A pointy divergence has emerged between Bitcoin’s change balances and its surging market value—signaling renewed long-term accumulation and provide tightening.

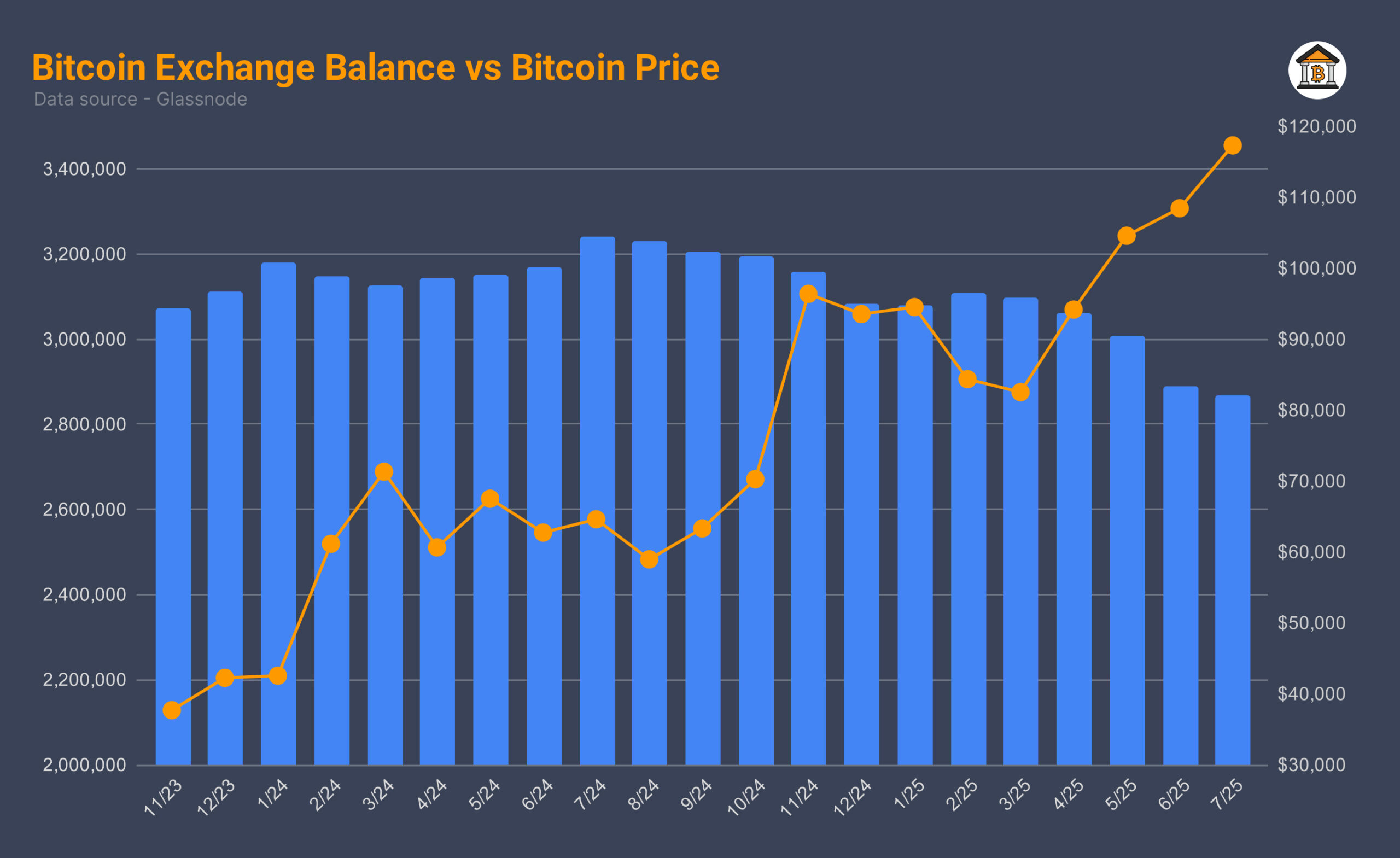

The newest Glassnode chart reveals Bitcoin hitting new highs above $120,000 whereas exchange-held BTC drops to multi-year lows.

Bitcoin provide on exchanges continues falling

Since late 2024, the variety of Bitcoin held on centralized exchanges has steadily declined. From a peak close to 3.3 million BTC in mid-2024, balances have fallen beneath 2.8 million by July 2025. This drop displays aggressive outflows doubtless tied to chilly storage, self-custody, and institutional accumulation. Alternate balances final dipped this low throughout bull runs in 2020 and early 2021.

Probably the most notable decline started in March 2025, simply as Bitcoin reclaimed the $90,000 stage. Since then, balances have dropped every month, with June and July displaying the steepest month-to-month declines of the yr.

BTC value soars above $120K amid shrinking provide

Whereas change balances dropped, Bitcoin’s value soared. After consolidating round $90,000 by way of early 2025, BTC broke above $100,000 in April and climbed aggressively into July. The worth surged previous $110,000 in late June and topped $120,000 in early July, at the same time as fewer cash remained out there on exchanges.

This inverse relationship suggests rising demand is chasing shrinking provide. With fewer liquid BTC in circulation, every bullish breakout features energy—pushing costs even larger.

Market outlook: bullish as provide squeeze deepens

Traditionally, falling change balances have preceded main bull runs. The present development mirrors 2020–2021, when BTC exploded from $10,000 to over $60,000 in lower than a yr.

If change balances proceed to say no whereas demand holds, Bitcoin could enter one other parabolic part. With ETF inflows, institutional curiosity, and macroeconomic tailwinds aligning, all indicators level to a supply-driven bull market gaining momentum.