Regardless of Bitcoin (BTC) exhibiting energy through the US session, merchants and buyers ought to count on some volatility through the early hours of the European session on Friday amid the anticipation of choices expiry.

Nonetheless, the influence may very well be short-lived, provided that markets rapidly modify to new buying and selling environments shortly after.

What Merchants Ought to Know About At the moment’s Choices Expiry

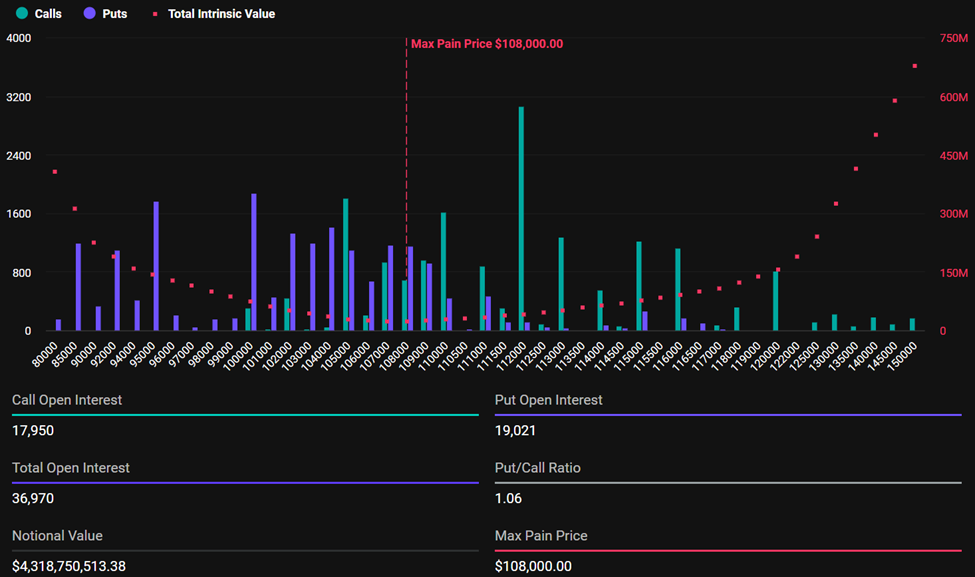

Information on Deribit exhibits that over $5.03 billion in Bitcoin and Ethereum (ETH) choices will expire at the moment. For Bitcoin, the expiring choices have a notional worth of $4.3 billion and a complete open curiosity of 36,970.

With a Put-to-Name ratio 1.06, the utmost ache degree for at the moment’s expiring Bitcoin choices is $108,000.

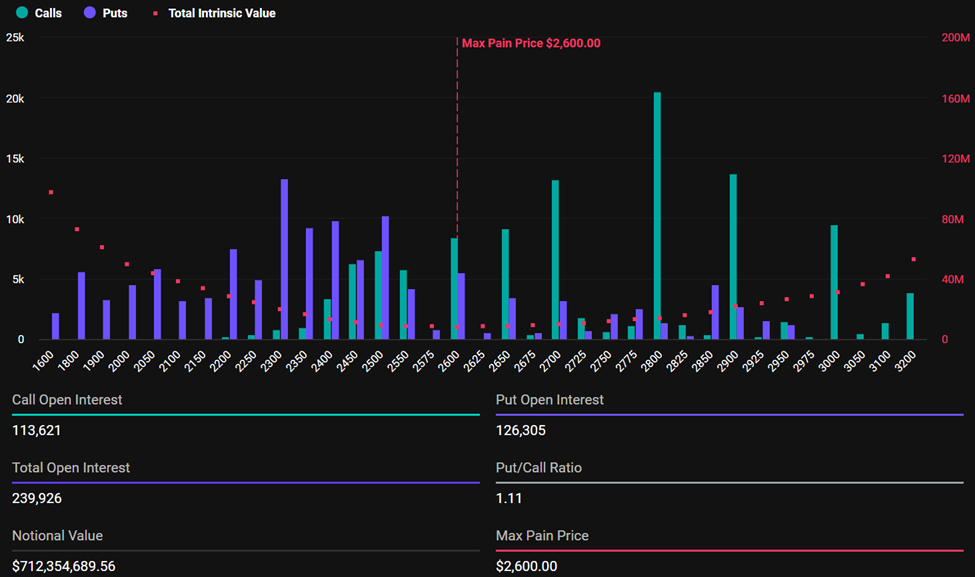

For his or her Ethereum counterparts, the notional worth for at the moment’s expiring ETH choices is $712.35 million, with complete open curiosity of 239,926.

Like Bitcoin, at the moment’s expiring Ethereum choices have a Put-to-Name ratio above 1, with Deribit information exhibiting 1.11 as of this writing. In the meantime, the utmost ache degree, or strike value, is $2,600.

Notably, at the moment’s expiring Bitcoin and Ethereum choices are considerably larger than final week’s. On July 4, BeInCrypto reported almost $3.6 billion expiring choices, highlighting 27,384 BTC and 237,274 ETH contracts, with notional values of $2.98 billion and $610 million, respectively.

Nonetheless, the primary similarity between this week’s expiring choices and people seen final week is that each show Put-to-Name ratios (PCR) above 1.

A PCR higher than 1 signifies that extra Put (Gross sales) choices are traded than Name (Buy) choices, suggesting a bearish market sentiment.

Bitcoin’s PCR at 1.06 and Ethereum’s at 1.11 counsel a balanced guess amongst merchants between sale and buy orders. This balanced outlook comes as buyers speculate whether or not the market will transfer decrease or are hedging their portfolios in case of a sell-off.

Excessive-Leverage Buying and selling Exercise – Excessive Danger Taking

Analysts at Greeks.dwell notice a minimal consensus on market course, with most exercise centered round information occasions relatively than value evaluation. Nonetheless, additionally they spotlight high-leverage buying and selling exercise and excessive risk-taking.

“Merchants discussing 500x leverage positions that seem ‘suicidal’ from present market ranges. New positions being opened regardless of the intense threat, described as interestarding. Dialogue of 100% sign buying and selling setups suggesting high-confidence however high-risk methods,” Greeks.dwell shared in a put up.

Notably, high-leverage buying and selling at 500x amplifies each good points and losses. In the meantime, Bitcoin and Ethereum traded properly above their respective max ache ranges.

As of this writing, Bitcoin had offered for $116,823 after establishing a brand new all-time excessive (ATH). In the meantime, Ethereum had traded for $2,970 after hovering nearly 7% within the final 24 hours.

The utmost ache level is a vital metric in crypto choices buying and selling. It represents the worth degree at which most choices contracts expire nugatory. This situation inflicts the utmost monetary loss, or “ache,” on merchants holding these choices.

The idea is important as a result of it usually influences market habits. Based on the Max Ache principle, the asset’s value tends to gravitate towards this degree as choices close to expiration.

Because the choices close to their expiry time, 8:00 UTC on Deribit, the costs of Bitcoin and Ethereum may drop in the direction of these ranges. Nonetheless, this doesn’t essentially imply falling all the way in which to $108,000 for BTC and $2,600 for ETH.

Markets often stabilize quickly after merchants adapt to the brand new value setting. With at the moment’s high-volume expiration, merchants and buyers can count on the same consequence, probably influencing market tendencies into the weekend.

The put up $5 Billion in Bitcoin & Ethereum Choices Expire At the moment: What Merchants Ought to Count on appeared first on BeInCrypto.