- HYPE broke its ATH at $46.32, powered by 60% quantity surge and main whale buys.

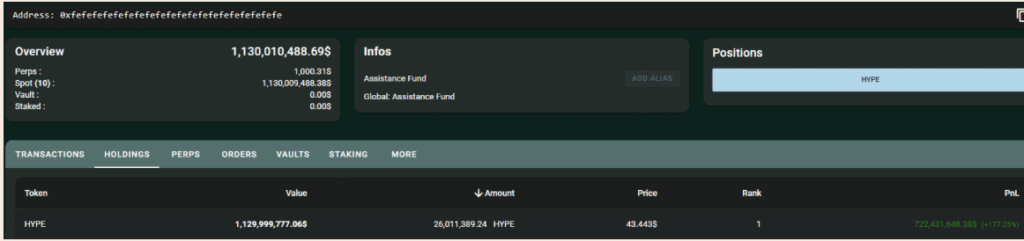

- Hyperliquid’s Help Fund has quietly stacked 26M HYPE and is probably going not completed.

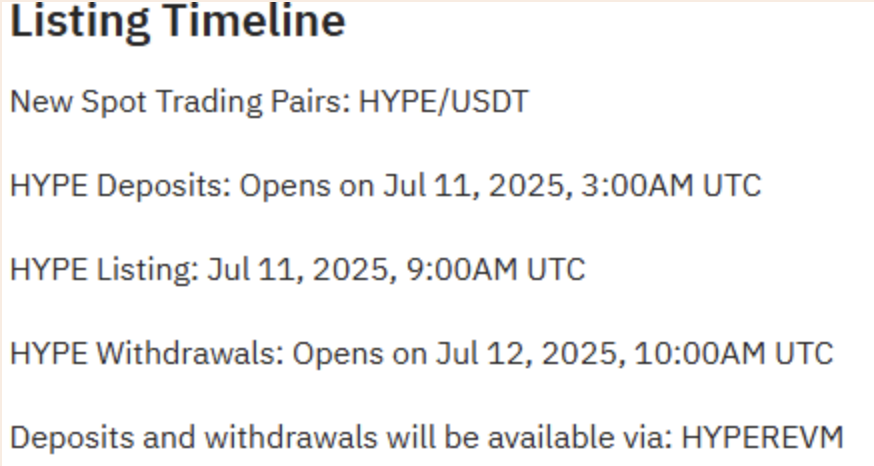

- Bybit itemizing and Grayscale watchlist inclusion may very well be the gasoline for the following wave.

Hyperliquid (HYPE) popped 8% up to now 24 hours, clocking a brand new all-time excessive of $46.32—not a large leap from the earlier prime at $45.50, however sufficient to make noise. Alongside that, buying and selling quantity jumped a stable 60%, in keeping with CoinMarketCap.

Now, regardless that the transfer appears modest, it’s what occurred round the worth motion that’s turning heads.

Whale Strikes and Help Fund Stack Up

Simply earlier than HYPE spiked, 5 wallets—yep, all probably tied to at least one entity—moved a chunky 22.5 million USDC onto the Hyperliquid platform. A kind of wallets went straight in with a $4.33 million purchase, scooping up almost 100,000 HYPE at a mean of $43.30.

One other pockets dropped buy-limit orders price $4.5 million, whereas the remaining look locked and loaded with $13.5 million—in all probability prepping for extra. However that’s not all.

The Hyperliquid Help Fund? It’s been on a quiet purchasing spree. Over the previous seven months, it’s grabbed 26 million HYPE from HyperCore—shopping for roughly 350,000 tokens each single week. Up to now, it’s spent round $400 million and is now sitting on income north of $722 million.

Yep, large numbers.

With a token unlock occasion looming (9.92 million HYPE unlocking in 141 days), the fund may step up its shopping for much more. That regular demand may preserve HYPE’s momentum alive.

Will HYPE Maintain Above $46?

HYPE’s chart exhibits a falling wedge breakout—often a bullish signal. That breakout helped it push previous the outdated ATH, now establishing $40 as a crucial help zone.

The MACD additionally paints a considerably optimistic image. Histogram bars are rising, hinting that momentum is likely to be constructing. However, and it’s a giant however, if the worth can’t stick above $45 for lengthy, a drop again towards $40 may very well be on the desk.

If that occurs? Effectively, it is likely to be a traditional retrace… or an indication that HYPE’s rally wants to chill off for a bit. Flip aspect: if bulls preserve issues above that new ATH, we may very well be trying firstly of one other leg greater.

Listings May Gasoline the Fireplace

And right here’s the kicker—Tier 1 alternate Bybit simply added HYPE to its listings. That alone may invite a wave of latest liquidity and a spotlight, particularly from extra risk-averse merchants who solely contact top-tier platforms.

Oh, and Grayscale? Yeah, they added HYPE to their “into consideration” checklist for Q3 2025. It’s sitting there alongside BONK and some others, hinting at a possible future inclusion in institutional portfolios.

That kinda publicity may very well be a game-changer.