A brand new report from CryptoQuant highlights a traditionally sturdy inverse correlation between the U.S. greenback and Bitcoin—one which may be signaling the subsequent leg of the crypto bull market.

In accordance with the report, the U.S. Greenback Index (DXY) has fallen 6.5 factors under its 200-day transferring common, marking the most important deviation in over twenty years. Whereas that may increase alarm in macroeconomic circles, for Bitcoin it may very well be a bullish reward in disguise.

CryptoQuant analysts level to a well-established pattern in conventional finance: when the greenback weakens, threat belongings are inclined to thrive. As traders reassess the protection and yield of dollar-based belongings, capital typically rotates into various markets—chief amongst them, cryptocurrencies.

The DXY’s sustained weak spot suggests a shift in investor sentiment, significantly because the U.S. debt hits report highs. Because the dollar loses its safe-haven attraction, Bitcoin turns into more and more enticing as a hedge in opposition to fiat debasement and macro instability.

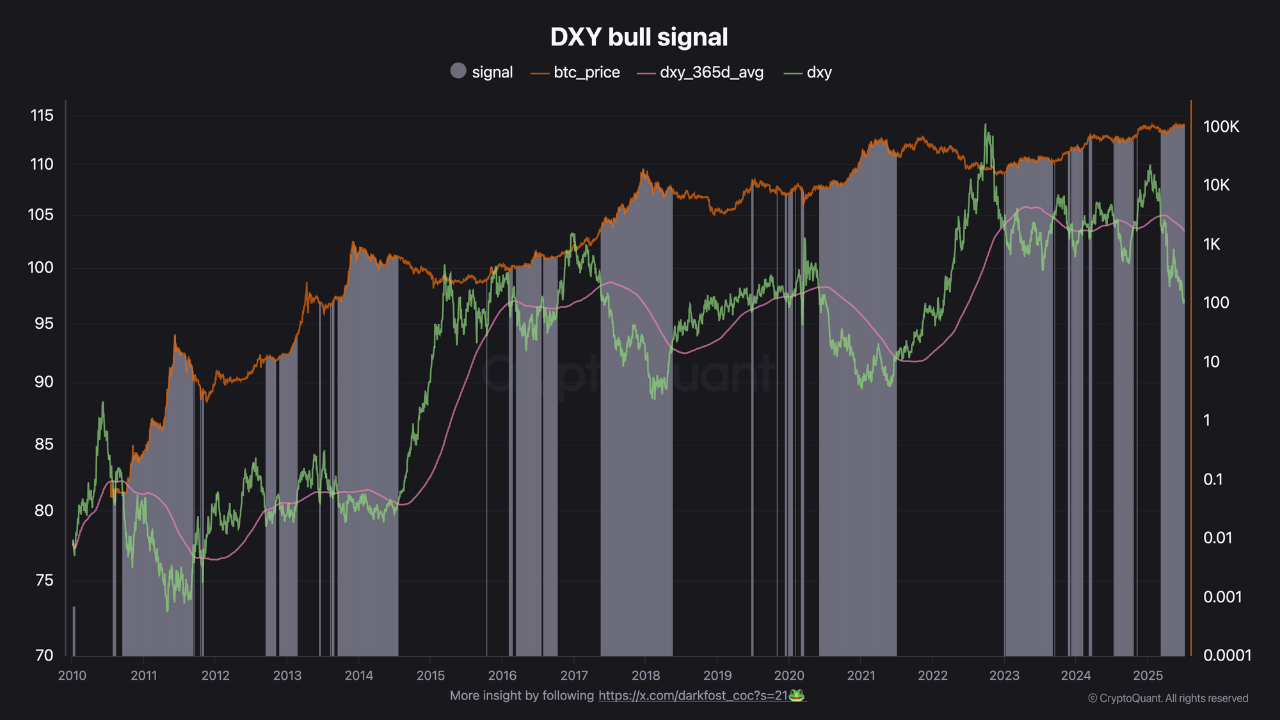

Traditionally, Bitcoin has carried out properly throughout prolonged DXY downturns. The report features a chart illustrating that each time the DXY trades under its 365-day transferring common, Bitcoin has entered both an early bull section or a interval of sustained euphoria.

Regardless of the technical setup, Bitcoin’s value has but to completely replicate this macro tailwind. On the time of writing, BTC stays in consolidation territory close to $109,000, whilst liquidity indicators recommend rising capital influx potential.

This disconnect, CryptoQuant suggests, could not final. If historic patterns maintain, the weakening greenback might quickly catalyze a significant transfer in Bitcoin. For market individuals monitoring long-term developments, the DXY’s present stoop is not only an information level—it could be an early sign that liquidity is returning to crypto, priming Bitcoin for a renewed surge.