- XRP broke above a bullish reversal sample however is now testing the neckline for assist—a key stage to observe.

- Derivatives exercise is surging, however brief sellers are nonetheless betting towards the transfer, which might gas a brief squeeze.

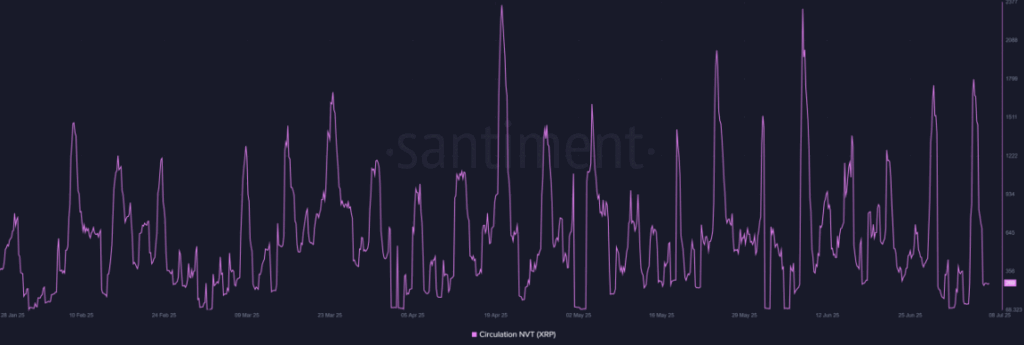

- Fundamentals like transaction quantity and NVT ratio are bettering, hinting at rising real-world utility behind the rally.

Ripple’s XRP simply pulled off one thing fascinating. After weeks of going sideways and testing merchants’ persistence, the worth lastly broke out above the neckline of an inverted head-and-shoulders sample—a traditional bullish sign, in the event you’re into chart stuff. However after all, it didn’t rocket to the moon proper after. As a substitute, it’s pulled again a bit, proper again to that neckline zone. And now? We wait to see if bulls present up once more.

As of now, XRP is hovering round $2.29, simply off a neighborhood excessive of $2.33. Not an enormous drop, however sufficient to make of us marvel if this can be a fakeout or only a textbook retest earlier than the true fireworks start. If patrons defend this stage, we may be trying at first of a a lot greater transfer.

Open Curiosity Surges, Merchants Begin Piling In

So why’s everybody watching XRP unexpectedly? Properly, there’s been a reasonably sharp leap in Open Curiosity—up 6.82% to $5.02 billion—and the buying and selling quantity practically doubled to over $10.2 billion. These sorts of numbers normally don’t present up with out severe intent behind them.

When each quantity and Open Curiosity rise collectively, it typically means merchants aren’t simply playing on noise—they’re inserting actual bets, with actual conviction. On this case, many of the motion is pointing up, even when there’s a little bit of shakiness on the floor.

Shorts Nonetheless Betting Towards the Transfer

Humorous factor, although: funding charges have dipped barely unfavorable. We’re speaking -0.004%—not loads, however sufficient to boost an eyebrow. That principally means brief sellers are paying to carry their positions open, which is kinda gutsy contemplating the breakout.

Right here’s the factor—when funding turns unfavorable throughout an uptrend, it could result in a brief squeeze. That’s when the shorts get squeezed out, shopping for again in at greater costs and unintentionally fueling the rally. So yeah, the extra they doubt the transfer, the extra explosive it might get.

Fundamentals Don’t Look Too Unhealthy Both

Past the charts, XRP’s community exercise is exhibiting indicators of life. The NVT Ratio—principally a measure of how a lot worth is shifting by means of the community versus its market cap—has dropped. That’s normally good. Decrease NVT means persons are truly utilizing the token, not simply holding and hoping.

Extra utilization equals stronger fundamentals, and when the technicals and fundamentals line up, it normally builds a greater case for long-term development.

So… Is This XRP’s Comeback Story?

Look, the breakout is actual. The pullback would possibly even be wholesome, particularly if patrons step in once more round this neckline zone. And all these rising metrics—Open Curiosity, transaction exercise, quantity—they’re not simply noise. They may very well be indicators that XRP’s lastly gearing up for an even bigger transfer.

However let’s not get carried away. Unfavourable funding charges and weak quantity on any bounce might imply bulls are getting chilly ft. If XRP can’t maintain this stage, it dangers slipping again into consolidation—or worse, retesting assist down beneath. But when momentum kicks in once more quickly, this would possibly simply be the beginning of one thing loads greater.