- XLM surged almost 6% in 24 hours, turning into the highest gainer among the many prime 20 cryptocurrencies, fueled by renewed investor curiosity and PayPal’s integration information.

- PayPal plans to launch PYUSD on the Stellar community, aiming to convey quick, low-cost stablecoin funds to over 170 international locations, with added instruments like PayFi for real-time enterprise financing.

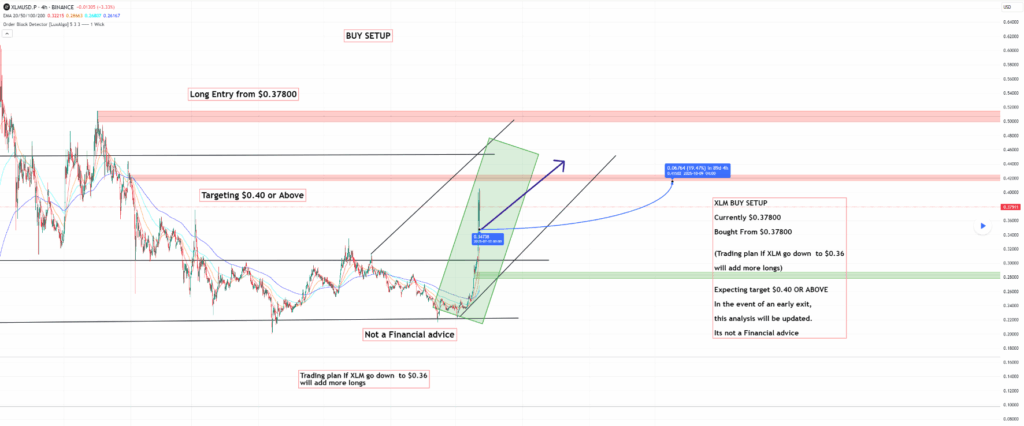

- Technical evaluation reveals sturdy assist round $0.385–$0.387, with heavy buying and selling quantity and bullish momentum suggesting XLM may very well be gearing up for an additional leg larger.

PayPal’s PYUSD Launch Might Be a Sport-Changer for Stellar

Stellar’s latest breakout isn’t simply value motion—it’s powered by actual utility. Earlier this week, Ian Burrill from PayPal dropped a fast video strolling by why they’re selecting Stellar for the following part of PYUSD. The plan? Deliver stablecoins to 170+ international locations, real-time, low-fee, and cross-border. Stellar’s been quietly constructing for this, with on/off-ramps, native wallets, and a payment-friendly setup already in place. And it’s not nearly funds both. PayPal teased a brand new monetary device known as “PayFi” that would let small companies entry instantaneous funding in PYUSD through the Stellar community. It’s a daring transfer—and markets are reacting accordingly.

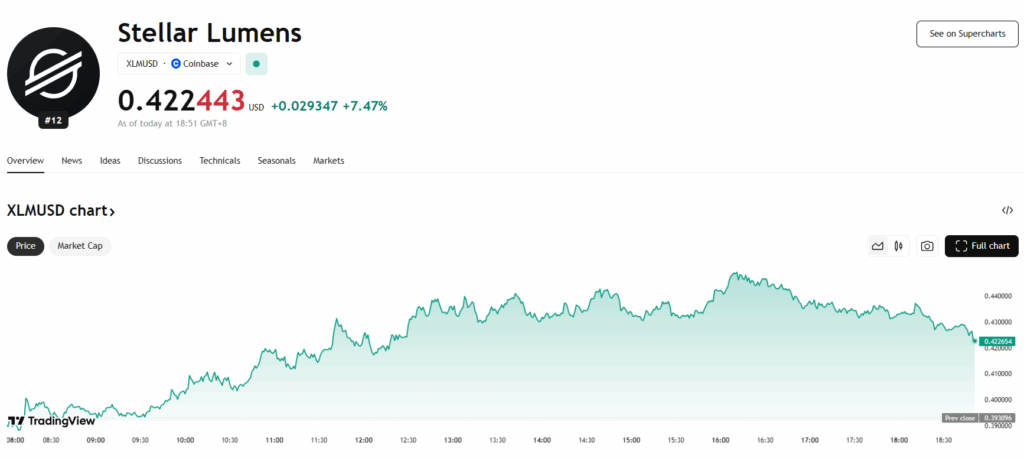

XLM Tops Crypto Charts With Greatest 24H Proportion Acquire

In a sea of inexperienced, Stellar (XLM) stood out. Over the previous 24 hours, it surged almost 6% to $0.388, touching a excessive of $0.4095 earlier than easing off. That spike made it the highest gainer within the prime 20 by market cap—a powerful feat on a day when Bitcoin itself was breaking data above $118K. However this wasn’t a fluke. The rally got here after PayPal’s Stellar integration information made the rounds once more, re-igniting bullish sentiment. Buying and selling quantity exploded, with XLM clocking over double its common 24H exercise. Momentum like this normally isn’t random—it’s narrative plus liquidity, and XLM’s acquired each.

Technical Indicators Level to Extra Upside for XLM

Value charts don’t lie, and XLM’s latest motion is filled with clues. From $0.345 to $0.416 in simply 24 hours? That’s almost 21% volatility, and it wasn’t all noise. Quantity spiked exhausting throughout two key home windows—first round 01:00 UTC, then once more simply after 16:00 UTC, the place XLM pumped from $0.374 to $0.385 in minutes. That form of motion, particularly on excessive quantity, normally screams institutional or coordinated buying and selling. Help now seems agency within the $0.385–$0.387 zone, with resistance simply above $0.40. If Bitcoin retains pushing and the Stellar narrative holds, we is perhaps one other leg up quickly.