Whereas Bitcoin struggles to interrupt above its all-time excessive and altcoins face problem discovering strong assist, one nook of the crypto market continues to broaden: stablecoins. Because the starting of the bull run, the stablecoin market has proven constant development, cementing its repute as one among crypto’s most dependable and scalable use circumstances. Not like risky property, stablecoins provide stability, liquidity, and utility throughout DeFi, buying and selling, and settlement.

Associated Studying

The rise in stablecoin provide underscores the sector’s resilience and significance. Whereas speculative tokens face resistance, stablecoins thrive on utility and adoption. Whether or not for hedging, yield methods, or capital motion, their function in crypto stays foundational. Because the broader market waits for its subsequent transfer, the silent development in stablecoin provide may very well be an early sign of renewed momentum throughout the board. The stablecoin narrative is much from over — actually, it could simply be beginning.

Stablecoin Progress Accelerates: On-Chain Information Factors To Renewed Liquidity

Stablecoins have emerged as one of the impactful improvements in crypto, creating a significant bridge between conventional finance (TradFi) and decentralized finance (DeFi). This narrative gained large traction in June when Circle (NASDAQ: CRCL), the corporate behind USDC, went public on the New York Inventory Trade. Initially priced at $31 per share, Circle’s IPO exceeded all expectations — closing the day at $82.84, marking a 167% acquire. Immediately, CRCL trades practically six instances above its IPO worth, giving the corporate a $42 billion market cap and reinforcing confidence within the stablecoin enterprise mannequin.

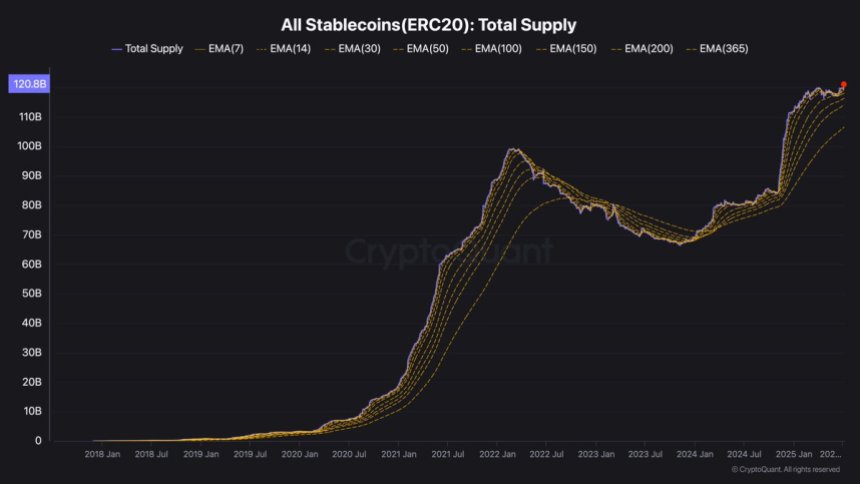

On-chain insights shared by Darkfost add one other layer to the story. In accordance with the information, the whole provide of ERC-20 stablecoins has began rising once more and simply hit a brand new all-time excessive of $121 billion. ERC-20 stablecoins are cryptocurrencies constructed on the Ethereum blockchain that observe the ERC-20 token customary. They’re designed to keep up a secure worth, normally pegged to fiat currencies just like the US greenback (e.g., USDC, USDT, DAI).

This surge in provide is essential as a result of stablecoins are minted on demand — their issuance straight displays consumer demand and recent liquidity getting into the system.

This increasing provide meets the wants of protocols and exchanges that face rising consumer exercise and capital inflows. Whereas market sentiment stays cautious, if the stablecoin provide continues to develop, it will sign renewed threat urge for food and capital deployment. In that case, stablecoins could as soon as once more function the early catalyst for the subsequent main section within the crypto bull cycle.

Associated Studying

Dominance Hovers Beneath 8%: A Impartial But Strategic Positioning

The weekly chart reveals stablecoin dominance at present sitting at 7.90%, a degree that displays cautious however sustained curiosity in liquidity reserves throughout the crypto market. After a pointy climb between 2020 and mid-2022—when stablecoin dominance peaked above 16% throughout risk-off intervals—dominance has step by step declined, aligning with risk-on rotations into Bitcoin and altcoins throughout bull runs.

Nevertheless, since early 2024, dominance has consolidated between 7% and 10%, signaling a extra balanced atmosphere. The present degree stays simply above the 50-week and 100-week shifting averages (7.76% and eight.02%, respectively), suggesting robust horizontal assist. In the meantime, the 200-week shifting common at 9.30% acts as a long-term ceiling.

Associated Studying

This impartial place implies that market individuals are neither totally risk-on nor risk-off. If dominance rises from right here, it might both mirror elevated worry (capital flowing out of risky property) or recent liquidity getting into the market, particularly if paired with an increase in stablecoin provide, which we’re already witnessing with ERC-20 tokens.

Featured picture from Dall-E, chart from TradingView