Bitcoin is testing uncharted territory after breaking previous its earlier all-time excessive of $112,000 final Thursday, igniting a strong new section within the bull market. With the worth at present hovering above $117,000, bulls are firmly in management as optimism spreads throughout the crypto market. The breakout comes after weeks of tight consolidation, signaling renewed confidence amongst buyers and merchants.

Associated Studying

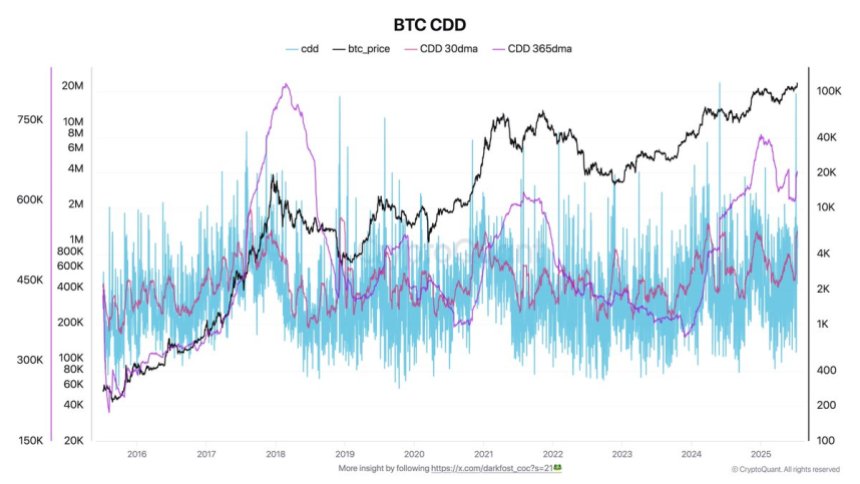

On-chain information from CryptoQuant provides additional help to the bullish narrative. The Coin Days Destroyed (CDD) metric—used to evaluate whether or not long-term holders are promoting—has returned to a comparatively low common regardless of the rise in worth. This implies that skilled holders usually are not offloading their positions, however as an alternative persevering with to carry via the rally.

With long-term holders largely inactive and momentum accelerating, Bitcoin seems to be getting into a decisive section. As macroeconomic circumstances stay favorable for danger property, and with institutional demand rising, all eyes are actually on how BTC behaves at these new highs—and whether or not the remainder of the crypto market will observe its lead.

Bitcoin Prepares For A Huge Surge

Bitcoin continues to commerce above key psychological and technical ranges, signaling that the market is getting into an growth section with the potential for a large surge. After clearing its earlier all-time excessive and consolidating round $117,000, Bitcoin’s construction appears more and more bullish. Analysts and merchants are carefully watching on-chain indicators to substantiate whether or not long-term holders are starting to exit, however to this point, the information suggests they aren’t.

Prime analyst Darkfost shared related insights relating to the Coin Days Destroyed (CDD) metric, a key instrument used to evaluate long-term holder exercise. CDD calculates how lengthy a Bitcoin stays unmoved earlier than a switch, revealing long-term members’ habits. Just lately, the metric noticed a pointy spike, elevating preliminary considerations about attainable distribution. Nevertheless, it was later confirmed that the transfer concerned 80,000 BTC in an inside switch — no precise promoting occurred.

Since that occasion, the CDD has returned to its earlier low vary, particularly when in comparison with Bitcoin’s hovering worth. This alerts that long-term holders are nonetheless sitting tight, exhibiting no urgency to promote into power. Their conviction displays rising expectations of upper costs forward, supported by macro circumstances, growing adoption, and rising institutional curiosity.

With sturdy arms holding agency and momentum constructing, Bitcoin seems poised for continuation. So long as key help ranges are maintained and long-term holders stay inactive, the setup favors an explosive transfer that would redefine worth discovery on this cycle.

Associated Studying

Value Discovery Kicks In: Momentum Accelerates

Bitcoin’s three‑day chart exhibits a textbook breakout from eight weeks of compression. Thursday’s candle closed firmly above the previous file cluster at $109,300, opening the door for a vertical push that carried worth to $118,800 on the very subsequent print. The candle physique towers nicely above the 50‑interval SMA, whereas the 100‑ and 200‑interval averages slope greater beneath, confirming a bullish lengthy‑time period construction.

The outdated resistance band between $105,000 and $109,300 now flips into first demand; any orderly retest that wicks into that zone would seemingly entice sidelined patrons. Under it, $103,600—the mid‑vary help that capped drawdowns all spring—stays the road within the sand for the present pattern.

Associated Studying

Upside projections derive from the peak of the 12 months‑lengthy vary (~$15 okay). Including that measure to the breakout level targets $124–125 okay as the subsequent logical goal, with the psychological $120 okay spherical quantity a possible interim stall space. Momentum oscillators on medium time‑frames are stretched however not at excessive ranges, suggesting room for continuation earlier than a cooling interval turns into obligatory.

Featured picture from Dall-E, chart from TradingView