Bitcoin has formally damaged via its earlier all-time excessive of $112,000, surging to $118,000 simply hours in the past and getting into uncharted territory for the primary time since late Could. The breakout confirms bullish momentum after weeks of consolidation and failed makes an attempt, with value motion now displaying clear energy. With the psychological and technical barrier of $112K cleared, many analysts consider this transfer may mark the start of Bitcoin’s subsequent expansive rally.

Associated Studying

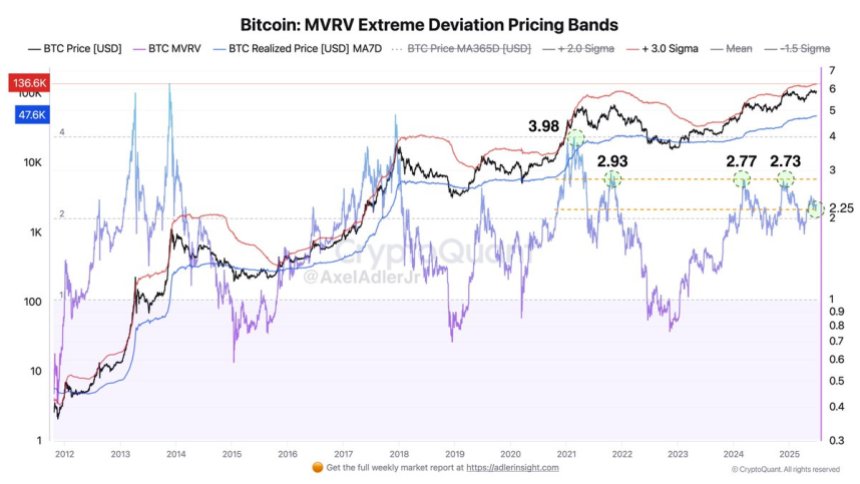

Bulls are firmly in management, and on-chain metrics assist this breakout narrative. In accordance with recent knowledge from CryptoQuant, the MVRV (Market Worth to Realized Worth) Excessive Deviation Pricing Bands presently stand at 2.25. Traditionally, Bitcoin enters the overheated zone round 3.0 or larger, suggesting there’s nonetheless room for progress earlier than reaching extreme valuation territory.

This metric, which measures the deviation between market value and realized worth, helps establish when BTC is overbought or undervalued relative to previous efficiency. At present ranges, the info factors to continued upside potential with out main overheating issues, fueling confidence that this breakout may lengthen additional.

Bitcoin Enters Enlargement Part As Market Eyes $130K

After weeks of tight consolidation under the $110,000 mark, Bitcoin has lastly damaged out, signaling the beginning of a brand new market section. The breakout above earlier highs has reignited investor optimism, not just for BTC but additionally for the broader altcoin market, with many altcoins now pushing above key resistance ranges for the primary time in months.

This transfer comes amid rising anticipation of a weakening US greenback and renewed inflationary pressures as Washington adopts looser fiscal insurance policies. The market is more and more pricing within the results of tax cuts, excessive authorities spending, and dovish political rhetoric—all of which create a positive setting for danger belongings like Bitcoin.

Nonetheless, the macro backdrop isn’t with out dangers. US Treasury yields stay elevated, flashing warnings of underlying systemic stress in credit score markets. This rigidity underscores the fragility of the present rally and the significance of monitoring elementary shifts.

High analyst Axel Adler shared insights utilizing the MVRV oscillator, a mannequin that compares Bitcoin’s market worth to its realized worth. In accordance with Adler, historic knowledge over the past 4 years means that when MVRV reaches 2.75, Bitcoin tends to face its first wave of significant promoting stress. If the identical sample holds true on this cycle, Bitcoin may attain roughly $130,900 earlier than seeing notable profit-taking exercise.

Whereas the present MVRV studying stays under that threshold, the mannequin affords a transparent sign of the place long-term holders might start offloading. Till then, the breakout units the stage for a possible leg larger, with bulls now in management, pushing towards value discovery and a attainable take a look at of the $130K zone.

Associated Studying

BTC Enters Uncharted Territory With Robust Momentum

Bitcoin has formally damaged into value discovery after blasting via its all-time excessive resistance close to $112,000. The three-day chart exhibits a large bullish candle pushing BTC as much as $118,683, representing an 8.94% acquire within the final session. This breakout is the primary clear signal of a robust bullish continuation after weeks of sideways consolidation under key resistance.

The chart highlights a textbook breakout construction. BTC revered the $103,600 and $109,300 assist zones a number of occasions all through Could and June earlier than lastly gaining sufficient momentum to pierce via the higher resistance. The latest surge got here with a noticeable spike in quantity, including confidence to the breakout’s sustainability.

Transferring averages additionally verify the bullish pattern. The 50, 100, and 200 SMA strains stay aligned upward with growing separation, suggesting that market construction stays robust and pattern continuation is probably going. Bitcoin is now buying and selling properly above all main transferring averages, reinforcing the energy of the rally.

Associated Studying

With no historic resistance ranges above, BTC enters a value discovery section. The following psychological goal for bulls will probably be $120,000, adopted by the MVRV-based resistance degree round $130,900. So long as BTC holds above $112K, the momentum stays decisively in favor of the bulls.

Featured picture from Dall-E, chart from TradingView