Beijing’s state media is rallying behind Chang’an Chain, a homegrown blockchain infrastructure hailed as an answer to China’s “root drawback” of digital sovereignty.

A profile on Qianlong.com credit researcher Dong Jin and his crew for constructing a totally open-source and state-backed blockchain stack now powering nationwide digital initiatives. Although little-known outdoors China, Chang’an Chain has gone by 21 iterations over six years and now claims to deal with over 100,000 transactions per second — a benchmark typically cited by next-generation blockchains aiming to match the dimensions of conventional monetary networks.

It’s reportedly being utilized in China’s nationwide actual property registration system and by firms to digitize provide contracts, permitting banks to confirm provider relationships and speed up mortgage approvals.

The profile comes simply as Chinese language tech giants foyer for the proper to challenge yuan-backed stablecoins in Hong Kong. However Beijing is sending a special message at house.

Notably, the Qianlong characteristic doesn’t point out crypto or stablecoins as soon as. As a substitute, it reinforces China’s longstanding imaginative and prescient of blockchain as state-controlled infrastructure for trusted knowledge trade and never a platform for digital currencies or hypothesis.

Whereas Hong Kong has rolled out maturing crypto laws to place itself as a regional hub for digital belongings, mainland China continues to ban cryptocurrency buying and selling, mining and trade operations. However the latest surge in world crypto markets has reignited hypothesis a couple of doable coverage shift. Thus far, Beijing hasn’t budged.

Assist for state-backed blockchains in mainland China has remained regular. In 2019, President Xi Jinping elevated blockchain to nationwide precedence standing, calling it a “core breakthrough expertise.” Whereas blockchain is just not listed among the many seven “frontier applied sciences” highlighted within the 14th 5-Yr Plan — which incorporates AI, quantum computing and brain-computer fusion — it stays a core a part of China’s broader digital technique, significantly in finance, governance, and provide chains. The plan’s improvement interval ends in December, with a last efficiency evaluate to be delivered by the State Council to the Nationwide Folks’s Congress through the annual legislative session in March 2026.

Quantum computing, one of many prioritized frontier fields, has been recognized as a possible risk to blockchain and Bitcoin safety as a consequence of its potential to interrupt cryptographic encryption.

This previous week, the South China Morning Put up reported that Chinese language researchers have developed a blockchain storage expertise that may resist quantum laptop assaults

Japan’s Solana stablecoin research

Japanese digital-only financial institution Minna Financial institution has launched a joint research with Solana Japan, Fireblocks, and TIS Inc. to discover the issuance of stablecoins and the mixing of Web3 wallets.

The research will concentrate on issuing stablecoins on the Solana blockchain, with potential functions together with tokenized real-world belongings (RWAs) akin to bonds and actual property, cross-border funds, and digital wallet-based monetary companies.

The transfer aligns with world tendencies, significantly within the US and Europe, the place establishments are exploring stablecoin regulation and RWA tokenization. Japan was among the many first international locations to ascertain a transparent authorized basis for fiat-backed stablecoins by revisions to the Fee Companies Act, which took impact in June 2023.

Minna Financial institution, which launched in 2021 and has surpassed 1.3 million accounts, goals to ultimately combine stablecoins and Web3 options into its core app as a part of its Banking-as-a-Service choices.

Learn additionally

Options

Previous-school photographers grapple with NFTs: New world, new guidelines

Options

Crypto-Sec: Evolve Financial institution suffers knowledge breach, Turbo Toad fanatic loses $3.6K

North Korean defectors falling for crypto scams

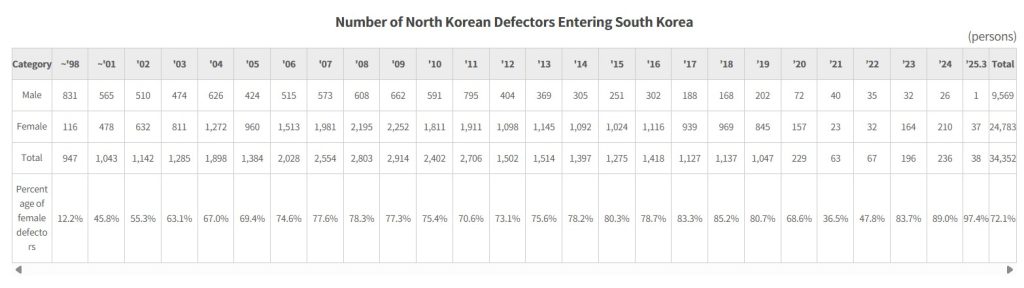

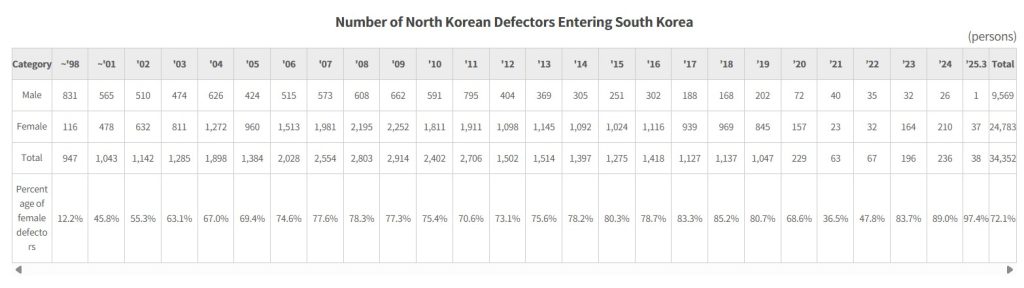

South Korean police are investigating a suspected cryptocurrency funding rip-off that allegedly focused North Korean defectors.

Based on native media citing police sources, 21 complaints have been filed between July 4 and eight towards an unnamed suspect.

The suspect reportedly operated an workplace in Siheung, a satellite tv for pc metropolis of Seoul, the place he solicited investments into crypto merchandise by way of a selected platform. Traders say their transferred funds have been transformed and deposited into platform accounts. Utilizing a cellular app, victims believed they have been investing these funds into crypto merchandise.

Nevertheless, the app all of a sudden stopped functioning earlier this month, leaving customers unable to withdraw their cash. The entire losses claimed to date quantity to roughly 1 billion Korean gained (round $720,000).

Some complainants stated the suspect launched themself as a North Korean defector and persuaded different defectors and acquaintances to affix the scheme. Others alleged that the suspect was not the mastermind however one in all a number of operatives in numerous cities and earned commissions by recruiting new members.

Victims consider many others have but to return ahead, suggesting the precise losses might be increased.

Learn additionally

Options

Actual AI use circumstances in crypto, No. 3: Good contract audits & cybersecurity

Options

Fan tokens: Day buying and selling your favourite sports activities crew

Indonesia’s licensed trade lists for public buying and selling

Indokripto Koin Semesta has develop into the primary Indonesian crypto trade operator to go public, itemizing on the Indonesia Inventory Alternate beneath the ticker COIN, the identical image utilized by Coinbase on the Nasdaq.

Shares jumped 35% on the July 9 debut.

Indokripto is the dad or mum firm of Central Finansial, a licensed crypto trade, and Kustodin Koin Indonesia, a digital asset custodian.

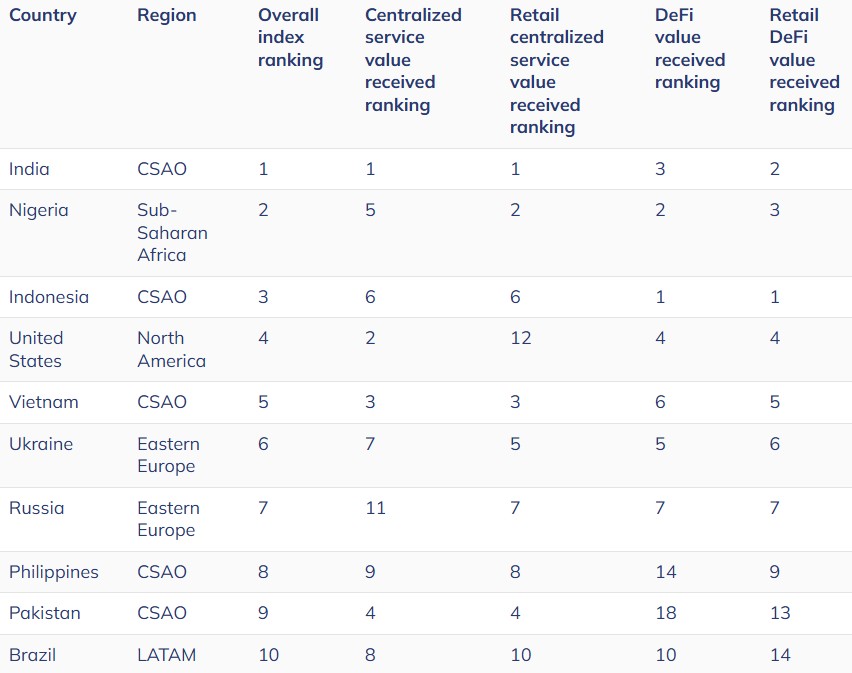

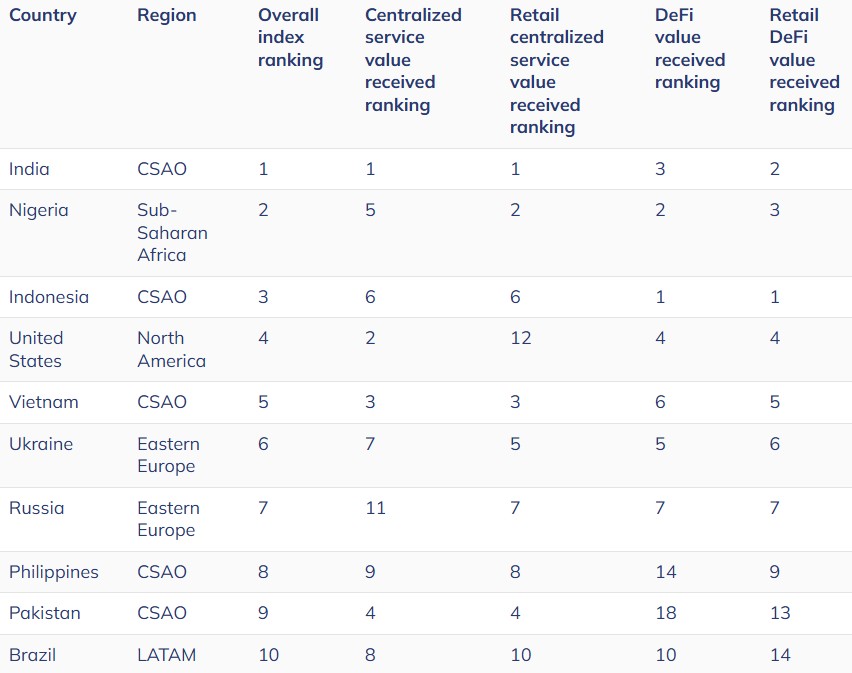

Whereas typically neglected in world discussions, Indonesia performs a significant function in crypto adoption. In 2024, it ranked third in Chainalysis’ World Crypto Adoption Index and first in DeFi worth obtained.

Earlier this yr, Indonesia appointed the Monetary Companies Authority (OJK) because the official regulator for crypto belongings. Thus far, just one trade — beneath the Indokripto umbrella — has obtained a crypto license.

Subscribe

Essentially the most partaking reads in blockchain. Delivered as soon as a

week.

Yohan Yun

Yohan Yun is a multimedia journalist protecting blockchain since 2017. He has contributed to crypto media outlet Forkast as an editor and has lined Asian tech tales as an assistant reporter for Bloomberg BNA and Forbes. He spends his free time cooking, and experimenting with new recipes.