Altcoins are being pulled off the world’s largest trade in droves, signaling a wave of institutional accumulation and long-term holding, in accordance with new information from CryptoQuant.

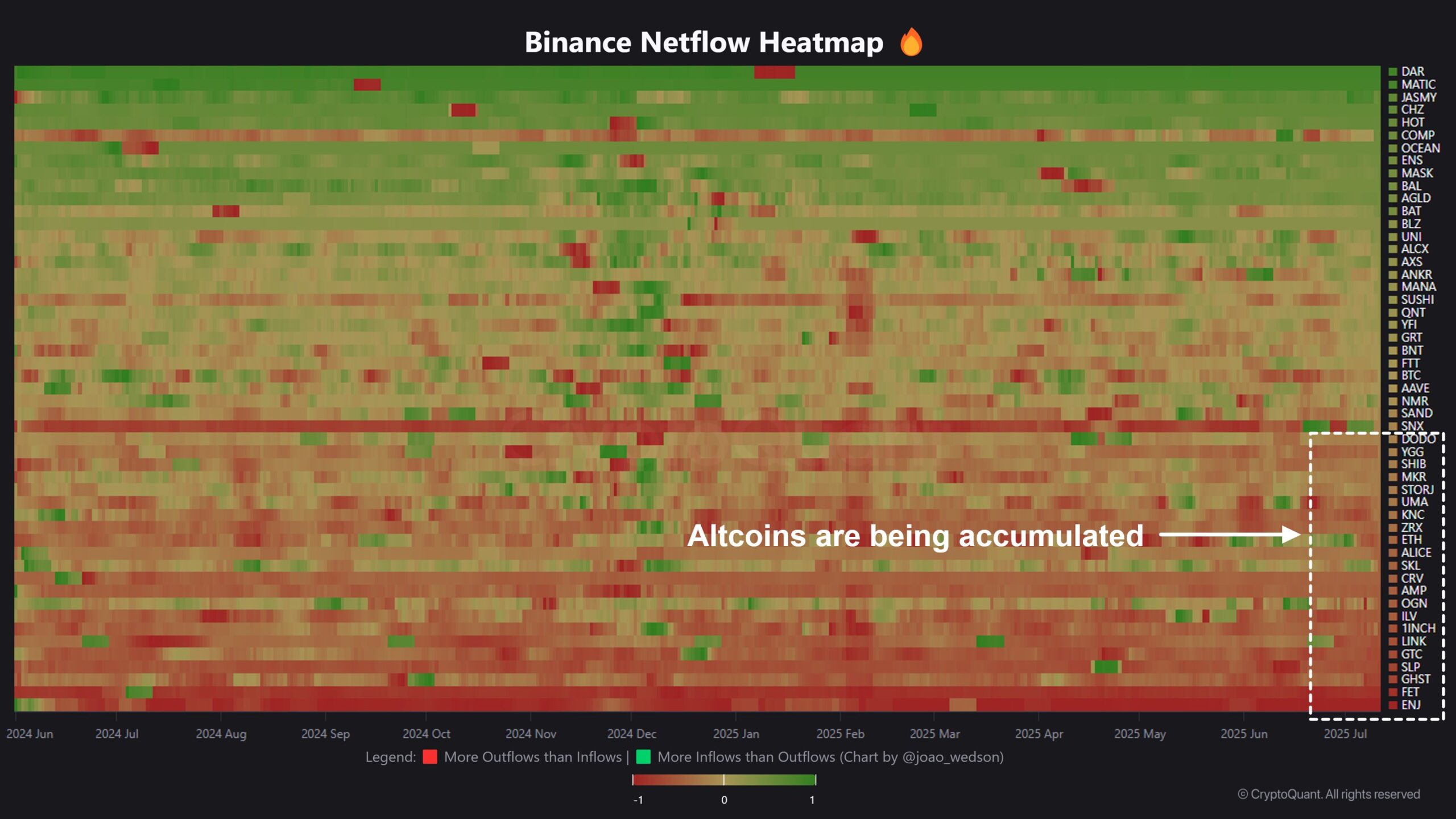

A heatmap of Binance’s netflow exercise reveals that quite a few altcoins are experiencing considerably extra outflows than inflows. This pattern sometimes marks a bullish accumulation section—the place massive holders, or “good cash,” are shifting tokens into chilly storage somewhat than holding them on buying and selling platforms.

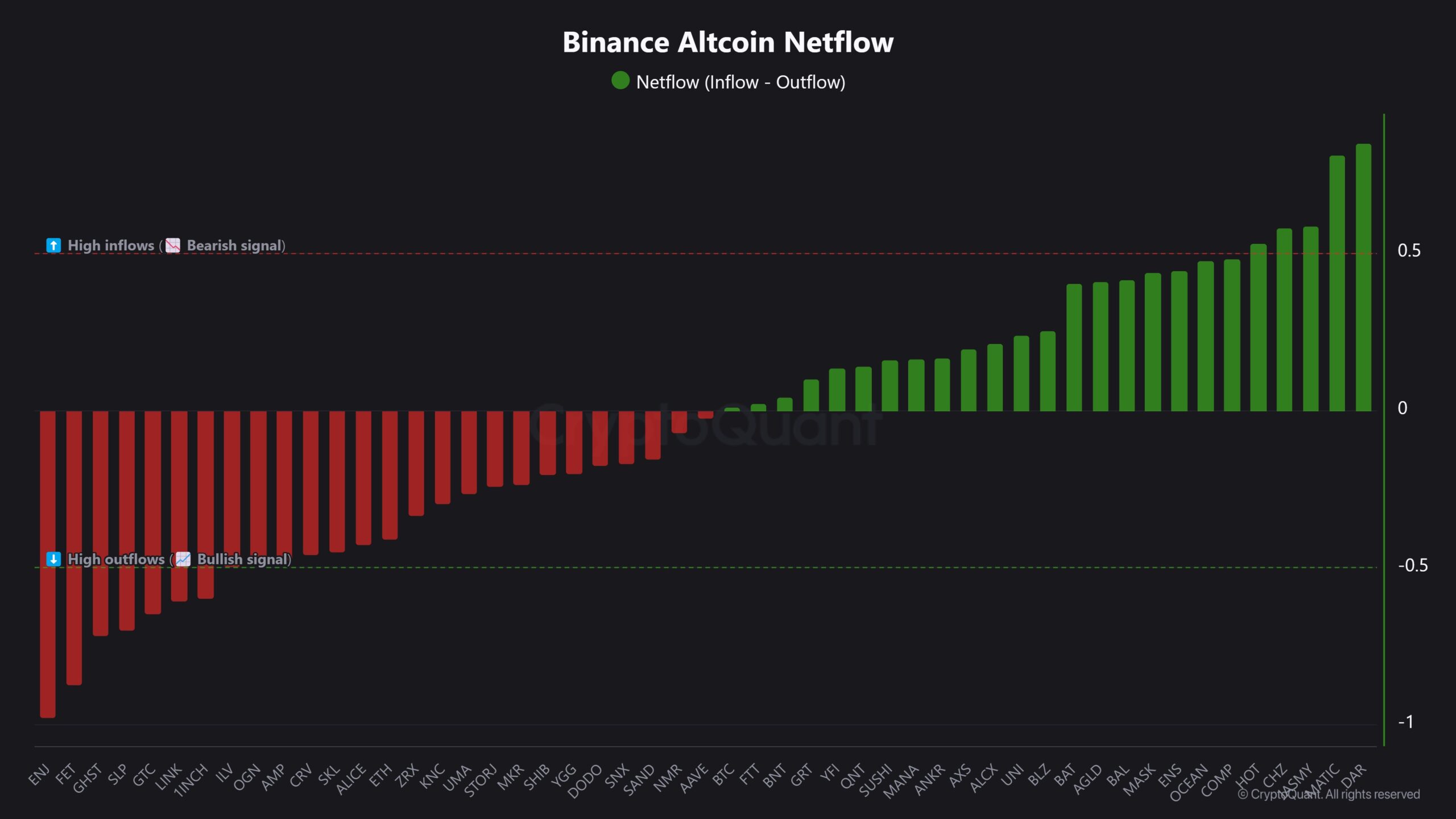

Altcoins exhibiting the strongest accumulation embrace:

- Blue-chip tokens: ETH, LINK, AAVE, SNX, CRV, 1INCH

- AI and gaming initiatives: FET, GHST, ILV, SLP

- Meme cash and steady property: SHIB, DOGE, MKR

- Others: ENJ, UMA, SKL, GTC, ALICE

The purple sign on CryptoQuant’s heatmap signifies that outflows exceed inflows, usually a precursor to produce shocks when demand spikes.

What does this imply for the market?

Giant-scale withdrawals from Binance often recommend:

- Lengthy-term holding methods

- Diminished circulating provide (provide shock)

- Institutional-level accumulation

These components mixed can drive up costs as demand meets lowered obtainable provide on exchanges.

Why Binance netflows matter

Because the world’s most liquid and globally dominant crypto trade, Binance stays the epicenter of buying and selling exercise for each retail and institutional buyers. It’s trusted for its compliance infrastructure, broad token listings, and big every day volumes—making outflow information a dependable sign of broader market developments.

Last takeaway

“Observe the stream. On-chain doesn’t lie,” Wedson advises. The most recent information factors to rising confidence in altcoins throughout classes—from DeFi and Layer 1s to meme and AI tokens. If the pattern continues, these withdrawals might set the stage for a significant altcoin rally within the coming weeks.