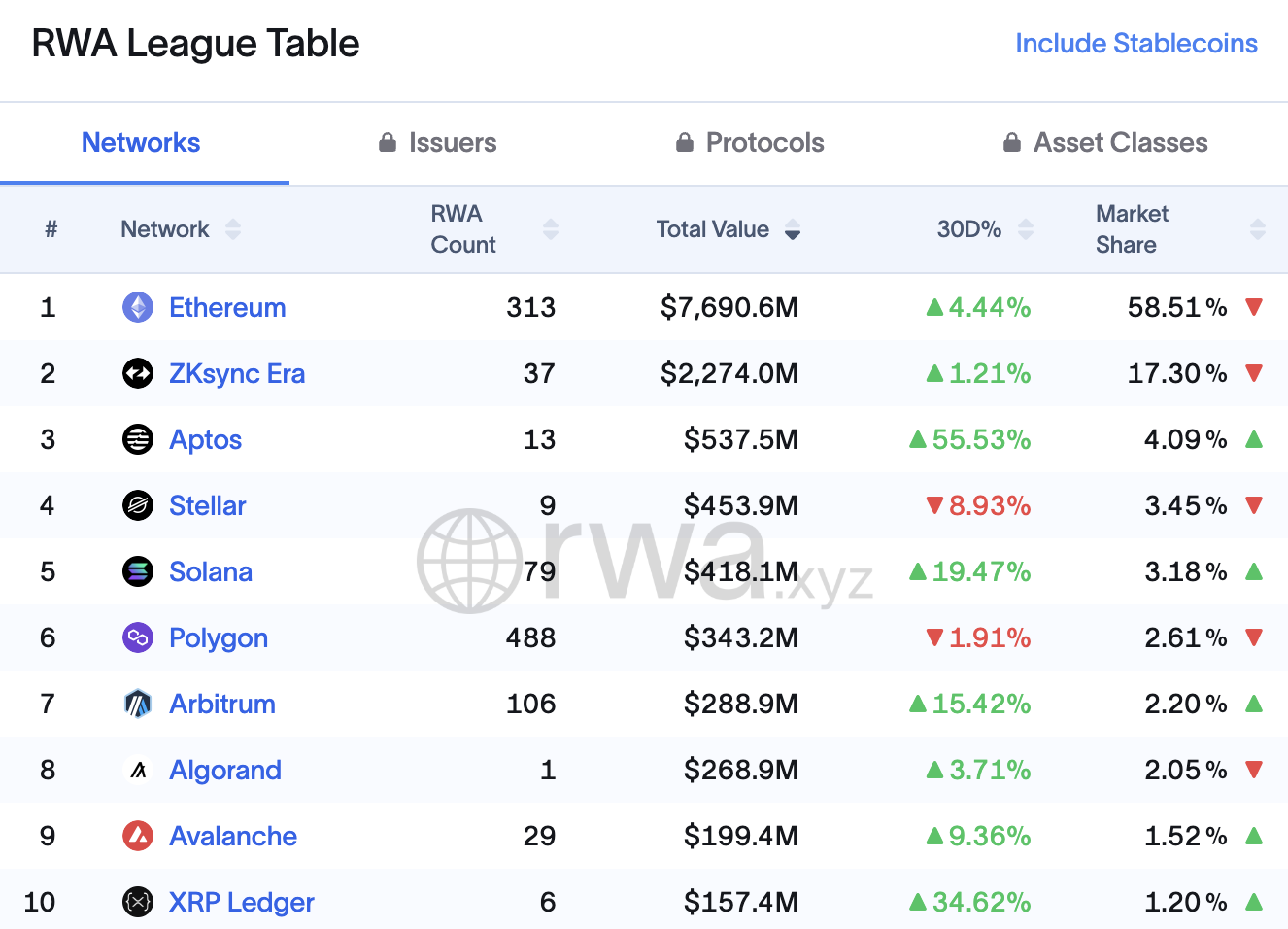

Aptos Community is making waves within the crypto trade. It secured the third spot within the international real-world asset (RWA) rankings, trailing solely Ethereum and ZKsync Period.

Can this community maintain its spectacular efficiency within the second half of 2025 with a targeted technique and strong infrastructure?

Dominating RWA with Strategic Focus and Stablecoin Surge

In response to RWA.xyz’s information, Aptos’ whole worth of locked belongings (RWA TVL) surged 56.28% over the previous 30 days, reaching $538 million.

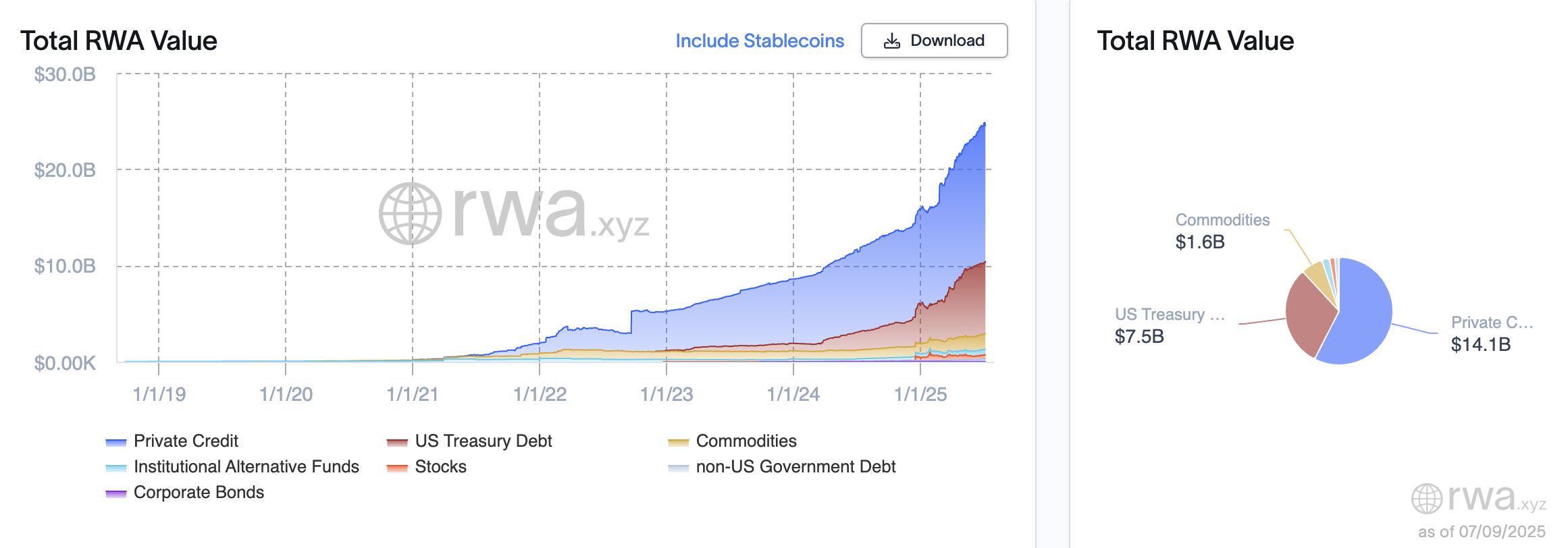

This contains practically $420 million from personal credit score, $86.93 million from U.S. Treasury bonds, and $30.72 million from institutional different funds. These figures spotlight sturdy breakthroughs and Aptos’ rising function in integrating real-world belongings into decentralized finance (DeFi) ecosystems.

The RWA rankings present Aptos surpassing rivals like Stellar ($454 million), Solana ($418 million), and Polygon ($343 million), reaching outstanding worth with simply 13 RWA tasks. This progress is pushed by a technique prioritizing high-impact tasks, as famous in a Redstone Finance report, quite than spreading sources skinny.

“Aptos’s technique facilities on concentrating on fewer, high-impact partnerships that convey vital worth onchain. By emphasizing institutional alignment and providing a technically, cost-effective different to Ethereum, Aptos positions itself as a compelling different for builders and asset managers trying to escape the constraints of EVM-based networks.” Redstone’s report said.

This strategy optimizes effectivity and attracts vital capital, particularly in private credit score. Private credit score, accounting for practically 78% of RWA TVL, paves the best way for decentralized lending alternatives.

One other key issue is the fast progress of stablecoins on Aptos, with over $1.2 billion in native stablecoins in circulation. Mixed with ultra-low transaction charges (underneath $0.0008, dropping to $0.00055 per Aptos), the community is a perfect selection for international fee options, from payroll integration to cross-border commerce. Quick processing speeds and low latency allow Aptos to construct versatile DeFi rails that attraction to retail and institutional traders.

Nonetheless, Aptos’ success comes with challenges. Sustaining a 56.28% progress price requires steady innovation and transparency in RWA mission administration. In comparison with Ethereum ($7,590 million) and ZKsync Period ($2,274 million), Aptos nonetheless faces a major hole, however its targeted technique and robust infrastructure place it to shut this hole in 2025.

The publish Aptos RWA Growth: Non-public Credit score Leads Community to World High 3 appeared first on BeInCrypto.