Bitcoin has as soon as once more hit a brand new all-time excessive, briefly shifting above $121,000 earlier than stabilizing close to $120,500. The value is up 2.54% right this moment, persevering with a powerful development that began earlier this month. However is that this rally sustainable, or nearing a slowdown?

Key indicators recommend the development may not be finished simply but.

Holders Aren’t Taking Income But

The adjusted Spent Output Revenue Ratio (aSOPR) presently sits at 1.03, effectively beneath the early July 2025 ranges, the place aggressive profit-taking pushed the ratio a lot increased. This time, regardless of Bitcoin making new highs, merchants look like holding as a substitute of promoting.

This implies most cash being moved on-chain should not being bought for large good points, which suggests the rally is just not overheated.

SOPR exhibits whether or not BTC moved on-chain is being bought at a revenue (>1) or at a loss (<1). Adjusted SOPR fine-tunes the metric and filters out short-term inside transactions to point out whether or not BTC moved on-chain is being bought at a revenue or loss.

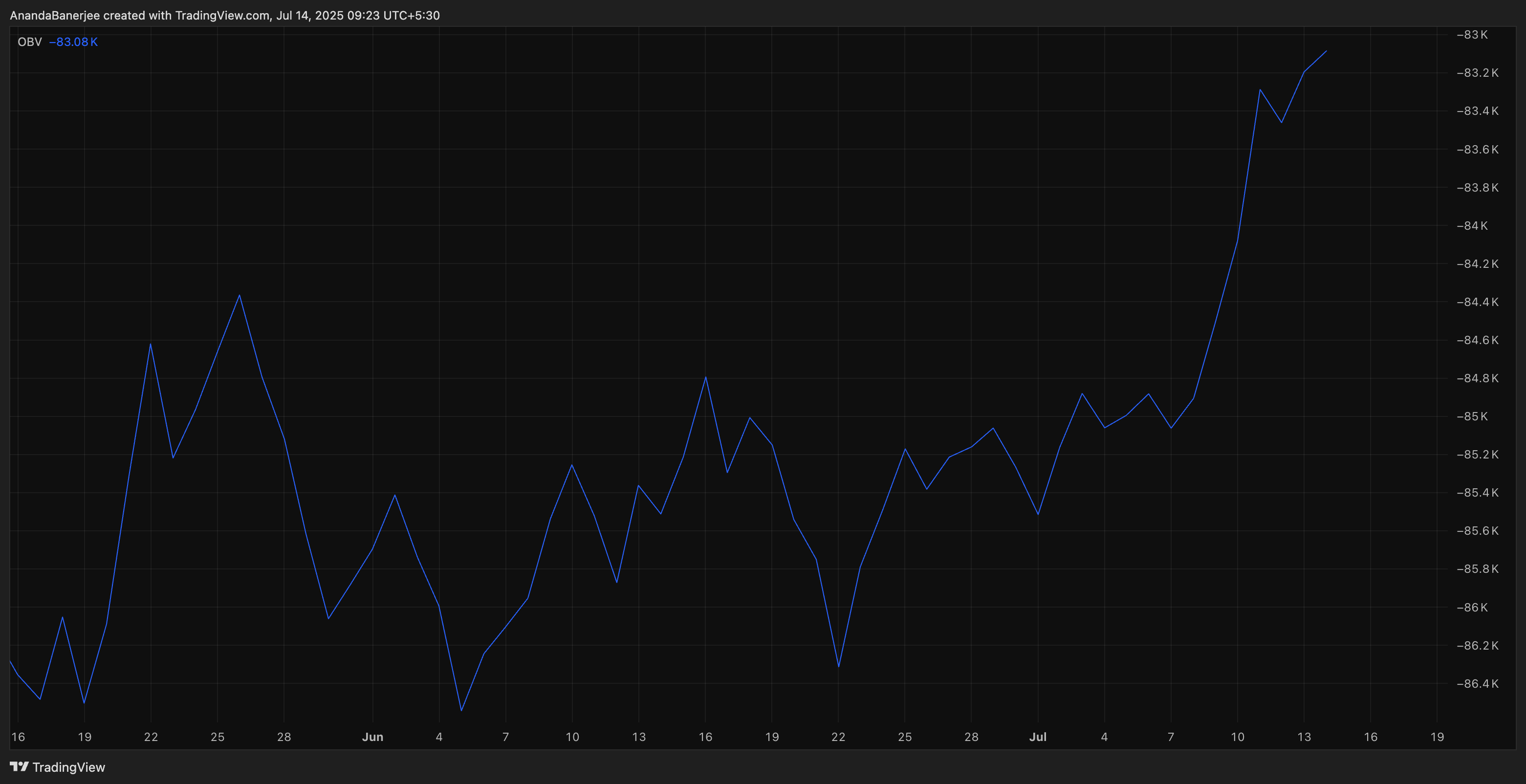

Quantity is Supporting the Rally

On-Steadiness Quantity (OBV) is shifting up in tandem with Bitcoin’s value, a key signal that purchasing quantity is protecting tempo with the rally. There’s no seen divergence, no breakdown in momentum.

In less complicated phrases: BTC goes up, and the amount goes with it, not in opposition to it.

OBV measures cumulative purchase/promote stress based mostly on every day quantity route. It’s a bullish signal when it follows a optimistic value development.

BTC Value Construction and Subsequent Ranges

BTC is presently holding slightly below $121,519, a key resistance degree from the Pattern-Based mostly Fibonacci Extension. If Bitcoin closes above this degree, the subsequent extension goal is $127,798, adopted by $135,425. These are long-range projections based mostly on earlier development conduct.

Pattern-Based mostly Fibonacci Extension is a instrument that makes use of three key value factors: a low, a excessive, and a retracement, to undertaking future resistance ranges in a trending market.

If BTC consolidates, near-term help sits at; $117,109, which is a previous breakout space. The bullish development would weaken if BTC falls beneath $112,699, a key help degree close to the primary all-time excessive, particularly if alternate inflows spike or SOPR begins to rise sharply. That may recommend holders are beginning to take earnings aggressively, which may result in a pullback or development reversal.

The publish New Day, New Bitcoin All-Time Excessive: What’s Subsequent For BTC Value? appeared first on BeInCrypto.