- Bit Digital dumped all its Bitcoin to load up on ETH, signaling a giant shift in institutional sentiment.

- ETH trade reserves and staking hit all-time highs, however worth motion stays oddly flat.

- A breakout above $2,736 may spark momentum, whereas a drop beneath $2,309 might flip the script bearish.

Ethereum’s sitting nonetheless round $2,550, barely blinking. It’s been doing this bizarre sideways shuffle these days—however behind the scenes, lots’s shifting. Establishments are piling in, trade balances are dropping like a rock, and staking numbers are at file highs. Nonetheless, the value? Caught. So the query now could be… are whales simply offloading in stealth, or is that this the quiet earlier than the subsequent leg up?

Bit Digital’s Daring Flip from BTC to ETH

In a fairly daring transfer, Bit Digital—yep, that Nasdaq-listed mining firm—dumped all of its Bitcoin. Like, all of it. They raised about $172 million by way of a public providing and offered one other $28 mil value of BTC, then rotated all that into Ethereum. In complete, they picked up practically $193 million in ETH, bringing their holdings to a chunky $254.8 million. That form of pivot doesn’t occur accidentally. They’re not simply shopping for, they’re betting on Ethereum large time.

Much more fascinating? They stated they’re not completed—extra ETH buys are coming. That type of public dedication, particularly from a listed agency, says lots about the place sentiment may be shifting.

Change Reserves Are Drying Up—Quick

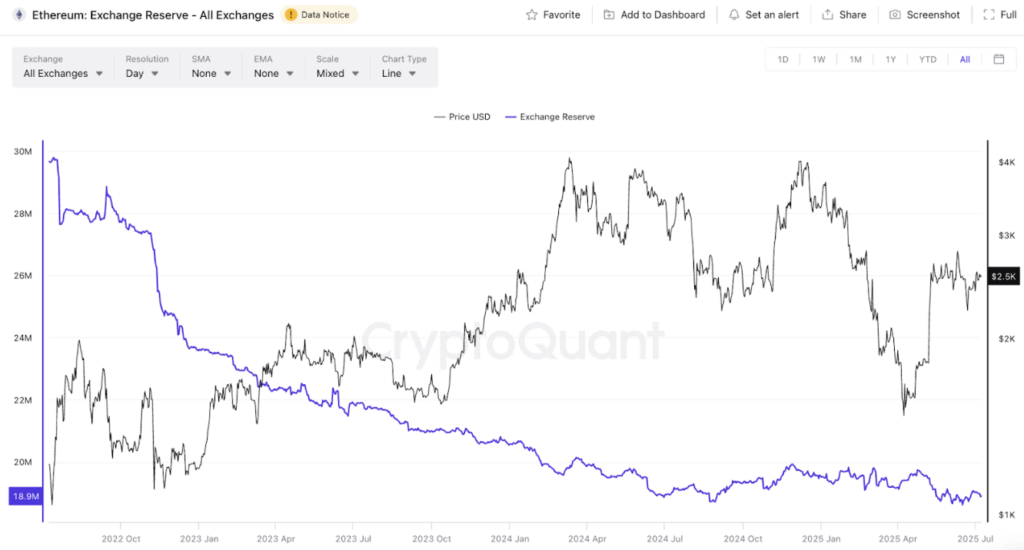

Even with Bit Digital going all-in, ETH’s worth nonetheless hasn’t flinched. And but, information from CryptoQuant exhibits ETH reserves on centralized exchanges are sitting at simply 18.9 million—yeah, that’s the bottom stage ever. Sometimes, this may scream “bullish!” to the market. Much less ETH on exchanges means much less promoting stress, proper?

In principle, yeah. It often indicators that individuals are transferring their ETH into chilly wallets or staking contracts, taking it out of play. And that’s precisely what we’re seeing. However once more—no worth response. That’s acquired some people questioning if others are dumping quietly into each rally try. Hmm.

Staking Retains Climbing, However Worth Refuses to Transfer

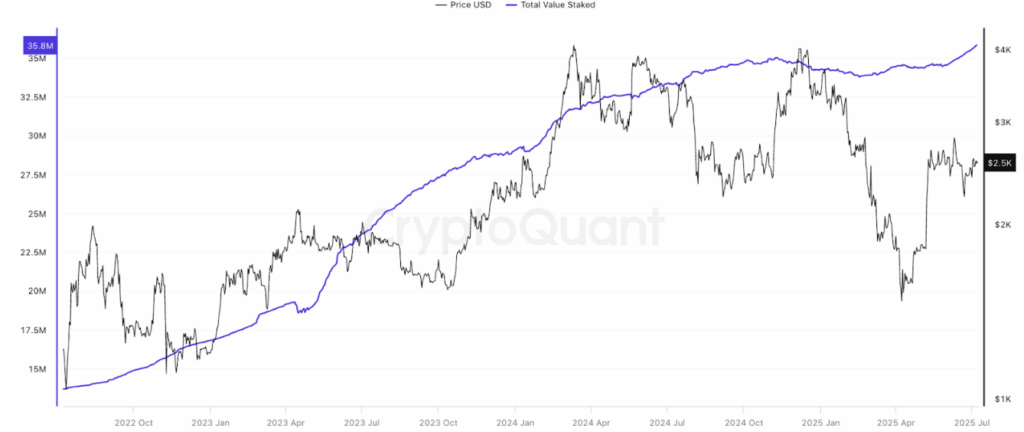

ETH staking’s doing nice. Over 35.8 million ETH are actually staked, the best it’s ever been. Which means extra individuals are locking up their tokens for yield and serving to safe the community—which is nice for Ethereum’s long-term well being.

However right here’s the rub: all that ETH getting staked must be appearing like a mini provide shock. As an alternative, the market’s simply… yawning. Some suppose we’re ready for a catalyst—a giant information pop or macro shift—to mild a hearth underneath ETH once more. Proper now, although, it’s all simply pent-up potential.

ETH Trapped in a Vary, Watching Fibonacci Strains

For now, ETH’s been caught on this horizontal grind between $2,515 and $2,590. That vary has been holding since early July, and it’s getting actual boring. Zooming out, when you plot the Fibonacci retracement from the $1,386 low to the $2,880 excessive in June, ETH’s caught proper on the 0.236 stage ($2,527). Subsequent main resistance sits at $2,736—if that breaks, issues may begin cooking once more.

These Fib ranges aren’t magic, however merchants swear by them. They map out zones the place costs are inclined to bounce or stall primarily based on previous strikes. Up to now, ETH’s bumping its head proper underneath that first line, too shy to interrupt by way of.

Remaining Ideas: Coiled Spring or Extra Chopping?

Right here’s the kicker—Ethereum’s fundamentals are glowing. Change provide? Lowest ever. Staking? All-time excessive. Establishments? Shopping for, and shopping for large. However worth? Nonetheless in snooze mode.

If ETH can snap above $2,736, it’d lastly validate what the basics have been hinting at for weeks. Till then, it’s like a spring wound tight… able to pop—or possibly simply uncoil sideways once more. One factor’s clear although: if ETH dips underneath $2,309, that bullish setup may unravel quick.