Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

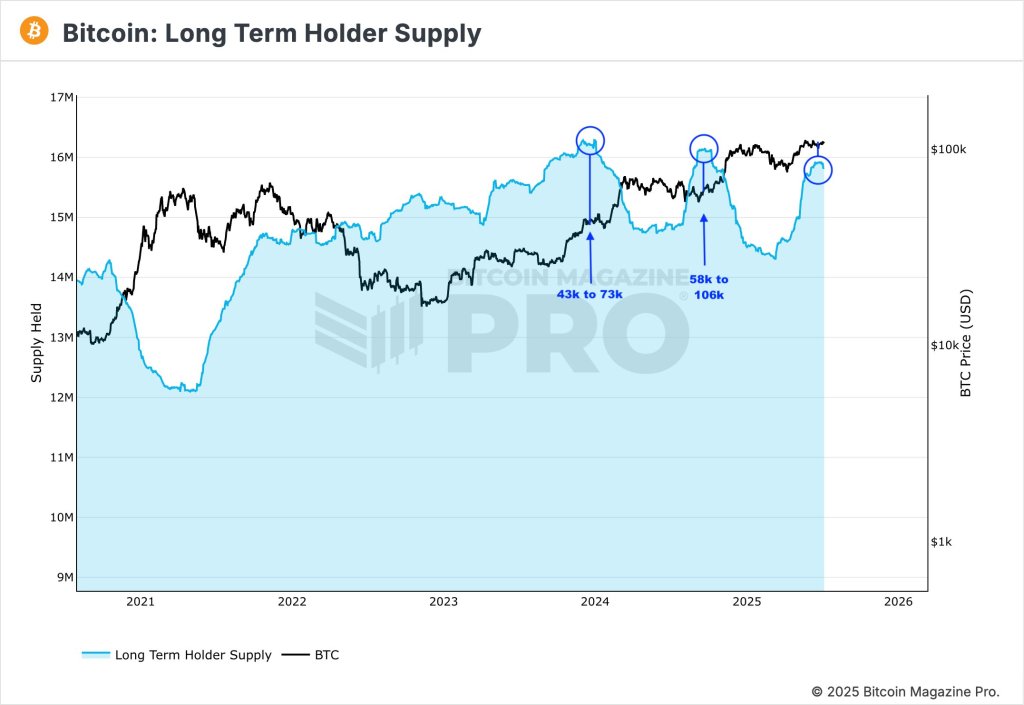

The Bitcoin market seems to be coiling for a significant transfer, in line with outstanding crypto analyst CrediBull Crypto (@CredibleCrypto), who highlighted in the present day through X that over 80% of all Bitcoin in existence is at present being held by long-term buyers—ranges of provide constraint beforehand seen solely at main inflection factors in Bitcoin’s value historical past.

Why No One’s Promoting Bitcoin

In his publish, CrediBull famous, “The one 2 instances in Bitcoin’s 15 yr historical past that this % was greater was at 43k earlier than a $30,000 impulse to 73k and at 58k earlier than a $50,000 impulse to 105k+.” Drawing on this historic precedent, he concluded that the market is poised for an additional large leg up: “When the vast majority of $BTC complete circulating provide is cornered by ‘diamond palms’, value strikes up aggressively on the trace of any ‘new’ demand.”

With “extra” provide now redistributed to long-term holders and institutional entities equivalent to Bitcoin treasury firms more and more taking the lead, the analyst sees a transparent sign: “The following impulse IS IMMINENT. This subsequent one can even seemingly be even larger than the final two ($50,000+). Who’s prepared for 150k+ Bitcoin?”

Associated Studying

The optimism just isn’t with out a technical underpinning. In a earlier publish, CrediBull addressed the present market construction and his personal Elliott Wave-based situation planning: “My authentic rely/thought shared a number of days in the past had us rejecting at vary highs above 110k and seeing a pullback all the way down to the BLUE zone at 102k-ish earlier than transferring sideways for a number of extra weeks earlier than the following impulse begins.”Nonetheless, the analyst acknowledged a major different chance: “I do nonetheless assume this situation is possible, I additionally acknowledge that there’s a non-zero likelihood that the following impulse up has already begun (most bullish situation depicted).”

Given the value motion and construction, CrediBull argued that the risk-reward profile now not favors bearish positioning. “In both case, draw back is comparatively restricted on Bitcoin from present ranges imo and so focus needs to be on figuring out potential lengthy opps on Bitcoin fairly than trying to quick clear energy.”

Associated Studying

He punctuated the purpose with a rhetorical jab: “Why is it now unlawful to quick Bitcoin? As a result of there’s a non-zero likelihood that the following impulse up has already begun.”

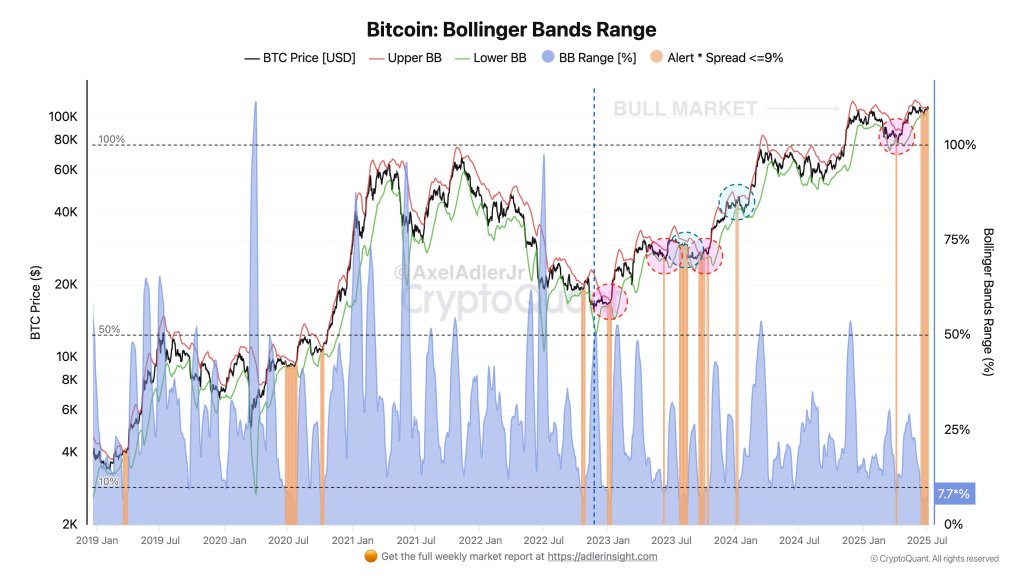

Including a layer of technical affirmation, analyst Axel Adler Jr supplied a concurrent sign from volatility metrics. Adler pointed to a major Bollinger Bands squeeze underway, writing: “The vary between the higher and decrease boundaries has fallen to 7.7%—one of many lowest values all through all the bull cycle.”

Such compressions in volatility traditionally precede massive directional strikes. Adler defined, “The lower in volatility signifies vitality accumulation available in the market; the value is prepared for a rally, and in an upward pattern setting, the probabilities of an upward breakout are considerably greater.”

Within the present cycle, Adler has recognized six episodes of such squeezes. 4 had been instantly adopted by sturdy value appreciation, whereas the remaining two noticed transient corrections earlier than persevering with upward. The takeaway: “Primarily based on this expertise, the present squeeze most probably foreshadows one other upward impulse, though a small consolidation earlier than the transfer can be not dominated out.”

With long-term holders now controlling an awesome share of provide, bullish technical compression in play, and institutional adoption persevering with to soak up circulating cash, the setting CrediBull describes echoes previous moments of explosive upside. Whereas nothing is assured, the mix of on-chain metrics and technical indicators counsel Bitcoin’s subsequent chapter could already be starting—quietly, beneath the floor.

At press time, BTC traded at $108,738.

Featured picture created with DALL.E, chart from TradingView.com