Kraken, one of many main cryptocurrency exchanges, has introduced plans to checklist 19 new tokens, together with a variety of widespread meme cash, and to combine three further blockchains.

This growth has sparked optimism throughout the crypto business, with many anticipating a extra favorable setting for token listings underneath the incoming Trump administration.

Kraken Plans to Listing 19 Tokens and Combine 3 Blockchains

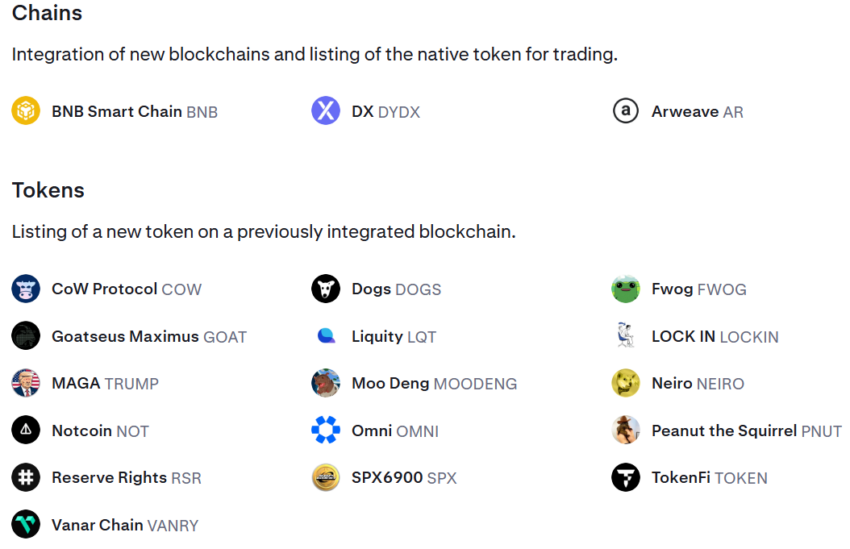

Based on its not too long ago revealed tradeable asset roadmap, Kraken will add the Binance Good Chain, dYdX, and Arweave blockchains to its platform. Every integration will embrace assist for the native tokens of those networks.

“Kraken lists BNB,” Binance founder Changpeng Zhao acknowledged.

Along with these three, Kraken plans to checklist 16 different tokens, primarily meme cash. A few of the notable additions embrace FWOG, TRUMP, NEIRO, DOGS, GOAT, PNUT, MOODENG, and COW, alongside eight others. These tokens belong to blockchains already built-in into Kraken’s ecosystem.

Nevertheless, the change clarified that itemizing plans should not assured. Funding and buying and selling for these tokens will solely start after an official announcement by Kraken Professional’s account on X. The corporate warned that Depositing tokens prematurely might end in losses.

Kraken’s deliberate token growth comes at a time when the change is navigating authorized challenges. The US Securities and Trade Fee (SEC) has accused Kraken of working an unregistered securities change and providing staking providers in violation of federal legal guidelines. The change has been actively defending itself towards these allegations.

Regardless of regulatory hurdles, crypto business stakeholders are optimistic that the incoming administration will ease restrictions on token listings. Many consider President-elect Trump’s pro-crypto stance might pave the way in which for a extra supportive regulatory setting. Expectations embrace a transparent regulatory framework, the potential institution of a Bitcoin reserve, and a departure from the SEC’s regulation-by-enforcement method.

Already, main US exchanges are capitalizing on the rising market optimism to broaden their token listings. Coinbase not too long ago listed PEPE and FLOKI, leveraging the continued meme coin development.

Equally, Robinhood expanded its choices by including tokens that the SEC beforehand described as securities — XRP, Cardano, and Solana. These strikes mirror a broader effort by exchanges to seize market momentum and cater to various investor pursuits.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nevertheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any selections primarily based on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.