Bitcoin investing may be as easy or as complicated as you select. But, by using a couple of free and highly effective metrics, traders can achieve a substantial edge over the typical market participant. These instruments, accessible without spending a dime, simplify on-chain evaluation and assist strip away emotional decision-making.

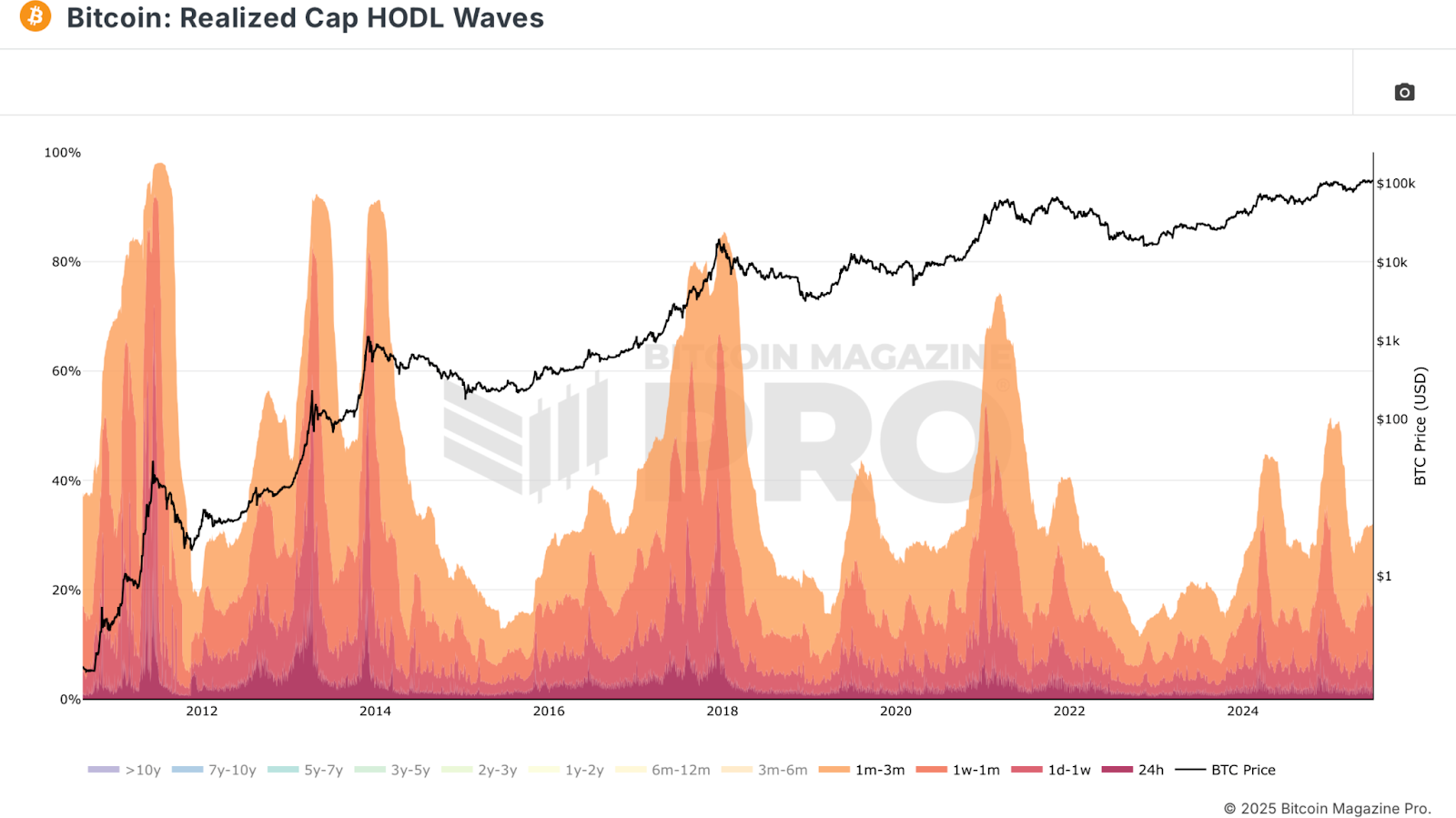

Realized Cap HODL Waves

The Realized Cap HODL Waves metric is among the extra nuanced instruments within the on-chain toolbox. It analyzes the realized worth, the typical price foundation for all Bitcoin held on the community, and breaks it down by age bands. A major set of age bands is cash held for 3 months or much less. When this phase dominates the realized cap, it signifies a flood of recent capital getting into the market, usually pushed by retail FOMO. Historic peaks in these youthful holdings, typically proven in heat colours on the chart, have coincided with main market tops, like these in late 2017 and 2021.

Conversely, when the affect of short-term holders diminishes to a low, it typically aligns with bear market bottoms. These are durations when few new patrons are getting into, sentiment is bleak, and costs are deeply discounted. This metric can visually reinforce contrarian methods, shopping for when others are fearful and promoting when greed dominates.

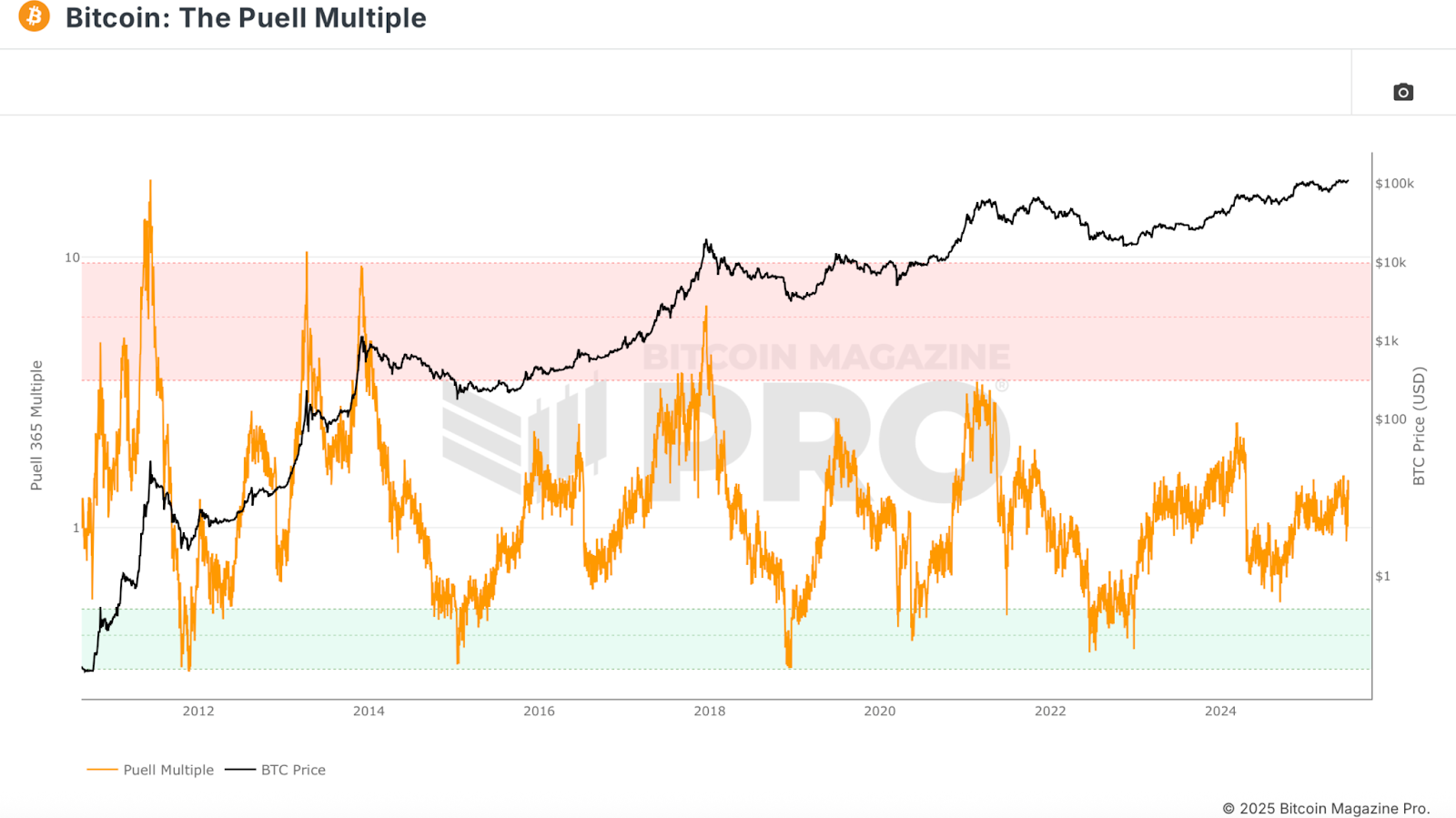

Puell A number of

The Puell A number of helps gauge the sentiment of miners by evaluating their present day by day income (in USD) in block rewards and charges in opposition to a one-year common. Excessive values point out miners are extraordinarily worthwhile, whereas low values counsel misery, probably signaling undervaluation.

Throughout earlier cycles, lows within the Puell A number of have been glorious alternatives for accumulation, as they coincide with occasions when even miners, with excessive prices and operational dangers, are struggling to stay worthwhile. This acts as an financial ground and a high-confidence entry sign.

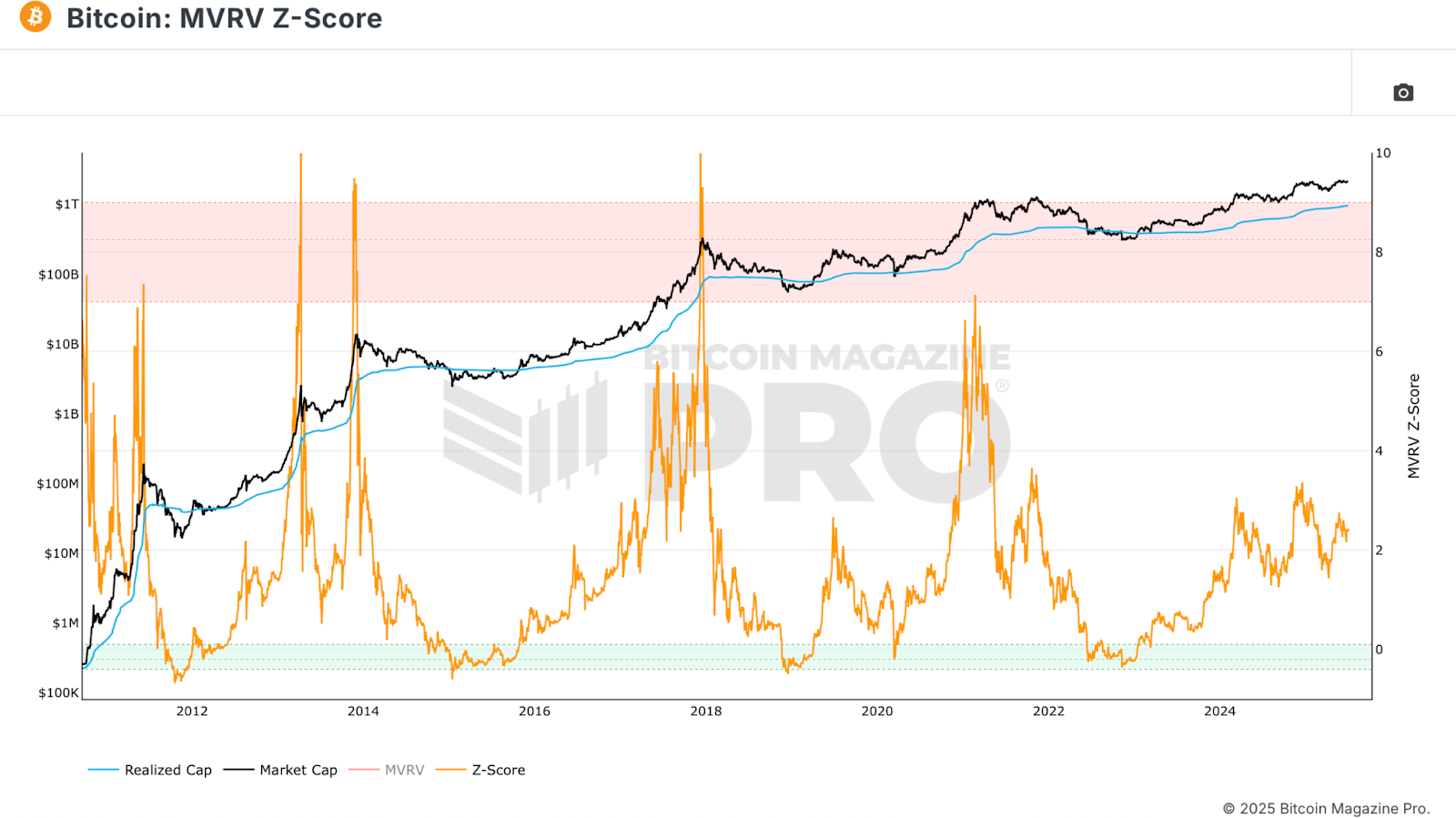

MVRV Z-Rating

The MVRV Z-Rating is probably probably the most well known metric within the on-chain arsenal. It standardizes the ratio between market worth (present worth multiplied by the circulating provide) and realized worth (common price foundation or realized worth), normalizing it throughout Bitcoin’s risky historical past. This z-score identifies excessive market situations, providing clear indicators for tops and bottoms.

Traditionally, a z-score above 7 signifies euphoric market situations ripe for a neighborhood prime. A z-score under zero typically aligns with probably the most engaging accumulation durations. Like all metric, it shouldn’t be utilized in isolation. This metric is extraordinarily efficient when paired with a few of the others mentioned on this evaluation for confluence.

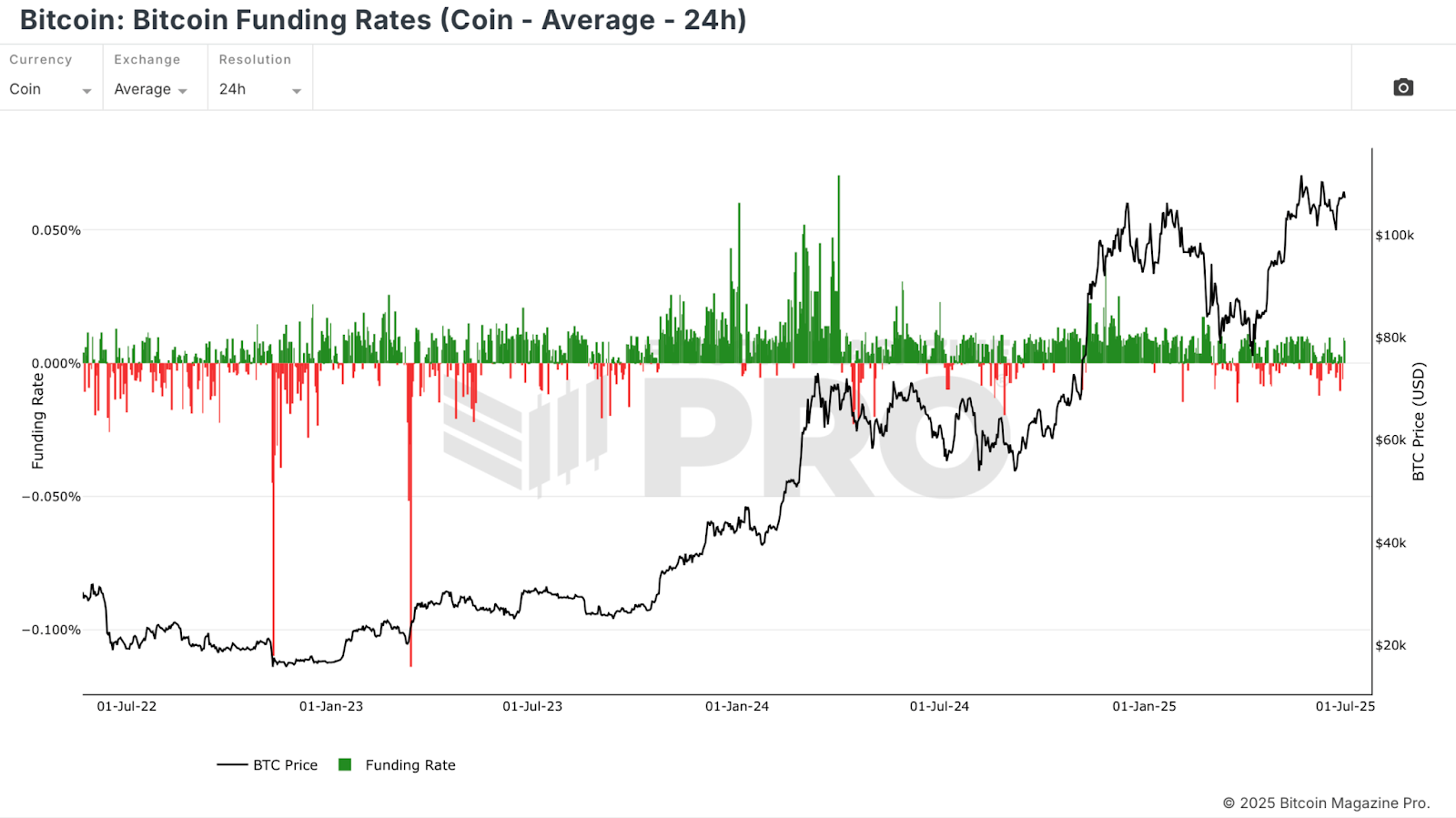

Funding Charges

Bitcoin Funding Charges reveal the sentiment of leveraged futures merchants. Constructive funding means longs are paying shorts, suggesting a bullish bias. Extraordinarily excessive funding typically coincides with euphoria and precedes corrections. Unfavourable funding, conversely, reveals concern and might precede sharp rallies.

Coin-denominated funding charges provide a purer sign than USD pairs, as merchants are risking their BTC immediately. Spikes in both route typically sign contrarian alternatives, with excessive charges warning of overheating and low or unfavorable charges hinting at bottoms.

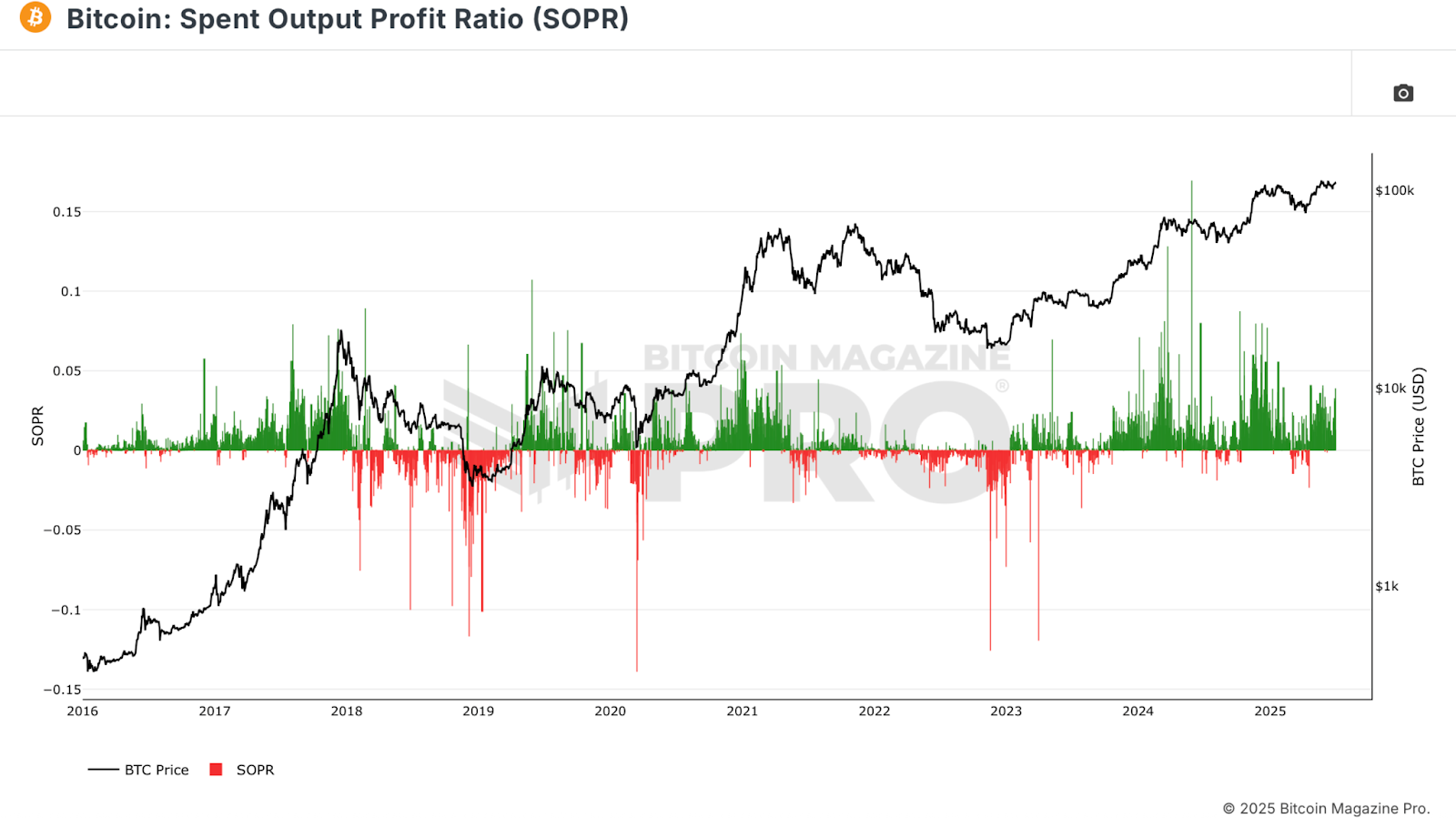

SOPR

The Spent Output Revenue Ratio (SOPR) tracks whether or not cash moved on-chain have been in revenue or loss on the time of transaction. A studying above zero means the typical coin moved was offered in revenue; under zero suggests realized losses.

Sharp downward spikes point out capitulation, traders locking in losses. These typically mark fear-driven selloffs and main shopping for alternatives. Sustained SOPR readings above zero can point out uptrends, however extreme profit-taking could sign overheated markets.

Conclusion

By layering these metrics: Realized Cap HODL Waves, Puell A number of, MVRV Z-Rating, Funding Charges, and SOPR, traders achieve a multidimensional view of Bitcoin market situations. No single indicator provides all of the solutions, however confluence throughout a number of will increase the chance of success. Whether or not you’re accumulating in a bear market or distributing close to a possible prime, these free instruments might help you take away emotion, comply with the information, and dramatically enhance your edge within the Bitcoin market.

💡 Cherished this deep dive into bitcoin worth dynamics? Subscribe to Bitcoin Journal Professional on YouTube for extra professional market insights and evaluation!

For extra deep-dive analysis, technical indicators, real-time market alerts, and entry to professional evaluation, go to BitcoinMagazinePro.com.

Disclaimer: This text is for informational functions solely and shouldn’t be thought of monetary recommendation. All the time do your individual analysis earlier than making any funding choices.