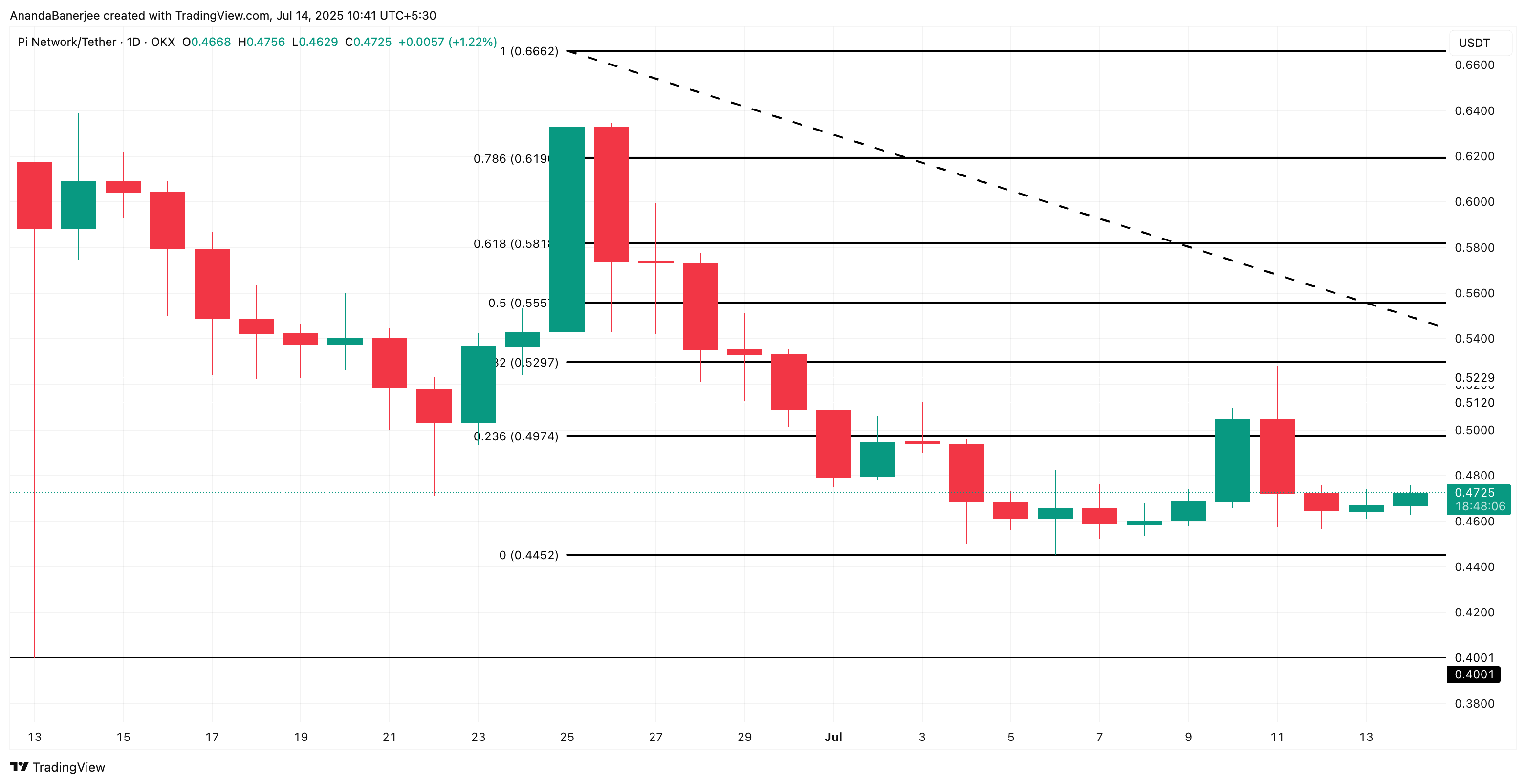

Pi Coin has been hovering dangerously near a key help degree after a sluggish buying and selling week. At press time, PI Value stands at $0.4725, struggling to carry above the $0.4452 degree.

Whereas on-chain metrics aren’t exhibiting sturdy conviction both method, some cracks within the bearish momentum are beginning to seem.

Open Curiosity and Funding Fee Sign a Pause

PI Value is exhibiting indicators of hesitation. Aggregated Open Curiosity on Coinalyze (within the 4-hour timeframe) is hovering round $10.09 million and can be exhibiting no main directional conviction over the previous few days. This implies merchants will not be aggressively constructing new lengthy or brief positions, suggesting indecision.

In the meantime, the Aggregated Funding Fee climbed to +0.0274, and the Predicted Funding Fee spiked even greater to +0.0516. In easy phrases, this implies Pi Coin longs are barely dominant and prepared to pay a premium to carry their positions, normally a bullish signal.

Open Curiosity refers back to the whole variety of unsettled contracts available in the market. A rising Open Curiosity usually confirms that extra merchants are coming into the market, supporting the present development. Funding Fee is the periodic payment paid between lengthy and brief merchants. Constructive values imply longs are dominant; destructive ones recommend shorts are in management.

General, the flat Open Curiosity with rising Funding Charges exhibits a gentle lengthy bias, however within the case of Pi Coin, it’s with out sturdy conviction.

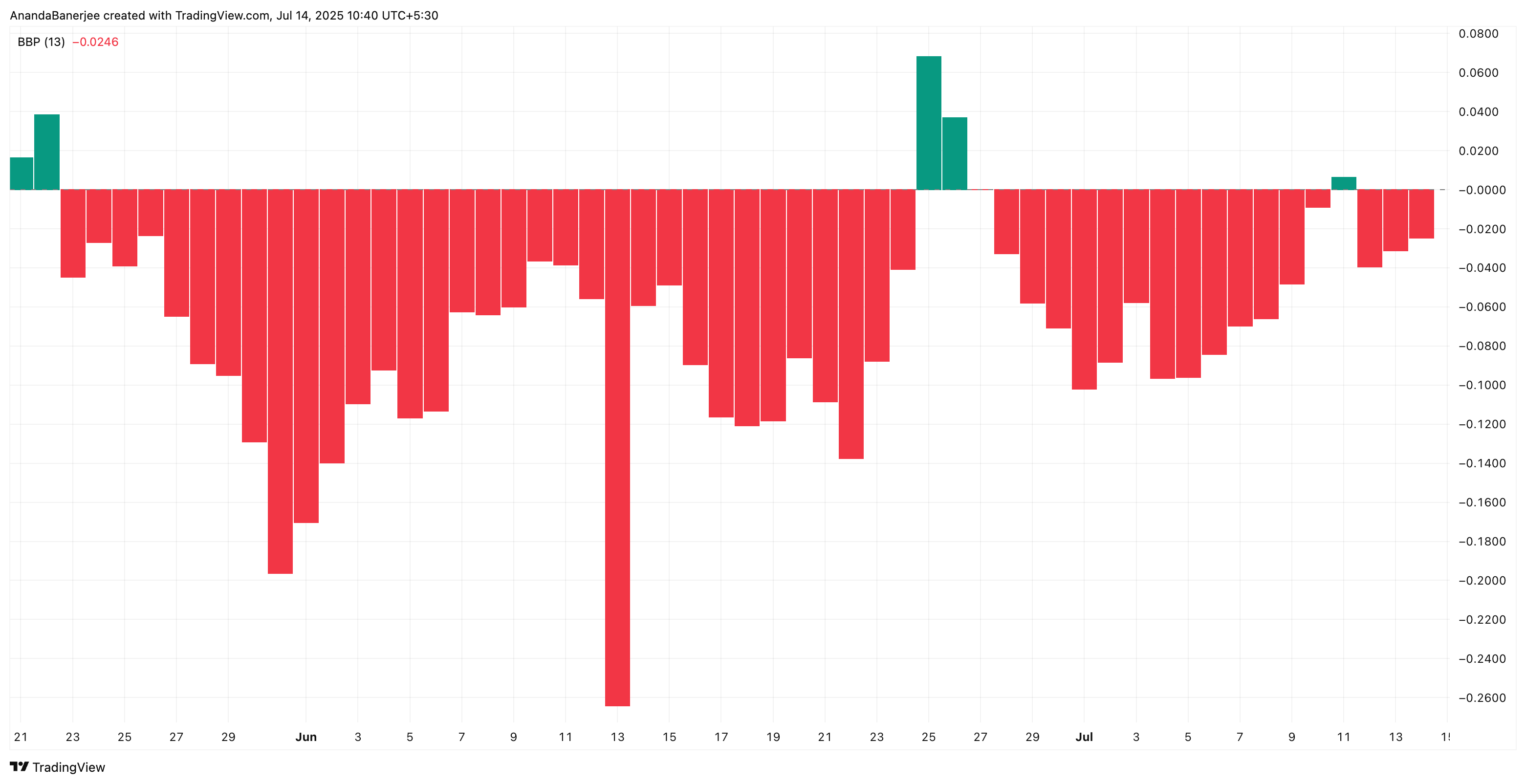

Bear Energy is Shedding Steam

With Funding Charges rising and Open Curiosity staying flat, the market leans barely lengthy however with out conviction. This hesitation is mirrored within the Bull Bear Energy indicator, a part of the Elder Ray Index, which tracks the energy of patrons/sellers available in the market.

On the time of writing, Bear Energy has continued to weaken, signaling that bearish momentum is fading.

PI Value Evaluation: Key Assist Nonetheless Holding

Pi Coin (PI) is presently buying and selling at $0.4725, hovering simply above the important thing help degree at $0.4452. This degree was derived utilizing the Fibonacci retracement software, drawn from the late June excessive to the July 6 low.

Fibonacci retracement is a technical software merchants use to determine potential help and resistance ranges by measuring how far the value has pulled again from a current transfer.

Thus far, this help has held regardless of PI’s broader downtrend. A breakdown beneath $0.4452 might expose Pi Coin to a sharper correction towards $0.4001, the following main help.

On the flip aspect, if momentum builds, the following upside resistance is at $0.4974, a degree the place the PI worth has been rejected a number of instances. A every day shut above $0.4974 might flip the construction short-term bullish, invalidating the bearish speculation.

Disclaimer

In step with the Belief Mission pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.