Ethereum simply broke above the important $3,000 degree, marking a significant technical milestone after surging over 20% since Tuesday. This decisive breakout alerts renewed power within the second-largest cryptocurrency, with bulls reclaiming management after weeks of tight consolidation. The transfer is reigniting curiosity throughout the broader altcoin market, which had remained comparatively muted throughout Bitcoin’s latest rally to all-time highs. Now, with ETH main the cost, many altcoins are exhibiting indicators of reversal and upward momentum.

Associated Studying

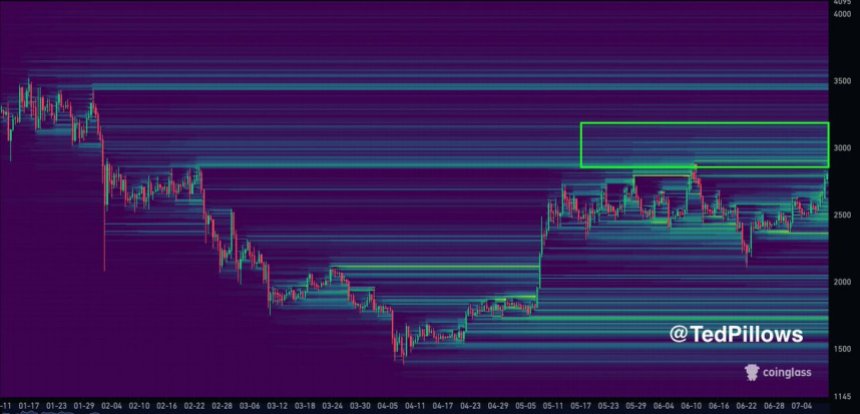

In accordance with prime analyst Ted Pillows, a key issue behind Ethereum’s rally is the massive focus of liquidity resting simply above the $3,000 mark. As soon as Ethereum cleared the $2,850 resistance, momentum quickly accelerated, driving value by the $3,000 degree and into a brand new vary of alternative.

This rally comes amid a broader shift in market sentiment. As Bitcoin units file highs, Ethereum and different altcoins seem poised to catch up. The large query now: can ETH keep this degree and lead a full altcoin season, or is that this only a non permanent breakout earlier than one other spherical of consolidation?

Ethereum Breaks Out Of Consolidation Vary

Ethereum has spent the final a number of weeks consolidating inside a clearly outlined vary that started in early Could. The altcoin hovered between help round $2,800 and resistance just under $3,000, with a number of failed makes an attempt to interrupt above. That modified yesterday. ETH lastly closed above this key resistance, signaling a possible breakout and confirming the beginning of a brand new bullish section.

This transfer comes as broader macroeconomic situations enhance. Sturdy labor market information within the US, alongside indicators of de-escalation in a number of world conflicts, have helped cut back uncertainty and reignite threat urge for food throughout monetary markets. With Bitcoin reaching new highs and risk-on sentiment returning, Ethereum’s breakout could sign the subsequent wave of upside for altcoins.

Prime analyst Ted Pillows highlighted a key technical issue: “ETH liquidity is mendacity above $3,000 — and liquidity is a magnet.” Which means massive clusters of purchase and cease orders are concentrated above this degree, attracting value motion towards these zones. Now that Ethereum has damaged previous resistance, the presence of excessive liquidity may speed up its transfer upward as merchants chase momentum.

The breakout additionally holds symbolic weight. It reveals that traders are regaining confidence in Ethereum’s worth proposition, significantly with the broader altcoin market exhibiting indicators of life. If ETH can maintain this breakout and set up $3,000 as new help, the subsequent leg increased may materialize shortly, opening the door to targets within the $3,400–$3,600 vary.

Associated Studying

ETH Breaks Main Resistance

Ethereum (ETH) has decisively damaged above the psychological and technical resistance at $3,000, closing its most up-to-date candle at $3,008.97. This breakout follows a robust 15% each day surge, as seen within the chart, marking a robust transfer backed by rising bullish momentum. Quantity has expanded considerably, confirming dealer conviction and institutional participation on this transfer.

The breakout places an finish to almost two months of sideways motion, with ETH beforehand locked between the $2,500–$2,850 vary. The 200-day easy transferring common (SMA), at present close to $2,796, was breached with power, performing as a springboard for value acceleration. The reclaim of this transferring common provides technical validation to the breakout and alerts the start of a brand new bullish leg.

Associated Studying

ETH is now in a key zone for potential continuation. So long as bulls defend the $2,850–$2,900 degree as help, Ethereum has room to rally towards $3,400 and past. With Bitcoin buying and selling at all-time highs and macro situations turning favorable for threat property, ETH may lead the subsequent wave of altcoin enlargement.

Featured picture from Dall-E, chart from TradingView