After weeks of drifting close to native lows, the PI worth has proven indicators of life. On July 10, the token rebounded from $0.465 to $0.51, an encouraging transfer that marks the primary notable upside since late June.

Whereas nonetheless trailing its earlier highs, the bounce comes with robust on-chain and technical affirmation that demand is creeping again.

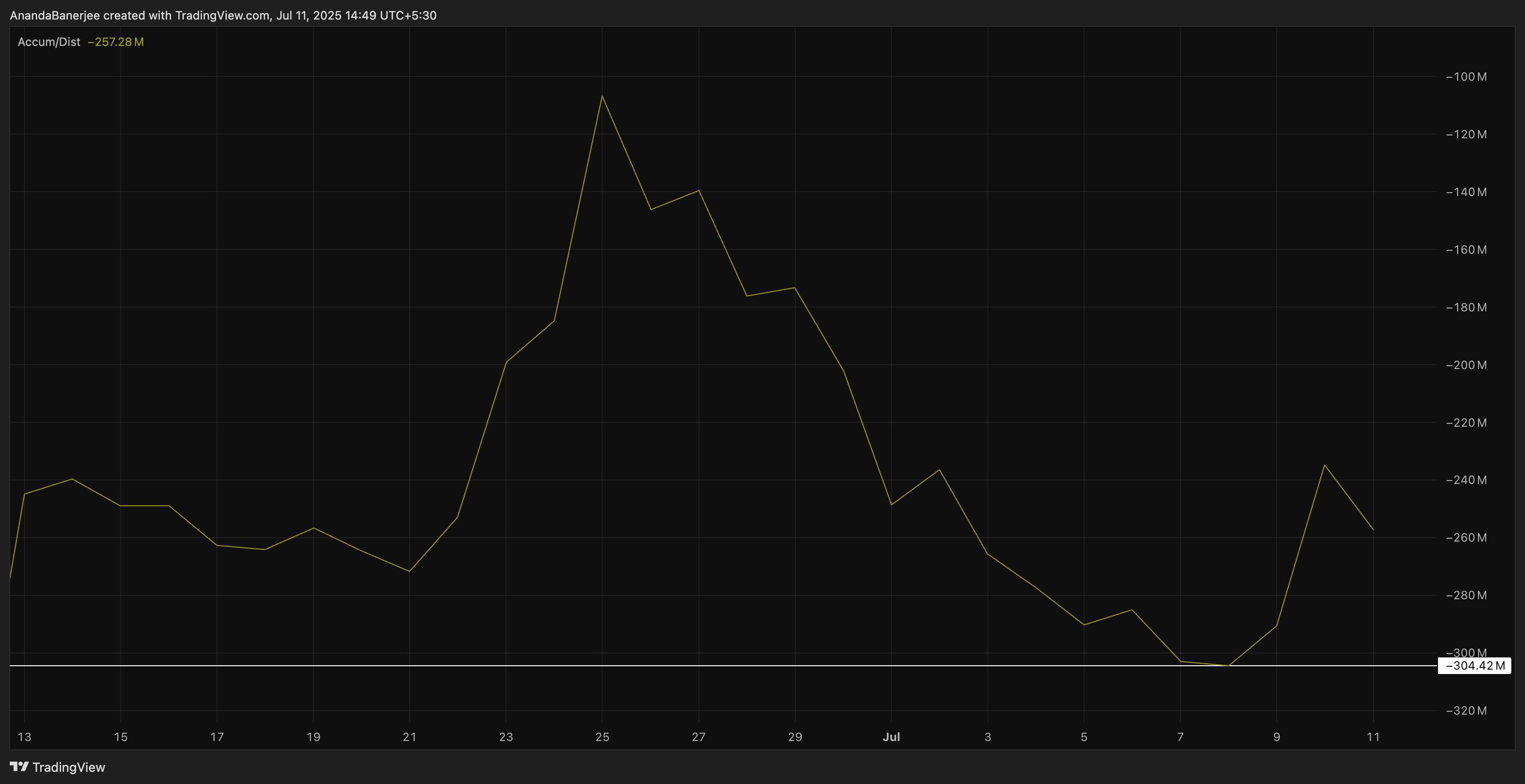

Accumulation Line Reveals Regular Purchaser Curiosity

The Accumulation/Distribution Line, which tracks the connection between worth and quantity to identify shopping for or promoting stress, has began rising once more. This occurred exactly on July 9.

If the A/D line, regardless of the next-day dip, manages to remain above the July 8 low (marked by the horizontal line), the costs may find yourself seeing a constructive influence.

This might recommend that good cash could also be quietly stacking Pi Coin regardless of the general stagnation.

Sentiment Stays Elevated Whereas PI Value Lags

historic traits, Pi Coin’s sentiment rating (crimson line) tends to maneuver in lockstep with the PI worth; as seen through the explosive rally in Might the place each strains surged collectively. This displays a real-time crowd response relatively than a predictive sign.

Now, sentiment has once more picked up and continues to hover within the higher constructive zone. It isn’t at euphoric highs like in mid-Might, however it stays effectively above impartial, suggesting that merchants nonetheless really feel optimistic about Pi’s prospects.

What stands out this time is the disconnect: worth hasn’t adopted with equal depth. Regardless that PI briefly jumped from $0.465 to $0.51 on July 10, it’s nonetheless hovering close to key resistance. If sentiment stays regular, because it has in previous rallies, a delayed worth response may nonetheless be on the desk.

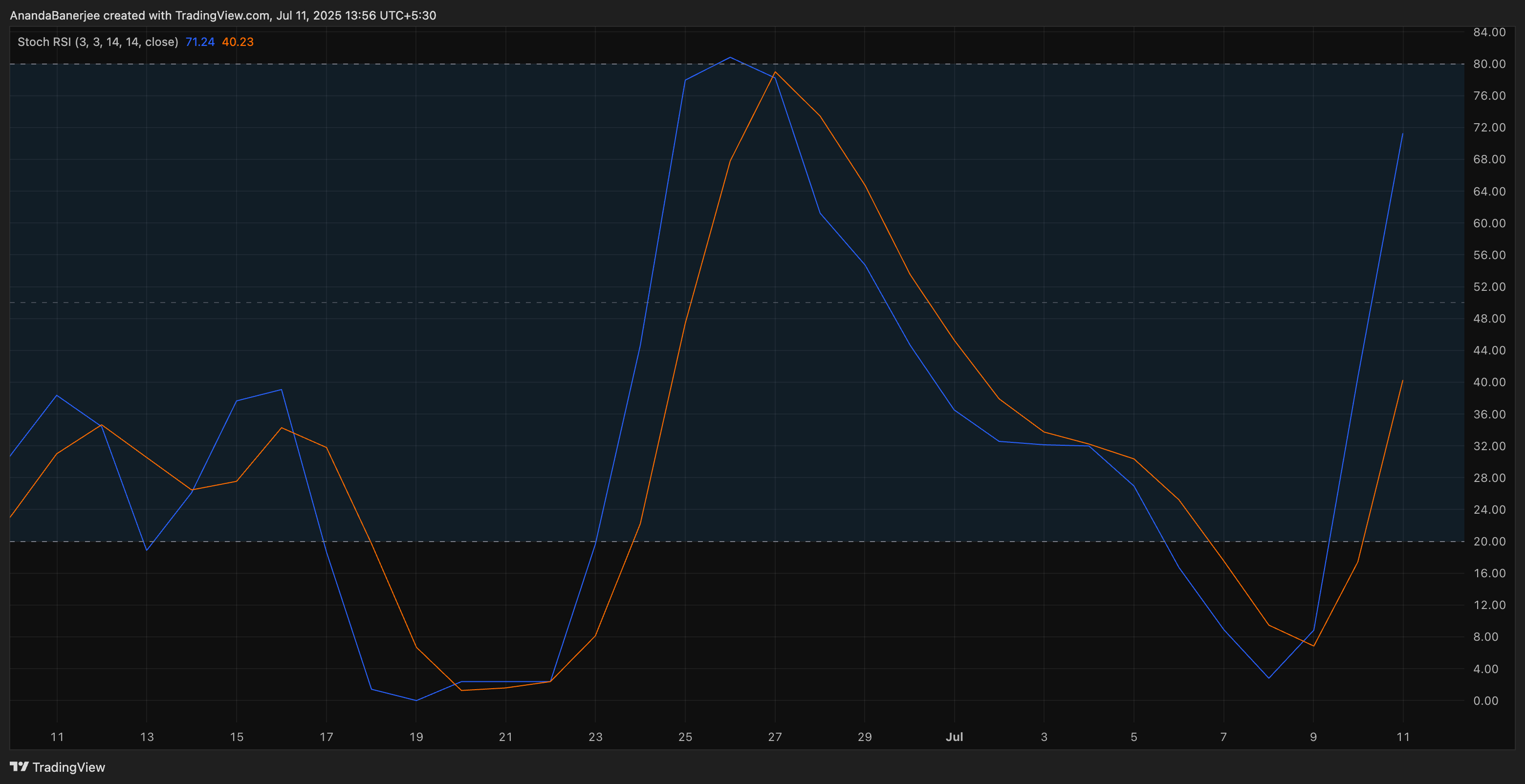

Stochastic RSI Crossover Provides Momentum Sign

Momentum affirmation got here from the Stochastic RSI, a momentum oscillator that compares an asset’s RSI to its high-low vary over time. The current crossover, the place the blue line moved above the orange line, alerts bullish momentum increase. This sort of crossover typically seems in the beginning of pattern reversals or contemporary legs up.

The Stochastic RSI—which exhibits how robust or weak an asset’s current worth motion is—presently has the blue line close to 72 and the crimson line round 40. This widening hole suggests rising bullish momentum, because the faster-moving line is pulling away upward. For context, whereas RSI (Relative Energy Index) tracks how overbought or oversold a token is, Stochastic RSI goes a step deeper by measuring how briskly RSI itself is altering—typically used to catch early pattern shifts.

PI Value Presses Into Resistance Zone

Value-wise, PI worth now flirts with a key resistance at $0.5026. This stage, derived from the 0.618 Fibonacci retracement zone, has traditionally acted as each a cap and a set off. If bulls handle to push cleanly previous it, the subsequent leg may eye the $0.54–$0.56 zone. Nevertheless, if the worth will get rejected once more right here, a pullback towards $0.4578 could happen.

At the moment, all three indicators —shopping for stress, sentiment, and momentum — are pointing upward. So long as the PI worth holds above $0.50 (psychological help zone), the pattern seems intact. Nevertheless, a failure to remain above that stage may open the door again towards the $0.45-$0.40 base.

The put up Pi Coin’s First Bounce in Weeks Sparks Bullish Divergence: Value Rally Forward? appeared first on BeInCrypto.