A serious shift within the crypto cycle could also be approaching as Bitcoin dominance (BTC.D) as soon as once more reaches crucial long-term resistance.

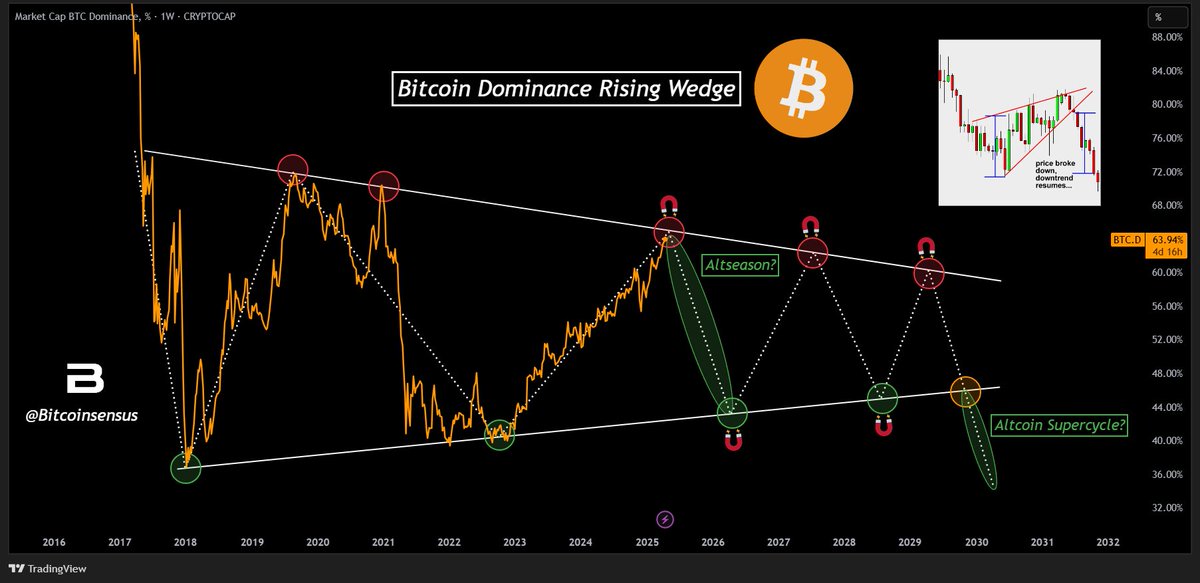

In keeping with evaluation shared by Bitcoinsensus, the BTC.D index — which measures Bitcoin’s market share relative to the whole crypto market — is testing the higher boundary of a multi-year rising wedge sample.

Historic sample suggests a reversal

The chart highlights a recurring sample relationship again to 2017. Every time BTC.D touched the higher resistance of this wedge, it triggered a pointy reversal — typically adopted by the beginning of an altseason. This cycle repeated in 2018, 2021, and 2023, and now seems to be establishing for an additional transfer decrease within the second half of 2025.

If historical past rhymes, a breakdown from this wedge might set the stage for a broad altcoin rally — particularly as Bitcoin’s dominance has surged to 63.94%, close to earlier native tops.

Why this resistance stage issues

The rising wedge sample signifies that BTC.D is making greater lows however dealing with rejection at a constant diagonal resistance. These trendlines act like stress zones. When dominance fails to interrupt above resistance, capital typically flows into altcoins, sparking elevated volatility and fast value appreciation throughout the sector.

A confirmed reversal might mark the start of the subsequent altcoin supercycle, with property like Ethereum, Solana, and different Layer 1s benefiting essentially the most.

Key ranges and timing

- BTC.D Resistance zone: ~64%–65%

- Wedge assist zone: ~40%–45%

- Historic altseason pivots: Put up-rejection phases from 2018, 2021, 2023

Bitcoinsensus notes that this setup “is smart” for a full-blown altseason within the subsequent few months, particularly if dominance begins to roll over.