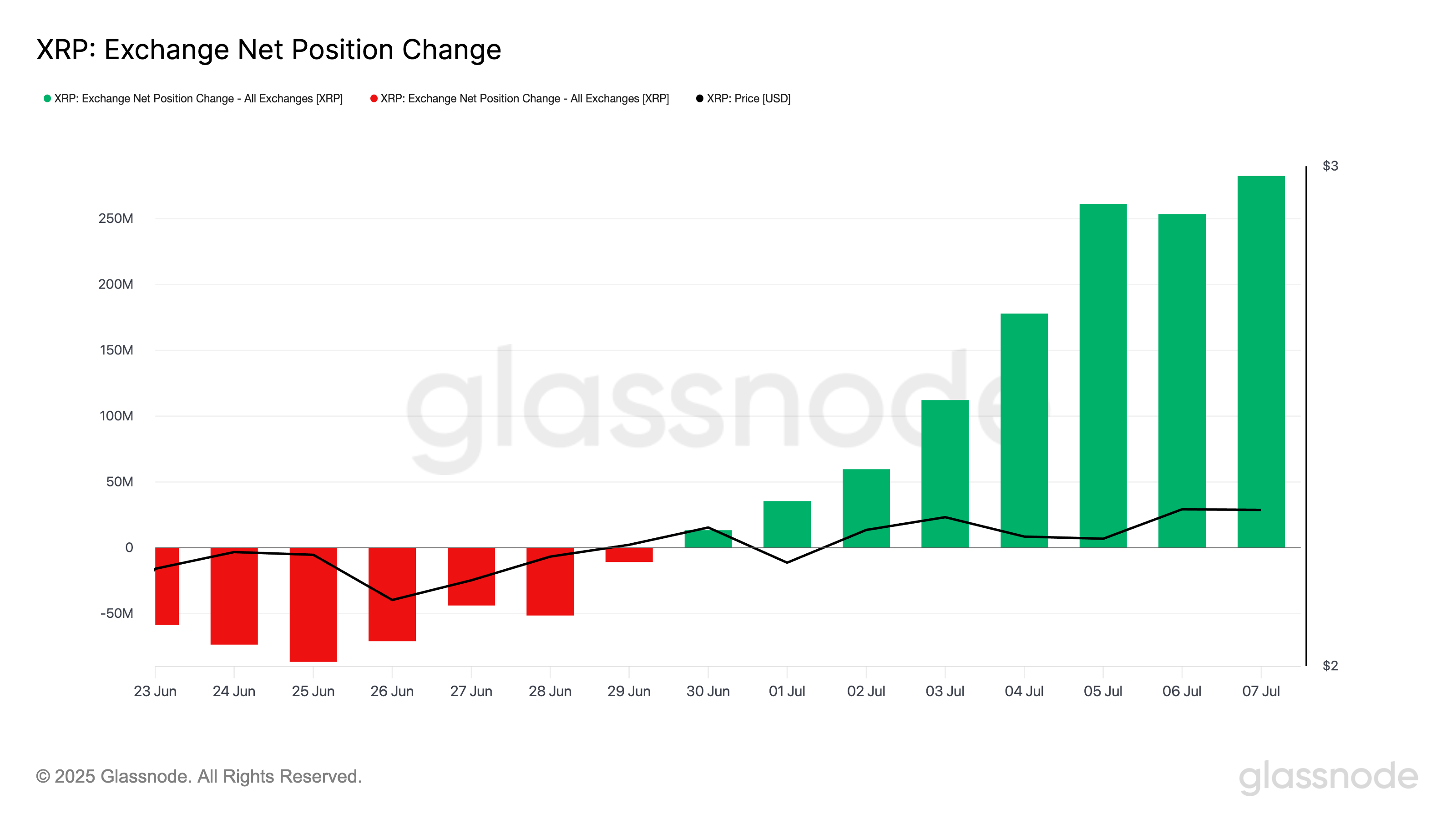

Glassnode information reveals a gradual uptick in XRP’s Change Web Place Change over the previous week. On-chain information exhibits that this metric, which tracks the web quantity of tokens shifting onto centralized exchanges, rose to an eight-month excessive of 283 million XRP on July 7.

The timing is notable, because the spike in change inflows coincides with XRP’s latest worth enhance. Which means many merchants look like utilizing the rally as a chance to exit positions, exerting some downward stress on the token.

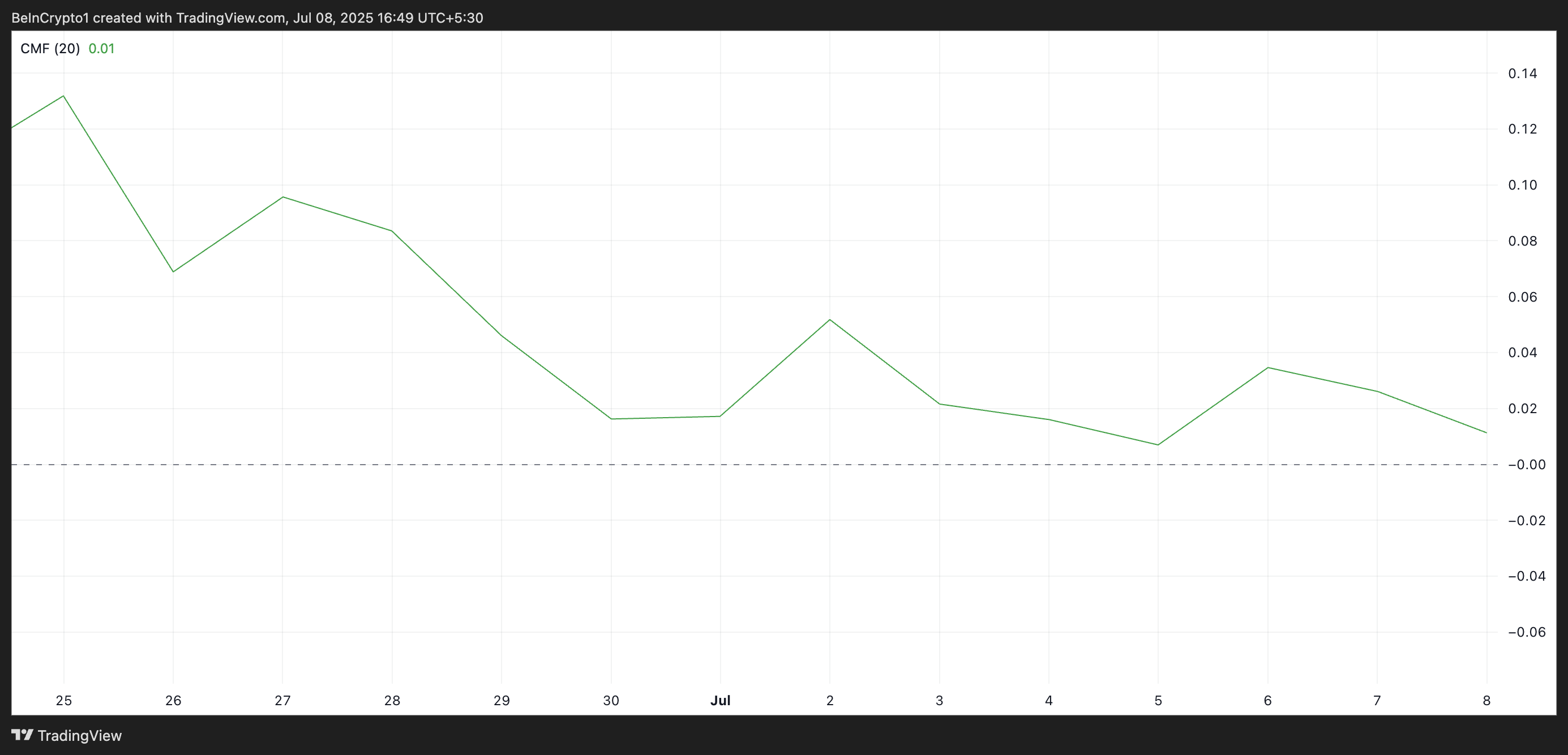

Moreover, regardless of XRP’s spike, its Chaikin Cash Move (CMF) has progressively trended downward, forming a destructive divergence with the token’s worth. As of this writing, this indicator is at 0.01, poised to interrupt beneath the zero line.

The CMF indicator measures how cash flows into and out of an asset. When its worth is optimistic, it suggests excessive demand and upward worth momentum. However, destructive CMF readings level to strengthening promoting stress and rising bearish sentiment.

Whereas XRP’s CMF has but to fall beneath the zero line, its continued decline alerts weakening accumulation. This development typically precedes a bearish reversal, and in XRP’s case, that consequence seems doubtless except recent demand enters the market to soak up the rising provide.

Shedding This Help May Spark a Drop to $2.14

On the each day chart, XRP is retesting the decrease line of the ascending channel it has trended inside over the previous week.

This channel is fashioned when an asset’s worth persistently makes increased highs and better lows inside two upward-sloping, parallel trendlines. The higher line acts as dynamic resistance, whereas the decrease line serves as dynamic assist.

Subsequently, when the value begins to check the decrease boundary, particularly after a powerful rally, it typically alerts exhaustion in upward momentum.

A decisive break beneath this decrease assist line is taken into account a bearish sign, because it means that patrons can not maintain the development. If this occurs, XRP dangers falling to $2.14.

Nonetheless, if the bulls regain management and demand climbs, they may drive XRP’s worth to $2.35.

The submit XRP Value Climbs Increased, However Right here’s Why the Rally May Be A Entice appeared first on BeInCrypto.