- SharpLink Gaming purchased 7,689 ETH, boosting bullish sentiment and treasury adoption narrative.

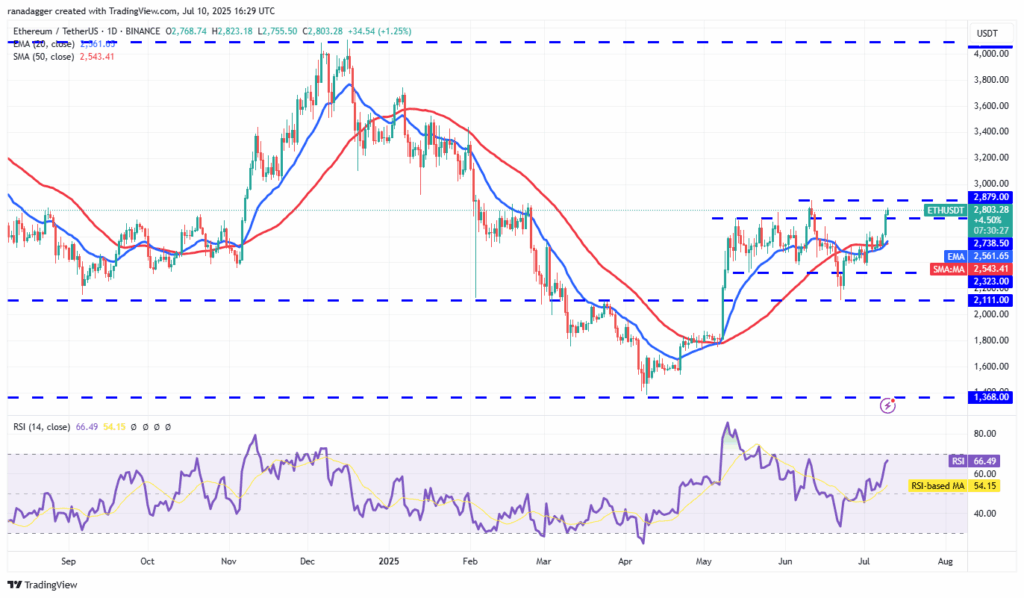

- ETH broke previous key resistance at $2,738; eyes at the moment are on $2,879 and $3,153.

- Quick-term charts recommend a pullback is feasible, however dips could also be rapidly purchased up.

Ethereum is heating up once more. After a stable rally this week, ETH is buying and selling round $2,818, and the temper is shifting rapidly in favor of the bulls. A lot of the latest hype traces again to SharpLink Gaming, which introduced a large Ether treasury buy that has merchants buzzing. The corporate scooped up 7,689 ETH between June 28 and July 4 at a median of $2,501—boosting its complete holdings to a staggering 205,634 ETH price over $533 million.

That transfer didn’t simply flip heads—it sparked optimism that extra corporations may undertake an analogous ETH treasury technique, doubtlessly clearing the trail for a run towards the $3,000 mark and past.

ETH Breaks Key Resistance—What’s Subsequent?

This week’s breakout above $2,738 was a giant deal. That stage had acted like a ceiling for some time, however ETH cracked by means of with sturdy quantity, signaling actual demand. The 20-day EMA has now turned upward, and the RSI is comfortably in bullish territory. That’s excellent news for patrons—and unhealthy information for anybody making an attempt to quick this rally.

Sellers will doubtless defend the subsequent hurdle at $2,879, but when bulls can push by means of it, a fast dash to $3,153 is on the desk. From there? It’s not loopy to consider $3,400 as the subsequent main zone—although that’s assuming the momentum holds.

However Don’t Rule Out a Dip Simply But

The flip aspect: RSI ranges are creeping into overbought territory, which regularly indicators a pause or pullback. If ETH slips under $2,738 once more, the 20-day EMA at $2,561 turns into the extent to observe. A wholesome bounce there would affirm patrons are nonetheless energetic on dips.

If not, we may be caught ranging between $2,111 and $2,879 for some time longer. That wouldn’t kill the rally—however it might delay any breakout goals.

Quick-Time period Setup Appears Promising

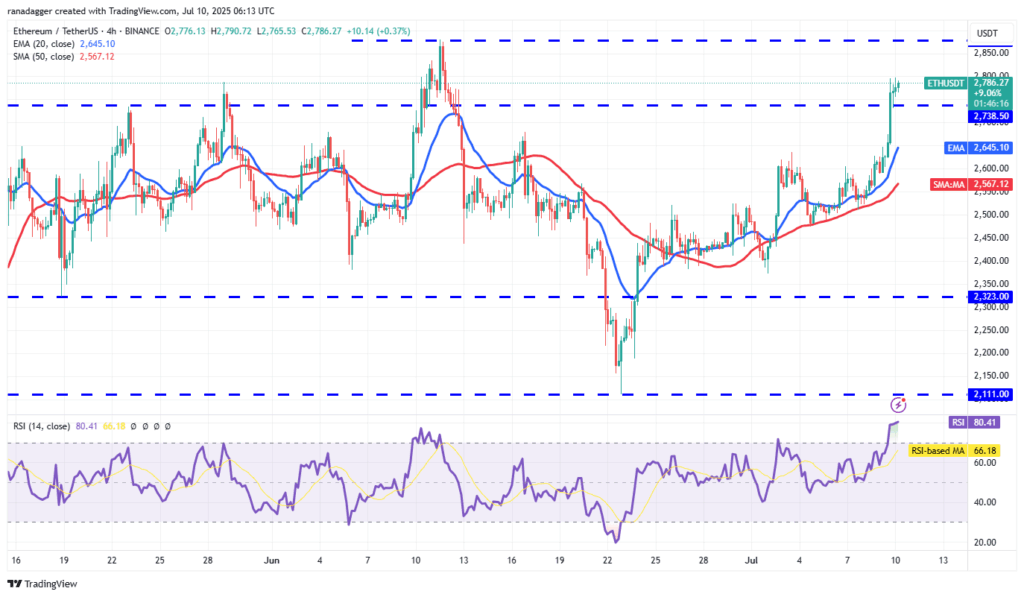

On the 4-hour chart, ETH has already pushed above $2,800, but it surely’s flirting with short-term exhaustion. If it pulls again to the 20-EMA and bounces cleanly, that’d be a powerful signal bulls are nonetheless shopping for each dip. But when that assist fails, search for a slide to the 50-SMA, which could sign profit-taking is gaining steam.

Backside line: if this momentum sticks—and if institutional ETH methods proceed gaining traction—Ether may very well be prepared for an additional leg up.